In This Guide

A reserve study is a financial planning document that shows whether an HOA has enough money saved for major repairs—and whether you face special assessment risk.

Learning how to read a reserve study could save you from the nightmare scenario every condo buyer fears: a surprise $40,000 special assessment notice arriving in your mailbox six months after closing.

It happens more often than you'd think. According to the Community Associations Institute, over 70% of HOAs are considered underfunded, meaning they don't have enough money set aside for major repairs. When an aging roof finally fails or an elevator needs emergency modernization, guess who pays? Every homeowner in the building—sometimes with as little as 30 days notice.

What our research shows: After analyzing 38 Florida SIRS reports, we found a more nuanced picture—65% of associations were at 100% funded, while 27% were critically underfunded below 30%. Very few fell in the middle. This bimodal distribution suggests HOAs are either proactively well-managed or seriously behind on contributions.

The information that could have predicted this financial hit was hiding in plain sight: buried in a 200+ page reserve study that most buyers never read.

But here's the good news: you don't need to read all 200 pages. In this guide, you'll learn exactly how to read a reserve study in under 5 minutes by focusing on just three critical numbers. These metrics will tell you whether an HOA is financially healthy or headed for a special assessment—before you sign on the dotted line.

Why Do Reserve Studies Matter When Buying a Condo?

Reserve studies matter because 70% of HOAs are underfunded—meaning special assessments of $5,000 to $100,000+ per unit are common when major repairs arise.

A reserve study is essentially a financial roadmap for an HOA's long-term capital expenses. Think of it like a savings plan for the building's major systems: roof replacement, parking lot resurfacing, elevator modernization, plumbing overhauls, and more.

Here's a helpful analogy: Imagine you're buying a used car. You'd want to know if the transmission is about to fail or if the owner has been saving for predictable repairs. A reserve study is like a detailed maintenance report for a building—it tells you what's wearing out and whether there's money to fix it.

What Happens When HOAs Don't Have Enough Reserves?

When an HOA doesn't have sufficient reserves, they issue a special assessment—a mandatory fee that can range from $5,000 to $100,000+ per unit. Unlike monthly HOA dues, special assessments often come with little warning and short payment deadlines.

Pro Tip

Special assessments can affect your ability to sell later. Buyers are wary of buildings with recent or pending assessments, which can depress property values and extend time on market.

Important: Post-Surfside Reality

After the 2021 Surfside condo collapse, Florida mandated structural inspections and reserve studies (SIRS) for all 3+ story buildings. Many associations discovered they were only 10-20% funded when they needed to be at 70%+. Special assessments of $50,000-$200,000 per unit became common. Similar legislation is spreading to other states—understanding reserve studies has never been more critical.

What Are the 3 Key Numbers in a Reserve Study?

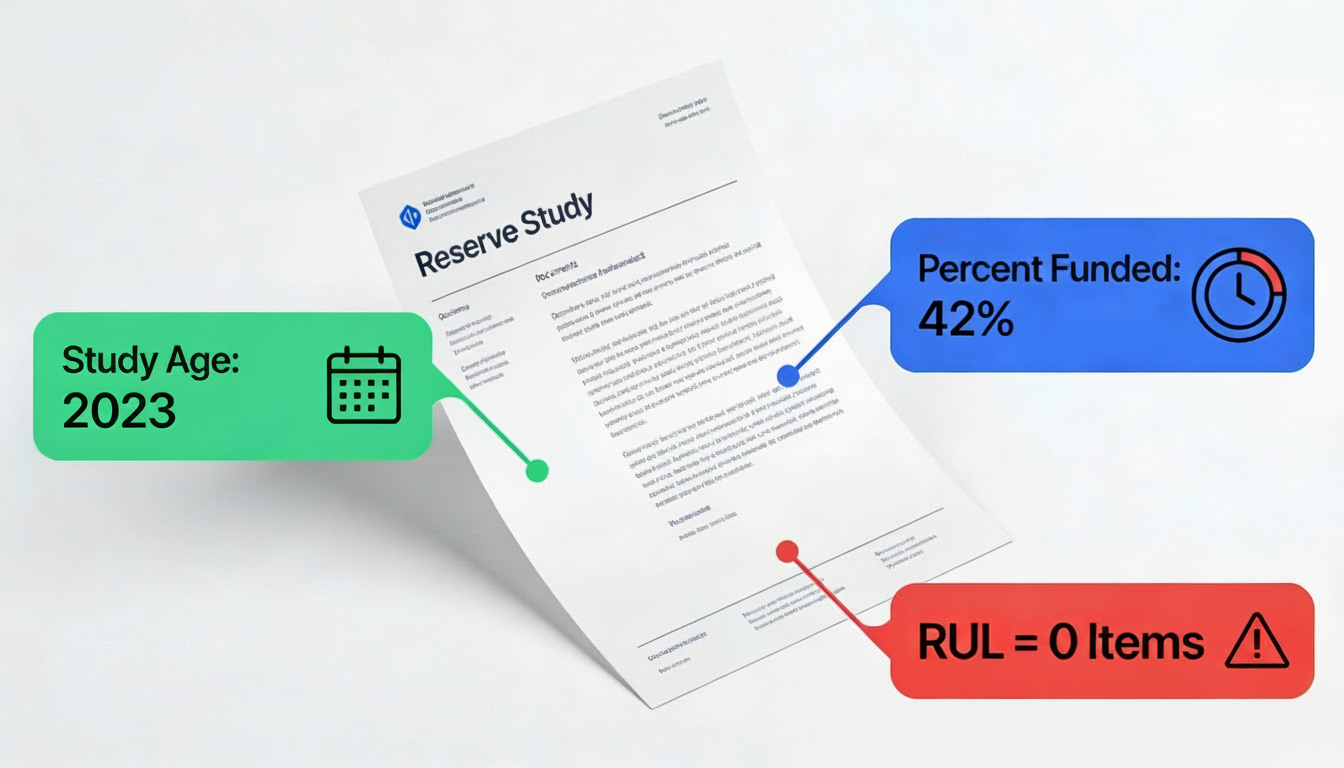

The three critical numbers are: Percent Funded (target 70%+), Study Age (should be under 3 years), and RUL=0 items (deferred maintenance needing immediate attention).

When learning how to read a reserve study, focus on these three metrics. Together, they paint a clear picture of an HOA's financial health and special assessment risk.

A sample reserve study dashboard highlighting the 3 key metrics

What is Percent Funded in a Reserve Study?

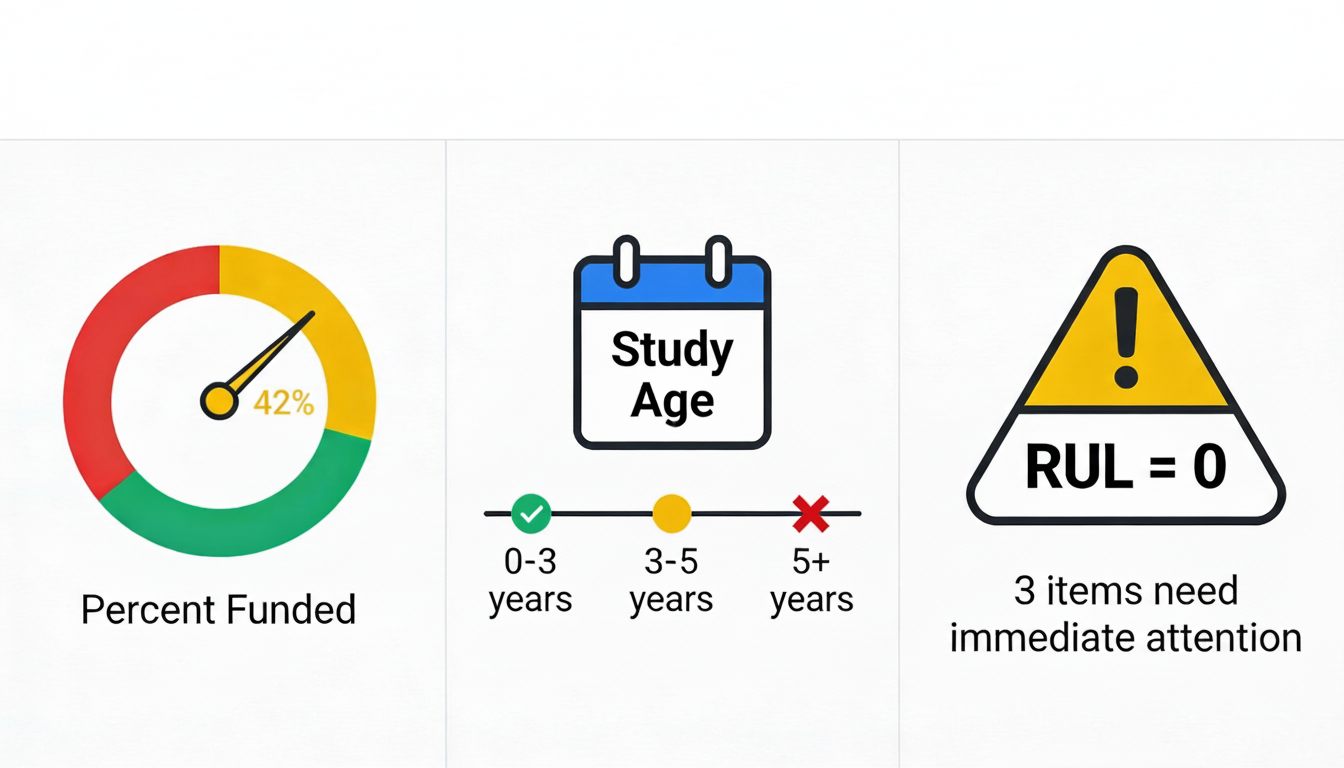

Percent funded measures what percentage of required reserves an HOA actually has—70%+ is healthy, 30-70% needs caution, below 30% signals high special assessment risk.

Percent funded is the single most important number in any reserve study. It answers a simple question: what percentage of the money the HOA should have does it actually have?

For example, if an HOA needs $1,000,000 in reserves to properly fund all anticipated repairs but only has $400,000, they're 40% funded.

| Percent Funded | Risk Level | What It Means | Action Required |

|---|---|---|---|

| 70-100% | ✓ Low Risk | Well-funded; HOA can handle most repairs from reserves | Standard due diligence |

| 30-70% | ⚠ Moderate Risk | Underfunded; some repairs may require special assessments | Review RUL = 0 items carefully |

| Below 30% | ✕ High Risk | Critically underfunded; special assessments highly likely | Proceed with extreme caution |

GoverningDocs Research Finding

Our analysis of 38 Florida SIRS reports found that 26.9% of associations were critically underfunded below 30%. Additionally, 10.5% had components at RUL=0 (past due for replacement). The average building age was 41 years, with 79% of buildings over 30 years old—explaining why so many major systems are reaching end of life.

Where to Find It

Look in the Executive Summary on pages 1-5. Search for "Percent Funded," "Funding Status," or "Reserve Fund Status." This number should be prominently displayed.

Important: Percent Funded Isn't the Whole Story

A small 10-unit HOA at 40% funded might only need an extra $50/month per unit to catch up. But a large complex at 80% funded could still face a major assessment if a $2M roof replacement is due next year. Always check the RUL = 0 items alongside the funding percentage.

How Old Should a Reserve Study Be?

A reserve study should be less than 3 years old. Studies older than 3 years may disqualify you from Fannie Mae/Freddie Mac financing and miss critical cost increases.

Reserve studies should be updated every 3-5 years. An outdated study is like using a 2015 GPS—it might get you there, but you'll miss all the new roads and construction.

Outdated studies create several problems:

- Missed new expenses: Building components age, fail, or get replaced between updates

- Underestimated costs: Construction and materials costs increase 3-5% annually

- Inaccurate timelines: Components may deteriorate faster than originally projected

Less than 3 years = Good

Recent data, reliable projections, likely meets lender requirements

3-5 years = Acceptable (with caution)

Still usable but aging; ask when next update is scheduled

More than 5 years = Red Flag

Outdated data; may miss critical components and underestimate costs significantly

Financing Alert

Fannie Mae and Freddie Mac require reserve studies less than 3 years old for condo financing. An outdated study can kill your buyer's loan approval. If the study is older than 3 years, ask the HOA about their update timeline.

What Does RUL = 0 Mean in a Reserve Study?

RUL = 0 means Remaining Useful Life is zero—the component is past due for replacement. These deferred maintenance items often trigger surprise special assessments.

Remaining Useful Life (RUL) tells you how many years a building component has left before it needs replacement. When RUL = 0, that component is past due for replacement—it needs attention now.

Understanding RUL (Remaining Useful Life)

Every major building component has an expected lifespan. RUL calculates how many years remain until replacement is needed.

Example: A roof with a 25-year lifespan that's 20 years old has an RUL of 5 years. When it reaches RUL = 0, replacement should happen immediately.

Why RUL = 0 Items Are Critical

RUL = 0 items represent deferred maintenance—work that should have already been completed but hasn't. This is often where surprise special assessments originate.

Where to Find It

Look in the Component List, Reserve Schedule, or 30-Year Projection Table. Filter or search for items with RUL = 0, "Immediate," or "Past Due."

High-Cost RUL = 0 Items to Watch For:

- Roof Replacement (RUL = 0) — Cost: $800K-$2M+

~$10K-$25K per unit in a typical building - Elevator Modernization (RUL = 0) — Cost: $300K-$500K per elevator

Safety issue + significant expense; may require temporary closure - Plumbing/Pipe Replacement (RUL = 0) — Cost: $500K-$1.5M

Emergency failure risk; often requires unit access - Structural Concrete Repair (RUL = 0) — Cost: $200K-$1M+

Safety-critical; may trigger additional inspection requirements

Pro Tip: Calculate Your Per-Unit Exposure

For every RUL = 0 item, divide the estimated cost by the number of units in the building. This gives you a rough idea of your potential special assessment exposure.

Formula: Total Component Cost ÷ Number of Units = Your Potential Share

Your Action Plan Based on What You Find

Now that you know how to read a reserve study, here's what to do with the information you've gathered.

If Percent Funded is Below 30%

- • Request the last 3 years of HOA meeting minutes—look for special assessment or deferred maintenance discussions

- • Ask the HOA board directly about upcoming assessments and funding plans

- • Review the reserve study's funding plan—are they proposing to catch up, or accepting underfunding?

- • Consider negotiating a seller concession equal to your estimated share of deferred maintenance

- • Evaluate whether to walk away—critically underfunded HOAs can become money pits

If Study Age is More Than 3 Years

- • Ask when the next study is scheduled—a responsible HOA will have this planned

- • Check with your lender—an outdated study may disqualify the property for conventional financing

- • Request recent capital expenditure history—what major work has been done since the study?

- • Consider requesting a study update as a condition of your purchase

If RUL = 0 Items Exist

- • Calculate your per-unit share: Total Cost ÷ Number of Units

- • Ask the HOA board about their plan—will reserves cover it, or is a special assessment planned?

- • Review HOA financials to verify actual cash reserves match the study

- • Budget for potential assessments in your closing cost calculations

- • Negotiate a price credit equal to your share of immediate maintenance needs

Essential Document Checklist for Condo Due Diligence

Request these documents during your contingency period for a complete picture of HOA financial health:

- □Reserve study — Confirm it's less than 3 years old

- □Current reserve balance statement — Bank statements or audited financials

- □HOA meeting minutes (12-36 months) — Look for assessment discussions or deferred maintenance debates

- □Current and prior year budgets — Verify reserve contributions match the study's recommendations

- □Special assessment history — Any assessments in the past 5 years? What were they for?

- □Insurance certificate — Check coverage limits, deductibles, and any exclusions

Real Example: How One LA Condo Buyer Saved $3,000 Using These Metrics

Let's see how these three numbers work together in a real scenario. A buyer was considering a unit in a 6-unit Los Angeles condo listed at $425,000. Here's what their reserve study analysis revealed:

Reserve Study Snapshot

Components with RUL = 0:

- • Structural pest control: $10,000

- • Ironwork: $1,000

- • Exterior trim: $2,800

- • Wood gates: $300

The Analysis: What These Numbers Revealed

At first glance, 30.68% funded seems borderline acceptable—right at the threshold between "caution" and "red flag." But the buyer dug deeper and discovered something concerning.

The monthly reserve contributions were $450/month, but the study recommended $618.30/month. That's a $168.30 monthly shortfall—meaning the HOA was falling further behind each month, not catching up.

With $14,100 in immediate maintenance needs and only $23,402 in reserves, the HOA could barely cover current deferred maintenance—leaving nothing for upcoming expenses like the slate decks (2 years RUL, $7,450 cost).

The Per-Unit Math

$14,100 (immediate needs) ÷ 6 units = $2,350 per unit

This is the buyer's potential exposure for just the deferred maintenance—not counting upcoming repairs.

The Outcome: Informed Negotiation

Armed with this analysis, the buyer contacted the HOA board. The board confirmed they planned to address the structural pest control "within the next 6 months" but hadn't decided whether to use reserves or issue a special assessment.

The buyer successfully negotiated a $3,000 seller concession to cover their estimated share of immediate and near-term deferred maintenance. They got the condo they wanted while protecting themselves from predictable costs.

Without understanding how to read a reserve study, this buyer might have faced an unexpected special assessment within their first year of ownership.

Pro Tips: Using Reserve Study Findings in Negotiations

- Request a price credit — For RUL = 0 items, ask for a credit equal to your per-unit share of deferred maintenance

- Negotiate an escrow holdback — For known near-term projects, request funds held in escrow until work is completed

- Extend your contingency period — If documents are incomplete or the study is outdated, request additional time for proper due diligence

- Request an updated reserve study — If the study is more than 3 years old, ask the HOA to commission an update before closing

Key Takeaways: Your Reserve Study Quick-Check Summary

Now you know how to read a reserve study in under 5 minutes. Here's what to remember:

The 3 Numbers That Reveal HOA Financial Health

- Percent Funded — Look for 70%+ (good), 30-70% (caution), below 30% (red flag). Find it in the Executive Summary.

- Study Age — Studies should be less than 3 years old. Older studies may disqualify you from conventional financing and miss critical updates.

- RUL = 0 Items — These are deferred maintenance items that need immediate attention. Calculate your per-unit share and factor it into your purchase decision.

Remember: Special assessments are rarely truly "surprises." The warning signs are almost always hidden in the reserve study—you just need to know where to look.

Save Time with Automated Reserve Study Analysis

Manually analyzing reserve studies takes 30-60 minutes per property. If you're a real estate agent helping multiple buyers or an HOA board member reviewing your association's financials, that adds up quickly.

GoverningDocs analyzes reserve studies automatically, flagging these critical metrics in under 2 minutes:

- Percent funded status with risk assessment

- Study age and update schedule recommendations

- All deferred maintenance items (RUL = 0) with cost estimates

- Per-unit cost calculations for upcoming expenses

- Comparison to industry benchmarks

Try it free—no signup required: governingdocs.dev/reserve-study →

About GoverningDocs Team

The GoverningDocs team specializes in AI-powered analysis of HOA documents. We've analyzed over 1,100+ reserve studies, CC&Rs, and governing documents to help real estate agents, HOA board members, and condo buyers make informed decisions. Our platform identifies red flags, verifies claims with sources, and extracts critical information in minutes—not hours.

Start Your Reserve Study Analysis Today

Analyze HOA reserve studies and governing documents in minutes. No signup required to get started.