In This Guide

The 3-day HOA review period fails because buyers receive 200-400 pages of legal and financial documents with no guidance on what to look for or how to evaluate risks.

You just got the HOA disclosure packet. It's hundreds of pages. Your review period expires in 72 hours. The clock started Friday afternoon.

Somewhere in those pages is a special assessment discussion from a recent board meeting. There's a reserve study showing the building is critically underfunded. The CC&Rs have a rental restriction that limits your flexibility if you need to relocate.

But you won't find any of that—not in three calendar days, with no professional guidance and no one telling you where to look.

This isn't a buyer failure. It's a systemic design flaw that favors speed over informed decision-making. Here's how the HOA review period actually works, why it fails, and what you can do about it.

How the HOA Review Period Works Today

HOA document review periods range from 3 to 10 days depending on the state—some states have no statutory period at all. The clock typically starts when documents are delivered.

When you're buying a condo or home in an HOA community, the seller (or the association) delivers a resale certificate or disclosure package during escrow. This is your window to review the documents and decide whether to proceed—or cancel.

Here's what that typically looks like:

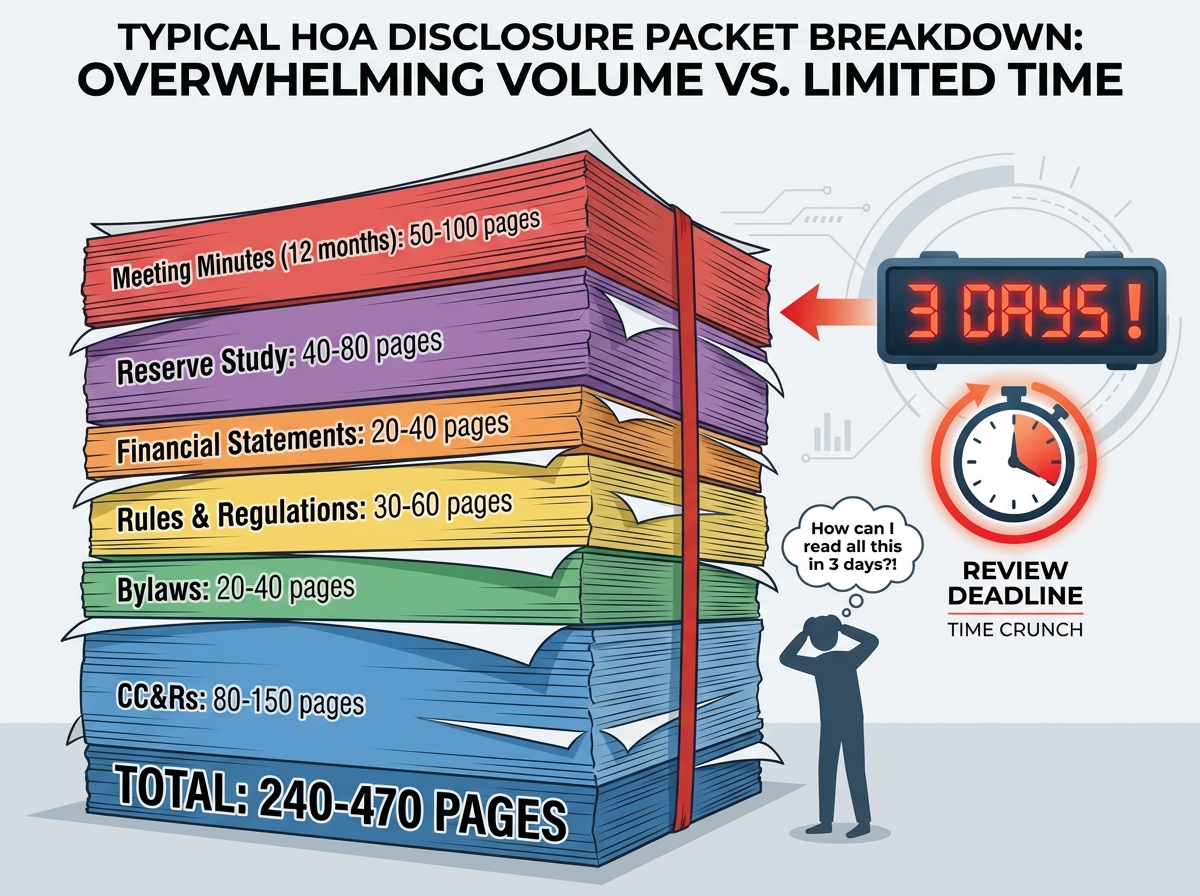

- 200-400 pages of CC&Rs, bylaws, rules, financials, meeting minutes, and reserve studies

- A statutory rescission period that varies by state (see table below)

- The clock starts when documents are delivered—which can be a Friday evening, holiday weekend, or your busiest day at work

- In states with statutory rescission periods, if you don't cancel within the window, you may be deemed to have accepted the terms disclosed in those documents (rules vary by state—consult your attorney)

| State | Review Period | Source |

|---|---|---|

| Virginia | 3 days (default, negotiable) | Va. Code § 55.1-2312 |

| Florida (condos) | 7 days (excl. weekends/holidays) | Fla. Stat. § 718.503 (HB 913) |

| California | 3-5 days after delivery* | Cal. Civ. Code §§ 4525, 4530 |

| Pennsylvania | 5 days | 68 Pa.C.S. § 5407 |

| Maryland (condos) | 7 days (resale); 15 days (new) | Md. Real Prop. Code § 11-135 |

| AZ, CO, others | No dedicated statutory period | Governed by purchase contract |

*In California, HOAs must deliver disclosure documents within 10 days of request (Cal. Civ. Code § 4530). The buyer's right to cancel is 3-5 days after delivery of late disclosures (§ 1102.3). Standard CAR purchase agreements typically include a 17-day contingency period.

Review periods vary by property type (condo vs. HOA) and may differ for new construction vs. resale. Always check your state's specific statute and your purchase contract. This table is for general reference only—consult a real estate attorney for advice specific to your transaction.

Important Distinction

Many states that provide rescission periods for condominium purchases do not extend the same protection to buyers of fee-simple homes in HOA communities. Some states (including Arizona and Colorado) may have no dedicated statutory review period for HOA documents—meaning your review time may depend largely on what you negotiate in the purchase contract. Laws change frequently, so verify your state's current requirements with a real estate attorney.

Why Short Review Periods Aren't Enough

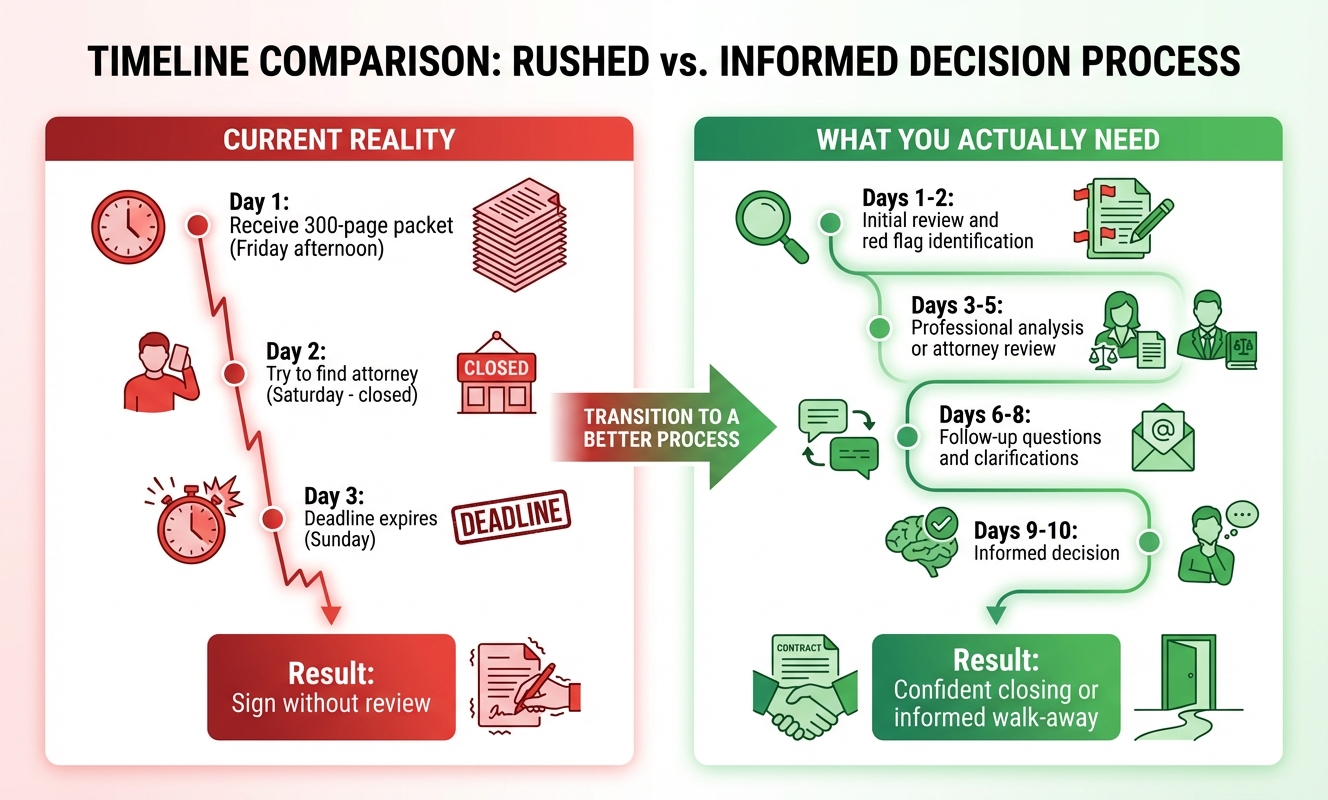

Short review periods fail because buyers can't find professional help on short notice, don't know what to look for, and face pressure from all sides to close quickly.

The review period assumes you know what you're looking at. Most buyers don't.

You Can't Find Help Fast Enough

Documents arrive Friday at 5 PM. You need an attorney or CPA who understands HOA governance. Their next opening is next week. Your deadline may be Monday.

Even if you find someone, a thorough attorney review of HOA documents typically costs $500-$2,000 and can take several business days to complete. That's often longer than the entire statutory review window.

You Don't Know What You're Looking For

The disclosure package is a data dump, not an analysis. Nobody highlights the important parts. There's no executive summary. The reserve study alone can be 80 pages of component tables and funding projections.

Based on GoverningDocs analysis of 1,100+ HOA documents, the most critical information—special assessment risk, deferred maintenance, and litigation—is almost never on the first page. It's buried in board meeting minutes, reserve study appendices, and financial footnotes.

Everyone Around You Wants You to Close

Your agent earns commission at closing. The seller wants the deal done. The lender has a rate lock expiring. Nobody else in the transaction benefits from you taking more time—except you.

A typical HOA disclosure packet runs 200-400+ pages across 6+ document types

What You're Actually Supposed to Find

Buyers should check reserve funding levels, special assessments, litigation, rental restrictions, insurance gaps, and deferred maintenance—all buried across multiple documents.

The disclosure packet isn't just legal boilerplate. It contains financial and operational intelligence that directly affects what you'll pay after closing. Here's what a thorough review should uncover:

Critical items buried across hundreds of pages of HOA documents

- Reserve study funding level: Industry guidelines consider under 30% funded a red flag for special assessments. Found in the reserve study, often buried deep in the document.

- Special assessments: Current or planned one-time charges that can add $5,000-$100,000+ to your costs. Discussed in board meeting minutes—if you know to look there.

- Ongoing litigation: Lawsuits against the HOA can result in assessments, insurance increases, or property value drops. Often disclosed in a single line item. See legal risks in buying HOA property.

- Rental restrictions: Rental caps and lease minimums that limit your flexibility if you need to relocate. Sometimes buried in CC&R amendments, not the original document.

- Transfer fees and capital contributions: One-time charges at closing that can range from hundreds to several thousand dollars.

- Insurance coverage gaps: Underinsured buildings face non-renewal, higher premiums, and financing problems.

- Deferred maintenance: Items the board keeps postponing. Found by cross-referencing meeting minutes with the reserve study—a task that takes hours.

Related: How to Review HOA Documents Before Buying →

The Cost of Missing Red Flags

Skipping HOA document review can lead to surprise assessments of $10,000-$100,000+, lost rental income, and property value declines—costs that dwarf the price of professional review.

These scenarios illustrate what can happen when buyers don't review HOA documents thoroughly:

- Special assessment months after closing. A reserve study showing critically low funding and board minutes discussing "necessary structural repairs" were both in the disclosure packet. The warning signs were there—nobody read them. In Florida, assessments of $50,000-$400,000 per unit are hitting condo owners right now. Read more about the Florida condo crisis.

- Rental restriction discovered after buying. The original CC&Rs may allow rentals, but a later amendment can add a rental cap that's already maxed out. Amendments are often buried hundreds of pages into the packet.

- Litigation settlement assessment. When an HOA is sued—over construction defects, personal injury, or other claims—meeting minutes typically reference "ongoing legal counsel discussions" for months before a settlement assessment arrives.

The cost of not reviewing HOA documents vs. the cost of professional analysis

Why the System Doesn't Protect Buyers

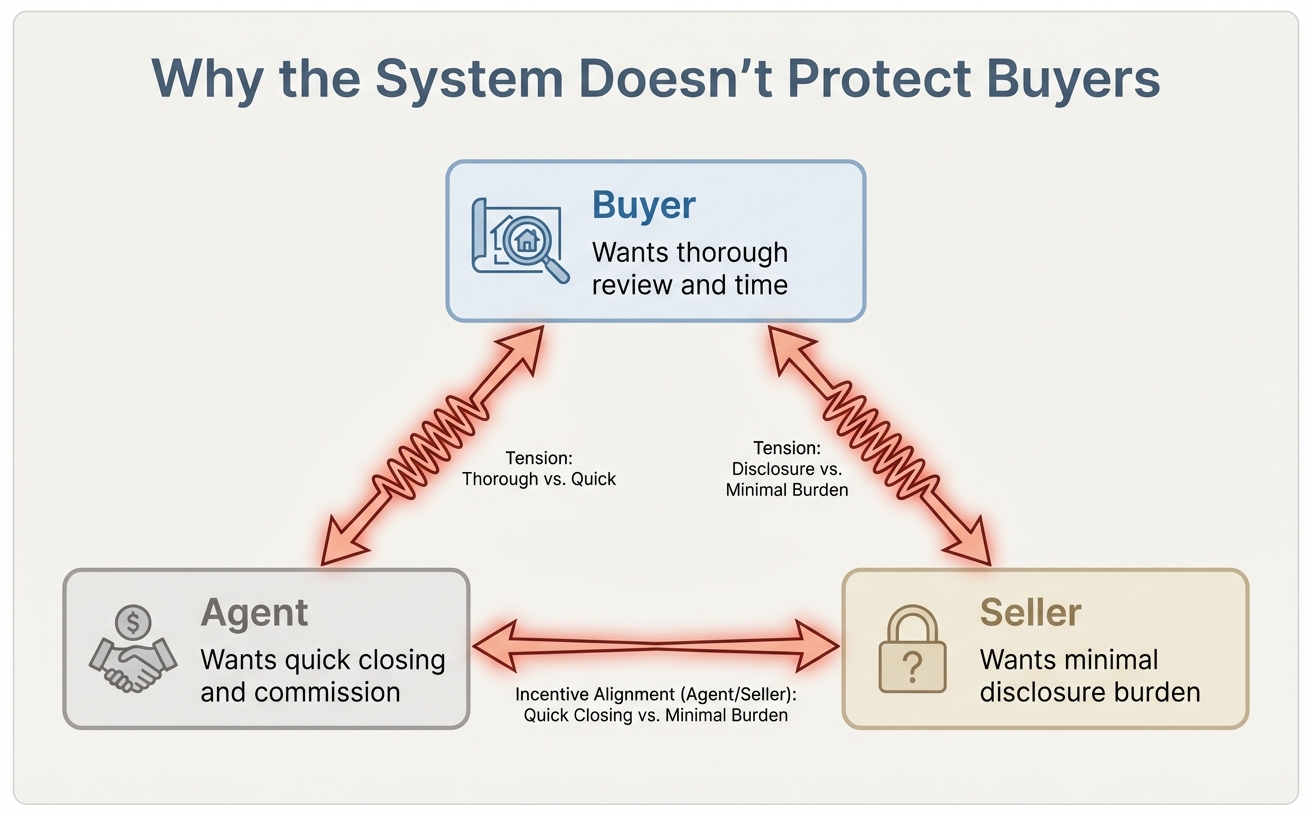

The HOA review process reflects conflicting incentives among buyers, agents, sellers, and management companies—with current laws generally favoring speed over informed decision-making.

Three parties, three conflicting incentives—and the buyer has the least power

Short review periods aren't just inadequate—they reflect a system where multiple incentives point away from buyer protection:

- Buyers want time to understand what they're committing to. They're the only party who benefits from thorough review.

- Agents earn commission at closing. Every delay introduces risk the deal falls through.

- Sellers want fast closings and minimal disclosure obligations. Extended review periods mean more chances for buyers to walk away.

- HOA management companies charge fees for producing disclosure packets and have no incentive to make them easier to understand.

Florida's HB 913: A Step Forward

Florida's HB 913 (effective July 1, 2025) extended the condo buyer rescission period from 3 days to 7 days excluding weekends and holidays, and requires associations with 25+ units to post documents online. It's meaningful progress—but even 7 days for 300+ pages is challenging without professional help.

What You Can Do About It

Request documents before making an offer, negotiate extended review periods in your purchase contract, or use AI-powered analysis tools to review 300+ pages in minutes.

GoverningDocs recommends requesting HOA documents before making an offer—not after. This gives you review time outside the high-pressure contingency window.

Request Documents Early

Ask your agent to request the resale certificate, reserve study, and last 12 months of meeting minutes before you submit your offer. Some states allow this; others require you to be under contract. Either way, the earlier you start reviewing, the more informed your decision will be.

Negotiate a Longer Review Period

Your purchase contract can include a longer HOA review contingency. Consider asking for 10-14 days instead of the statutory minimum. In a buyer's market (like much of Florida right now), sellers may be more willing to accommodate longer review windows.

Use Technology to Compress Review Time

AI-powered document analysis can identify red flags across hundreds of pages in minutes. Instead of spending your entire review period reading, you can focus on the findings that matter—reserve funding gaps, assessment risk, rental restrictions, and litigation.

What the 3-day timeline looks like vs. what informed decision-making actually requires

Know When to Walk Away

If the review period expires before you can complete your analysis, that's information too. An HOA that makes it difficult to access or review documents may be signaling something about transparency.

Don't Let a Short Deadline Cost You

GoverningDocs analyzes CC&Rs, reserve studies, and meeting minutes—identifying the red flags that matter. Free tools available, no signup required.

Upload your documents and get results in 3-5 minutes.

Frequently Asked Questions

How long is the HOA review period in my state?

It varies significantly by state and property type. Virginia defaults to 3 days if no period is negotiated in the contract (Va. Code § 55.1-2312). Florida gives 7 days excluding weekends and holidays for condos (HB 913, effective July 2025). In California, the HOA must provide disclosure documents within 10 days of a request (Cal. Civ. Code § 4530), and buyers may cancel within 3-5 days if disclosures are delivered late. Some states have no dedicated statutory review period—meaning your review time depends on what you negotiate in the purchase contract. Laws change frequently, so check your state's current statute or consult a real estate attorney.

Can I extend the HOA review period?

In most cases, yes—through your purchase contract. You can negotiate a longer HOA contingency period before signing. In a buyer's market, sellers may be more likely to agree. Consider asking for 10-14 days. Your real estate agent or attorney can help you include this in the contract.

What happens if I don't review the HOA documents?

In states with statutory rescission periods, if the review period expires without you canceling, you may be deemed to have accepted the terms in the disclosure package—though the specific legal implications vary by state and situation. This may include existing assessments, rental restrictions, and other obligations disclosed in the documents. This is not legal advice—consult with a real estate attorney about the specific implications in your state.

Can I use ChatGPT to review HOA documents?

General AI tools can summarize individual documents, but they lack domain-specific training on HOA governance. They may not flag that a particular reserve funding level is concerning, can't cross-reference meeting minutes with reserve studies, and can't identify what's missing from the package. Tools specifically designed for HOA document analysis, like GoverningDocs (trained on 1,100+ HOA documents), are built to catch issues that general-purpose AI may miss.

How much does professional HOA document review cost?

Attorney review of HOA documents typically costs $500-$2,000 depending on the complexity and market. Attorneys primarily focus on legal exposure, while financial analysis (reserve funding, assessment risk) may require separate expertise. AI document analysis tools like GoverningDocs offer free analysis of individual documents (CC&Rs, reserve studies, meeting minutes).

The Bottom Line

Short HOA review periods—whether 3 days, 5 days, or even 7—create a structural disadvantage for buyers trying to make informed decisions about 200-400 pages of legal and financial documents.

The good news: you have options to protect yourself regardless of your state's statutory minimums.

- Request HOA documents before you make an offer

- Negotiate longer review periods in your purchase contract

- Use AI analysis to identify red flags in minutes, not days

- Consult with a real estate attorney if you find anything concerning

Sources & References

- Virginia Code § 55.1-2312 (Resale Disclosure Act) — Virginia Legislative Information System

- Florida House Bill 913 (2025) — Florida Senate (condo buyer rescission period extended to 7 days)

- New 2025 Florida Condo Laws (HB 913) — What Homeowners Need to Know — Perez Mayoral, P.A.

- California Civil Code §§ 4525, 4530 (Davis-Stirling Act) — California Legislative Information (required disclosures and 10-day HOA document delivery obligation)

- 68 Pa.C.S. § 5407 (Uniform Planned Community Act) — Pennsylvania General Assembly (5-day rescission period)

- Maryland Real Property Code § 11-135 — Justia (7-day resale / 15-day new condo rescission period)

- What Realtors Should Know About the Virginia Resale Disclosure Act — Northern Virginia Association of Realtors

- What Percent Should HOA Reserves Be Funded? — Reserve Advisors (industry funding benchmarks)

- Understanding Costs of Hiring an HOA Lawyer — HOA Companion

- South Florida condo owners dumping homes after six-figure assessments — Yahoo Finance

This article is for informational purposes only and does not constitute legal, financial, or professional advice. HOA laws, rescission periods, and disclosure requirements vary by state, property type (condo vs. HOA vs. co-op), and individual governing documents. Statutes referenced may have been amended since publication. Always consult with a qualified real estate attorney licensed in your state for advice specific to your situation and transaction.