In This Guide

Review CC&Rs for restrictions, reserve study for funding levels, meeting minutes for red flags, and budget for fee stability. Request all documents before closing to avoid costly surprises.

You've found the perfect condo. Great location, right price, move-in ready. But buried in a 300-page document stack you have 3 days to review is a rental restriction that kills your backup plan—or a reserve fund so depleted that a $40,000 special assessment is inevitable.

Most condo buyers focus on the unit and ignore the HOA documents. They skim the CC&Rs, glance at the budget, and assume everything is fine. Then, months after closing, they discover they can't rent out the unit, the HOA is being sued, or a major repair is about to drain their savings.

The truth is: you're not just buying a home—you're joining a mini-government with the power to charge you fees, restrict how you use your property, and even place a lien on your home.

This guide shows you exactly which HOA documents to request, what to look for in each one, and the red flags that should make you negotiate harder or walk away. In about 90 minutes, you can complete a basic review that catches the issues that surprise most buyers.

Why HOA Documents Matter More Than the Unit Itself

When you buy a condo, you're joining a mini-government with enforcement power. HOA documents reveal hidden costs, restrictions, and financial risks that can cost $10,000-$100,000+ after closing.

The unit you're touring is only half the purchase. The other half—the one that determines your monthly costs, usage rights, and financial exposure—lives in the HOA documents.

Consider what these documents control:

- Your monthly costs: HOA fees, special assessments, transfer fees

- What you can do: Rent it out, have pets, make modifications, park your car

- Your financial exposure: Lawsuit liabilities, underfunded reserves, pending assessments

- Your resale value: Well-managed HOAs maintain property values; troubled ones destroy them

⚠️ Real Example:

A buyer in Florida closed on a condo without reviewing meeting minutes. Four months later, they received a $35,000 special assessment for concrete restoration—a project the board had been discussing for 18 months. The warning signs were in the minutes.

The 6 Essential HOA Documents to Request

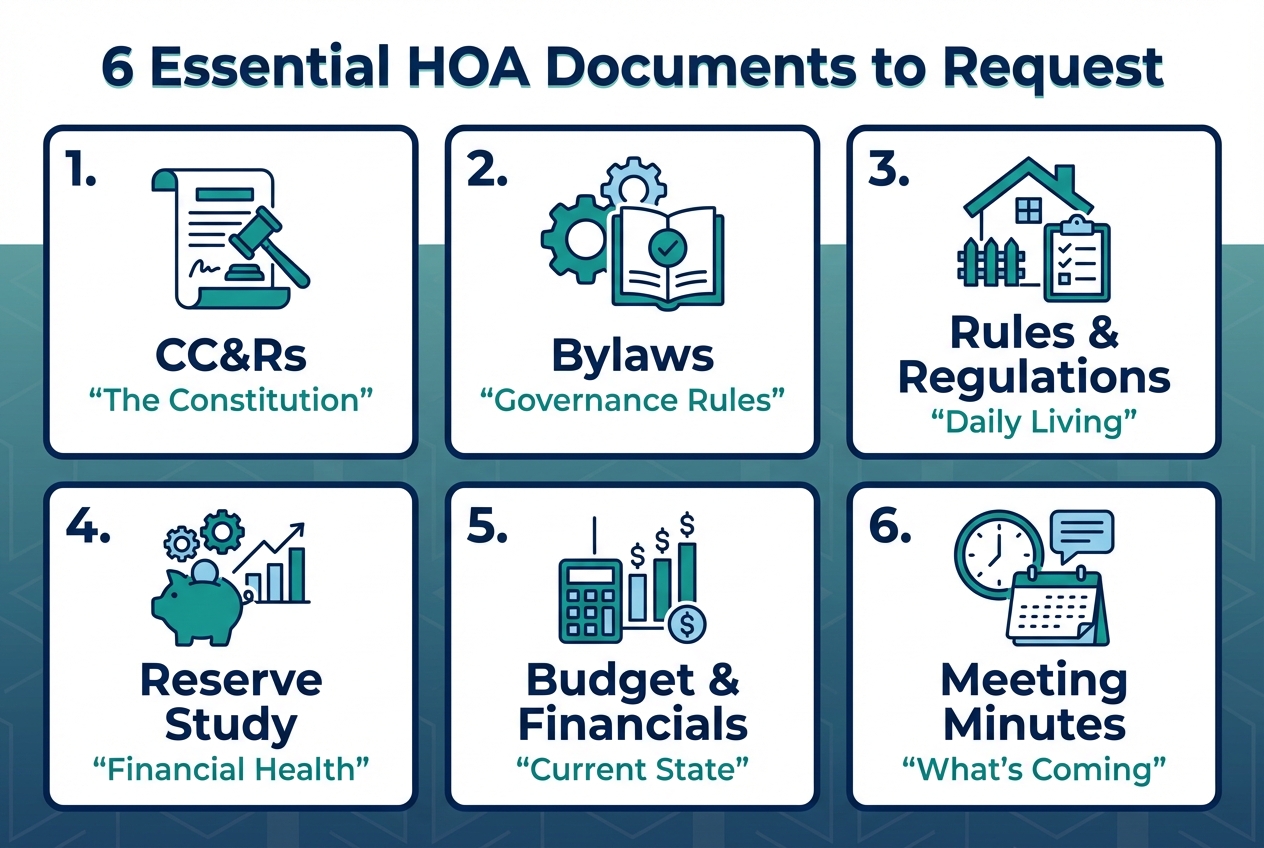

Request CC&Rs, bylaws, rules & regulations, reserve study, budget & financials, and the last 12-24 months of meeting minutes. Each document reveals different risks.

Six documents every buyer must review before closing

1. CC&Rs (Covenants, Conditions & Restrictions)

The CC&Rs are the "constitution" of the HOA—the foundational legal document that governs the community. They're recorded with the county and require an owner vote to change.

Key sections to review:

- Use restrictions: What you can and can't do with your property

- Rental/leasing provisions: Can you rent? Are there minimums or caps?

- Assessment authority: How assessments are calculated and allocated

- Maintenance responsibilities: What the HOA maintains vs. what you maintain

Related: How to Check for Rental Restrictions →

2. Bylaws

Bylaws govern how the HOA operates—the board structure, voting procedures, meeting requirements, and officer duties.

Key things to check:

- Board term limits and election procedures

- Quorum requirements for meetings and votes

- Amendment procedures (how hard is it to change rules?)

3. Rules & Regulations

Unlike CC&Rs, Rules & Regulations can typically be changed by the board without an owner vote. These cover day-to-day living: pet policies, parking, noise restrictions, pool hours, move-in procedures.

💡 Pro Tip:

Rules can change after you buy. Check recent board meeting minutes for discussions about rule changes—especially if you have pets, plan to rent, or need specific parking arrangements.

4. Reserve Study

The reserve study is your window into the HOA's financial health. It assesses the condition and remaining useful life of major components (roof, elevators, plumbing, etc.) and whether the HOA has enough money saved to repair them.

Key numbers to find:

- Percent funded: 70%+ is healthy, under 50% is concerning, under 30% is a red flag

- Items at RUL=0: Components at "end of useful life" need immediate attention

- Recommended vs. actual contributions: Is the HOA following the study's recommendations?

Related: How to Read a Reserve Study in 5 Minutes →

5. Budget & Financial Statements

The annual budget and financial statements show the HOA's current financial position—what they're collecting, spending, and saving.

Look for:

- Operating vs. reserve accounts: Are reserves held separately?

- Fee increase history: How often and how much have fees increased?

- Delinquency rate: High delinquency (over 10%) affects budgets and lending

- Budget vs. actual variances: Large variances suggest budgeting problems

6. Meeting Minutes (Last 12-24 Months)

Board meeting minutes reveal what financial statements can't: what the board is discussing, worrying about, and planning. They're your early warning system.

Search the minutes for:

- "Special assessment" or "assessment"

- "Defer" or "deferred maintenance"

- "Legal" or "litigation"

- "Insurance" (premium increases, coverage issues)

- "Reserve" (funding discussions, waiver votes)

Related: Understanding HOA Special Assessments →

The 3-Day Review Problem

Most states give buyers only 3 calendar days to review 200-400 pages of HOA documents. That's not enough time for thorough analysis. Request documents early or negotiate an extension.

Here's the systemic problem: you typically receive the HOA resale package during escrow, with only 3 calendar days (not business days) to review it and cancel if you find issues.

What you're expected to review in 3 days:

| Document | Typical Pages |

|---|---|

| CC&Rs | 80-150 |

| Bylaws | 20-40 |

| Rules & Regulations | 30-60 |

| Reserve Study | 40-80 |

| Financial Statements | 20-40 |

| Meeting Minutes (12 mo) | 50-100 |

| Total | 240-470 pages |

How to Get More Time

- Request documents before making an offer. Ask your agent to obtain the resale package during your search phase.

- Negotiate a longer review period. Include a 7-10 day document review contingency in your offer.

- Use professional help. A document analysis service can review 300 pages faster than you can.

💡 Florida Update:

As of July 2025, Florida law (HB 913) extends the condo buyer review period from 3 days to 7 days. This is a significant improvement, but still requires efficient review.

Red Flags Checklist: What to Look For

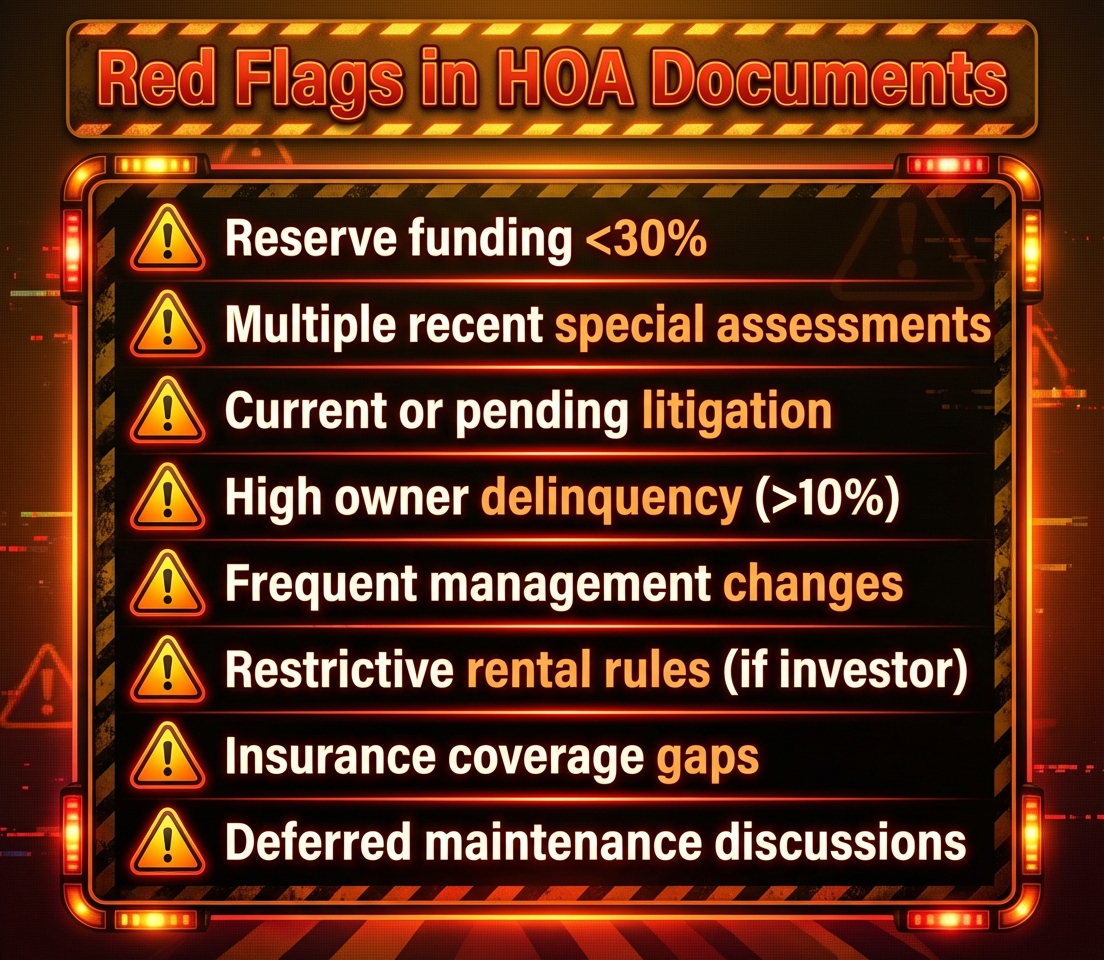

Major red flags include reserve funding under 30%, multiple recent special assessments, pending litigation, high delinquency rates, frequent management changes, and insurance coverage gaps.

Watch for these warning signs in HOA documents

Not all issues are deal-breakers, but these red flags warrant serious consideration:

High-Risk Red Flags

- ⚠️Reserve funding under 30% — High probability of special assessment

- ⚠️Multiple special assessments in past 3 years — Pattern of underfunding

- ⚠️Active or pending litigation — Legal costs and uncertainty

- ⚠️Owner delinquency rate over 10% — Affects budget and lender approval

- ⚠️Frequent management company changes — Sign of board problems

- ⚠️Insurance coverage gaps or non-renewal — Building may be high-risk

- ⚠️Deferred maintenance discussions — Work being postponed for budget reasons

- ⚠️Rental restrictions (if you may need to rent) — Could limit your options

Document-by-Document Review Guide

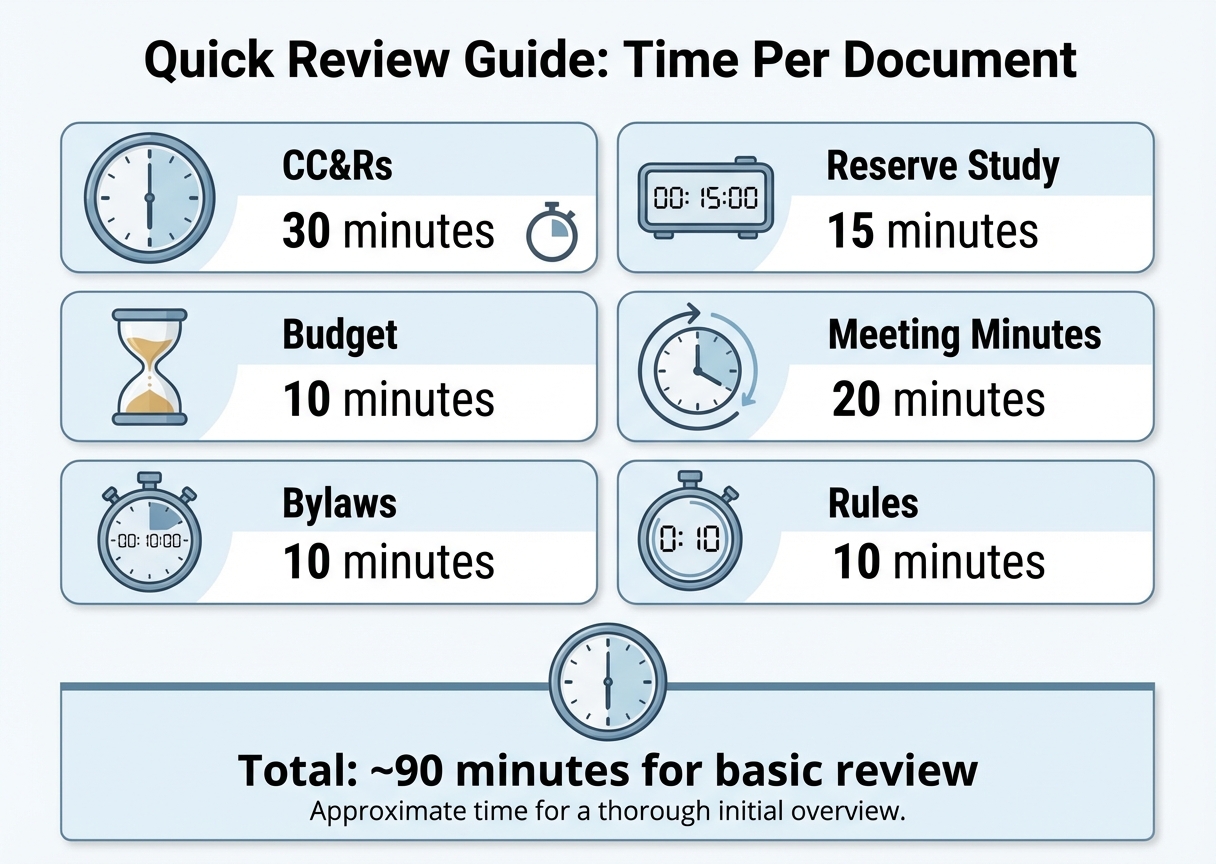

A focused review takes about 90 minutes: 30 min for CC&Rs, 15 min for reserve study, 10 min for budget, 20 min for meeting minutes, and 15 min for bylaws and rules.

Time allocation for efficient document review

CC&Rs (30 Minutes)

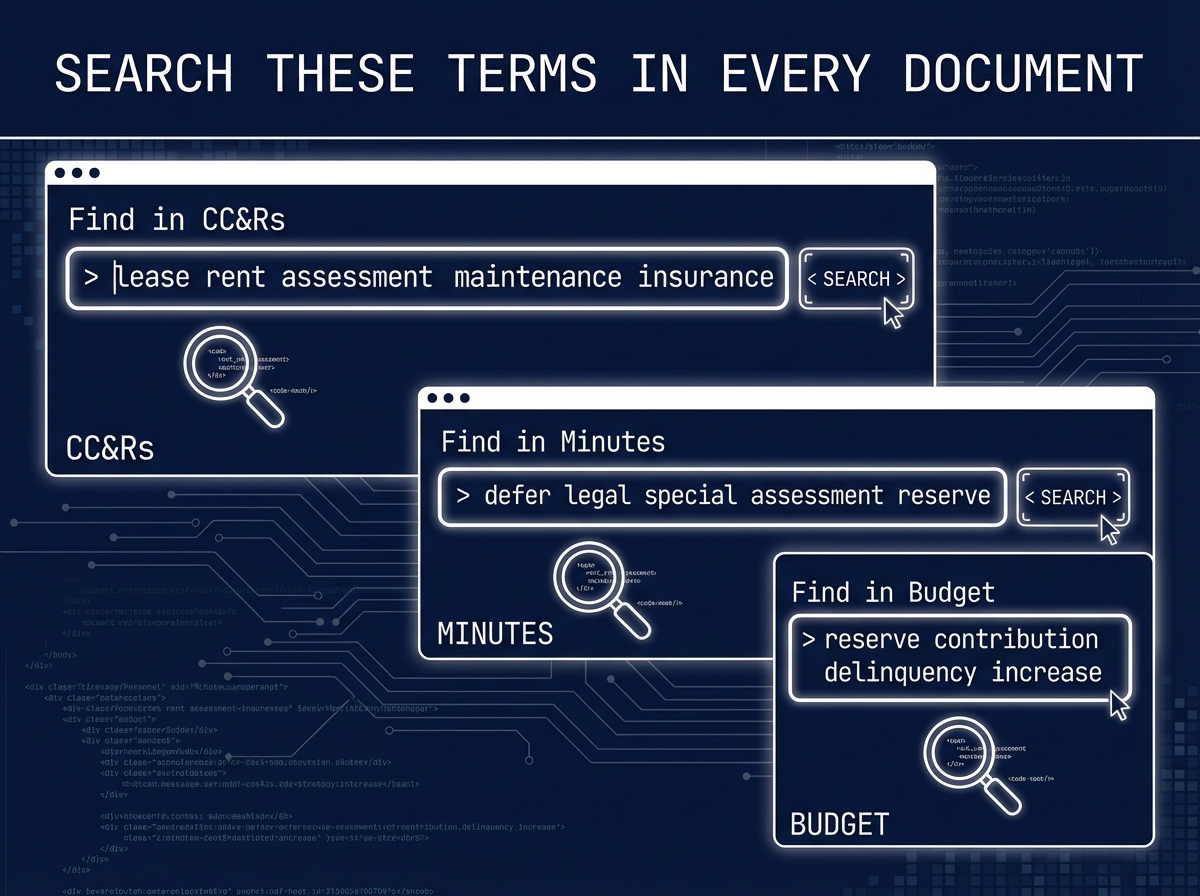

Use Ctrl+F (or Cmd+F) to search for these key terms:

"lease"or"rent"— rental restrictions"assessment"— how assessments work"maintenance"— who maintains what"insurance"— coverage requirements"pet"— animal restrictions"modification"or"alteration"— what changes you can make

Reserve Study (15 Minutes)

Go directly to the executive summary and find:

- Percent funded: The single most important number. Under 50% = concern. Under 30% = major red flag.

- Components with RUL = 0: These need immediate replacement. Multiple items = assessment coming.

- Recommended annual contribution: Is the HOA actually contributing this amount?

Use these search terms to find critical information quickly

Budget (10 Minutes)

Focus on:

- Reserve contribution line item: Is it at least what the reserve study recommends?

- Budget vs. actual comparison: Large variances (over 10%) suggest budgeting problems

- Fee increase history: Consistent large increases may continue

Meeting Minutes (20 Minutes)

Search for warning phrases:

"defer"— maintenance being postponed"legal"— attorney involvement, litigation"special assessment"— past or planned assessments"reserve"— funding discussions or waivers"insurance"— premium or coverage issues

Questions to Ask Based on What You Find

If reserves are under 50%, ask about the funding plan. If there's litigation, ask about potential outcomes. If delinquency is high, ask how it affects the budget. Get answers before closing.

When you find issues, ask specific questions before making your decision:

If You Find This → Ask This

- Reserve funding under 50%:

"What is the board's plan to increase reserve funding? Are fee increases or special assessments being discussed?" - Pending litigation:

"What are the potential outcomes of this litigation? Is there reserve exposure or assessment risk?" - High delinquency rate:

"How does the delinquency rate affect the operating budget? Is the HOA using reserves to cover shortfalls?" - Items at RUL=0:

"What is the timeline for replacing these components? Is there a plan and funding in place?" - Insurance issues:

"Has the association had difficulty obtaining coverage? What is the current coverage amount and deductible?"

When to Walk Away

Walk away from buildings with reserve funding under 20% and major repairs needed, active structural litigation, uninsurable properties, or multiple compounding red flags.

Some issues are negotiable—a price reduction for known assessment risk, for example. But certain situations should make you seriously consider walking away:

Strong Walk-Away Signals

- ✗Reserve funding under 20% with major repairs needed

- ✗Active structural defect litigation

- ✗Building effectively uninsurable

- ✗Multiple red flags compounding (low reserves + litigation + deferred maintenance)

- ✗HOA refuses to provide documents or is not transparent

- ✗SIRS not completed (Florida, if required) with no plan to complete

If you see multiple red flags, they compound the risk. A building with 40% reserves might be fine. A building with 40% reserves, pending litigation, and deferred roof repairs is a different story entirely.

Getting Help: Your Options

Options range from DIY review with a checklist (free but risky), to real estate attorney review ($300-500), to professional document analysis services ($39) with faster turnaround.

You don't have to review HOA documents alone:

| Option | Cost | Turnaround | Best For |

|---|---|---|---|

| DIY with checklist | Free | 2-4 hours | Simple situations |

| Real estate attorney | $300-500 | 3-5 days | Complex legal issues |

| GoverningDocs analysis | $39 | 30 min - 1 hour | Fast, comprehensive review |

Key Takeaways

Your HOA Document Review Checklist

- 1.Request all 6 documents early—don't wait for the 3-day review period.

- 2.Check the reserve study first. Under 50% funded = dig deeper. Under 30% = serious concern.

- 3.Read the meeting minutes. They reveal what financials can't—what's coming.

- 4.Use the red flags checklist. Multiple red flags compound risk.

- 5.Ask questions before closing. Get answers in writing.

- 6.Know when to walk away. Some buildings aren't worth the risk.

HOA document review isn't exciting, but it's the best protection against post-purchase surprises. Ninety minutes of careful review can save you tens of thousands of dollars—or help you find a building that's actually well-managed.

Get Your HOA Documents Analyzed

GoverningDocs extracts key information from CC&Rs, reserve studies, and meeting minutes—identifying red flags, rental restrictions, and assessment risk so you can make an informed decision.

Try Free Analysis →No signup required. Upload your HOA documents and get results in under an hour.

Frequently Asked Questions

What if the HOA won't provide documents before I make an offer?

This is a yellow flag. Well-managed HOAs are transparent and provide documents readily. If you can't get documents early, make sure your offer includes a document review contingency that gives you time to review and cancel if you find issues.

How old should the reserve study be?

Reserve studies should be updated every 3-5 years. A study older than 5 years is outdated—component conditions and costs change significantly. If the study is old, ask if an update is planned and factor potential changes into your assessment.

What's a "normal" HOA fee increase?

Annual increases of 3-5% are typical and healthy—they keep pace with inflation and maintenance costs. Increases over 10% annually, or large one-time increases, may indicate the HOA is catching up on deferred maintenance or underfunding.

Should I worry about pending litigation?

It depends on the type. Minor disputes (collections, vendor issues) are common. Construction defect lawsuits, personal injury claims, or disputes with significant potential damages are more concerning. Ask about the nature, potential outcomes, and whether reserves or insurance cover potential liability.

Can I negotiate based on HOA document findings?

Absolutely. If you discover issues like pending assessments, low reserves, or upcoming repairs, you can negotiate a price reduction, request seller credits, or ask the seller to pay known assessments. Document findings give you leverage.

What documents does the seller have to provide?

Requirements vary by state. Most states require a "resale package" or "disclosure packet" that includes governing documents, financials, and the reserve study. Some states mandate specific items; others leave it to the HOA. Your agent should know local requirements.