In This Guide

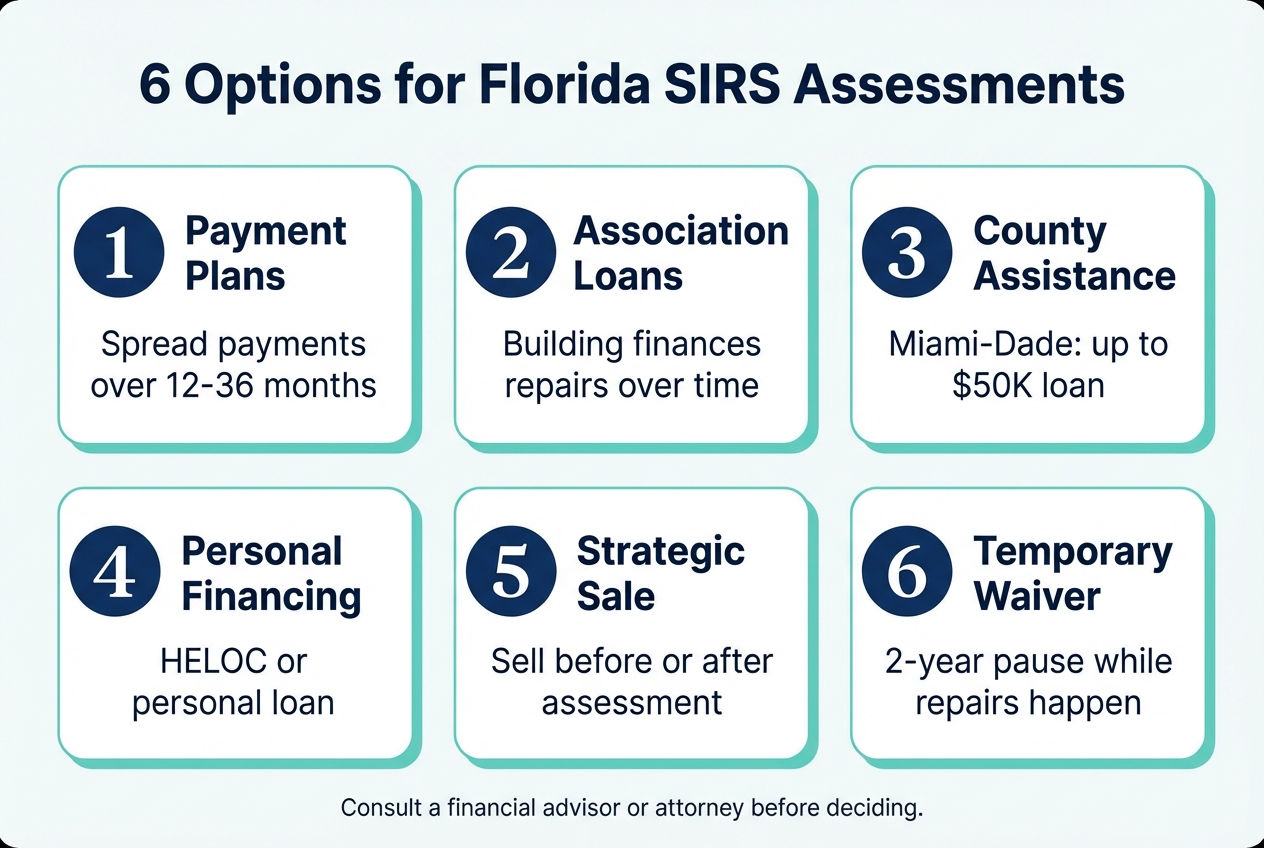

Florida owners facing SIRS assessments have options: payment plans, association loans, county assistance programs, personal financing, strategic sale timing, or temporary waivers.

The envelope from your HOA sits on the counter. Inside is a special assessment notice for $45,000. It's due to SIRS compliance. You have 90 days to pay.

You're not alone. Across Florida, condo owners are opening similar letters. Post-Surfside structural safety laws now require buildings to fully fund reserves for 8 critical components. Reserve waivers are over. The bills are arriving.

Based on GoverningDocs analysis of 38 Florida SIRS reports, 26.1% of HOAs are underfunded below 50%. That means roughly one in four Florida condo buildings is facing significant assessment pressure right now.

But getting an assessment notice doesn't mean you're out of options. Florida law, county programs, and your own association's bylaws give you several paths forward. Here's what they are and how to use them.

You Got the Assessment Notice. Now What?

Don't panic. Read the notice carefully for payment amount, deadline, and what the assessment covers. You likely have more time and more options than you think.

First, take a breath. Then read the notice carefully. Look for these four things:

- Total amount due: What's your unit's share of the assessment?

- Payment deadline: When is it due? Is there a single lump sum or installment option?

- What it covers: Which SIRS components need repair or reserve funding?

- Consequences of non-payment: What happens if you can't pay on time? (Liens, late fees, interest.)

Important

Do not ignore the notice. Under current Florida law, associations generally have the authority to place a lien on your unit for unpaid assessments and may ultimately pursue foreclosure, subject to specific notice and procedural requirements. The sooner you respond, the more leverage you have to negotiate terms. Consult a Florida real estate attorney for guidance on your rights.

Understanding Your SIRS Assessment

SIRS assessments fund 8 mandatory structural components that can no longer be waived. They exist because of the Surfside collapse and Florida's new reserve funding requirements.

After the Champlain Towers South collapse in 2021, Florida passed laws requiring condos and co-ops with 3 or more habitable stories to complete a Structural Integrity Reserve Study (SIRS). Under current law, associations with budgets adopted on or after December 31, 2024, can no longer waive funding for the mandatory SIRS components, and full SIRS reserve funding must begin by January 1, 2026.

The 8 Mandatory SIRS Components

- Roof

- Structure (load-bearing walls, columns, foundations)

- Fireproofing and fire protection systems

- Plumbing

- Electrical systems

- Waterproofing and exterior painting

- Windows and exterior doors (common area)

- Any other item with a deferred maintenance expense or replacement cost exceeding $25,000 that affects structural integrity (threshold raised from $10,000 by HB 913, adjusted annually for inflation)

SIRS vs. Non-SIRS Assessments

This is a critical distinction. Under current Florida law, SIRS reserves can no longer be waived by owner vote for budgets adopted on or after December 31, 2024. Non-SIRS reserves (pools, landscaping, HVAC) may still be subject to waiver by owner vote, depending on the association's governing documents. If your assessment is specifically for SIRS components, the association was required by law to fund them. Consult a Florida real estate attorney for questions about your specific situation.

Related: Florida Condo Crisis 2026: What Buyers Must Know →

Option 1: Payment Plans

Most associations offer installment plans that spread the assessment over 12-36 months. Contact your board or management company to request extended payment terms.

Many associations allow owners to pay assessments in installments rather than a single lump sum. This is often the simplest and most accessible option.

- How to request: Contact your property manager or board in writing. Ask specifically about installment options.

- Typical terms: 12-36 monthly payments, sometimes with interest (usually 8-18% annually).

- What to expect: Some associations charge a setup fee or require a down payment (10-25% of total).

- If you miss payments: Late fees accrue, and the association can accelerate the full balance due. This can also trigger lien proceedings.

Tip

Put your payment plan request in writing. If the association doesn't have a formal installment policy, ask the board to adopt one. Florida's HB 913 gives associations more flexibility in how they collect reserves.

Option 2: Association Financing

HB 913 allows associations to use loans and credit lines for reserve funding, spreading the cost over time through smaller monthly assessment increases instead of one large bill.

Instead of hitting every owner with a massive one-time assessment, your association can take out a loan to fund the repairs and repay it over time through slightly higher monthly assessments.

- How it works: The association borrows from a bank or lender. Repayment is built into monthly HOA fees over 5-15 years.

- Approval required: Voting requirements vary by association. Check your governing documents and consult your association's attorney for the specific approval process.

- Advantage: Spreads a $50,000 assessment into something like $350-500/month added to your HOA fee.

- Downside: Interest adds to total cost. And owners who sell early still benefit while remaining owners keep paying.

If your board hasn't explored association financing, raise it at the next meeting. Several lenders specialize in condo association loans and understand Florida's SIRS requirements. Your property management company or a community association attorney can help identify lending options.

Six options available to Florida condo owners facing SIRS assessments

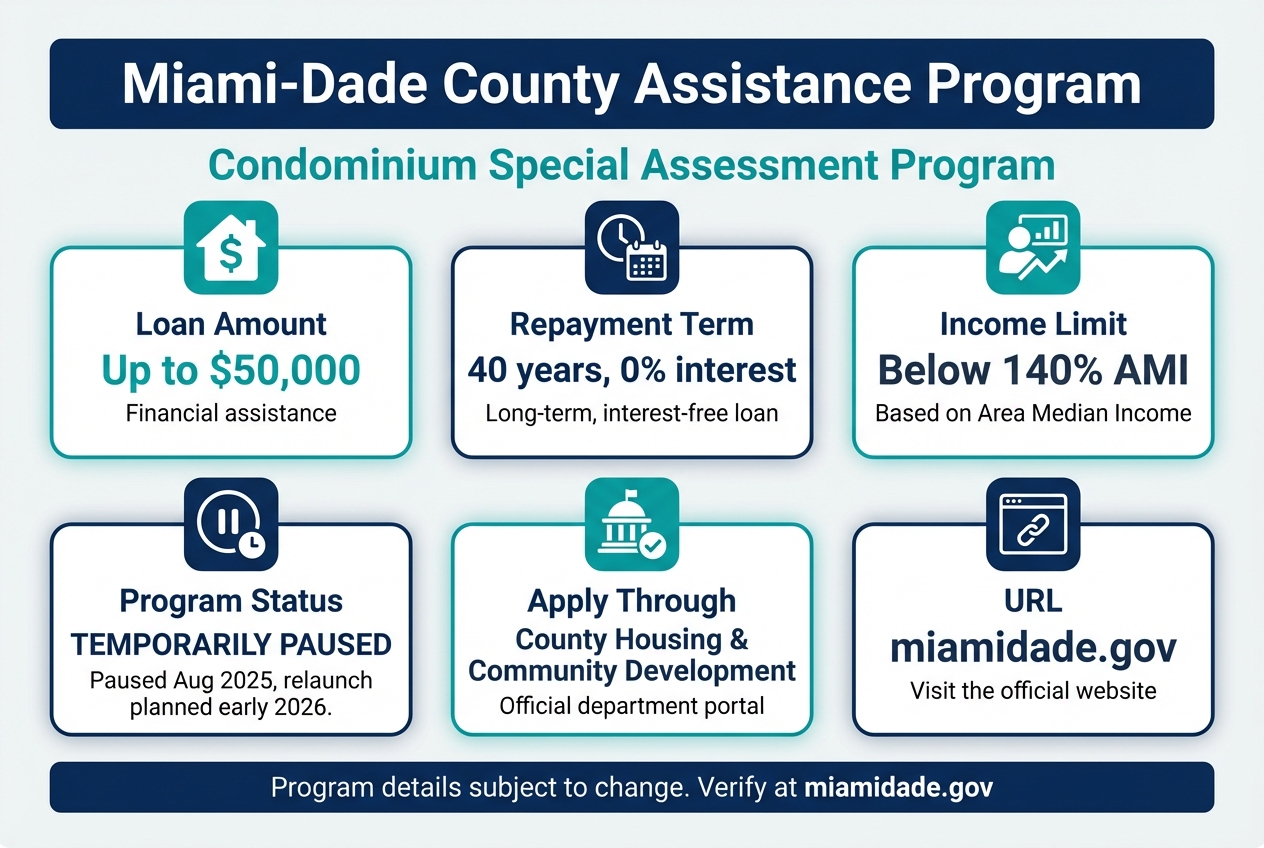

Option 3: County Assistance Programs

Miami-Dade County offers up to $50,000 in loans with 40-year repayment terms for condo owners facing special assessments. Other Florida counties may have similar programs.

Miami-Dade Condominium Special Assessment Program

Miami-Dade County has a dedicated program for condo owners who can't afford special assessments. It's one of the most generous assistance programs in Florida.

Miami-Dade County's assistance program for condo owners facing special assessments

- Loan amount: Up to $50,000

- Repayment term: Up to 40 years

- Income limit: Household income must be below 140% of Area Median Income (AMI)

- Status: Program was temporarily paused in August 2025 with plans to relaunch in early 2026. Check the county website for current availability.

- How to apply: Through Miami-Dade County Housing and Community Development

Check Your County

Miami-Dade isn't the only county exploring assistance. Palm Beach County commissioners have discussed creating a similar fund for low-interest loans, though details are still being finalized. Contact your county's housing department to ask what's available in your area.

You can also check with the Florida Housing Finance Corporation for state-level programs that may apply.

Option 4: Personal Financing

Home equity lines of credit (HELOCs) and personal loans can cover assessment costs at lower interest rates than HOA late fees. Avoid credit cards and 401(k) withdrawals if possible.

If the association doesn't offer a payment plan or loan option, you'll need to finance the assessment yourself. Here are the most common approaches, ranked from best to worst:

| Option | Typical Rate | Pros | Cons |

|---|---|---|---|

| HELOC | 7-10% | Lower rate | Uses home as collateral, takes 2-4 weeks to set up. Interest may only be tax-deductible if funds are used for home improvements (consult a tax professional). |

| Personal loan | 8-15% | Fast approval, no collateral | Higher rate, shorter terms |

| Credit card | 20-29% | Immediate availability | Very high interest. Avoid if possible. |

| 401(k) withdrawal | Penalties + income tax may apply | No credit check | Destroys retirement savings. Tax rules and exceptions are complex. Last resort only. Consult a tax professional and financial advisor first. |

A HELOC is usually the best option if you have equity in your unit. If your assessment is due quickly, a personal loan from your bank or credit union can fund in a few days.

Option 5: Selling Before or After Assessment

Selling is an option, but Florida's condo market is a buyer's market with 10-14 months of inventory. Price your unit to reflect the assessment situation and disclose clearly.

Some owners decide to sell rather than pay a large assessment. This is a legitimate option, but it comes with trade-offs in today's market.

Market Reality

- Florida condo values are down significantly for older buildings (30+ years), with statewide condo prices down roughly 8-14% from peak

- In major Florida metros, 85-92% of condo sales are closing below asking price (per Redfin)

- South Florida has 10-13+ months of condo inventory, meaning buyers have leverage

- TD Economics projects recovery by late 2026, but timing is uncertain

Timing Considerations

- Sell before the assessment is levied: Buyers will still discover the building's reserve situation during due diligence, so you'll likely need to price accordingly.

- Sell after paying: A paid assessment and SIRS-compliant building can actually be a selling point. "Repairs done, reserves funded" attracts buyers who want certainty.

- Negotiate with the buyer: You can split the assessment, offer a credit at closing, or adjust the sale price.

Option 6: Temporary Waiver (Limited Cases)

HB 913 may allow a temporary suspension of SIRS reserve funding after a milestone inspection identifies needed repairs. This delays the obligation but does not eliminate it.

Florida's HB 913 includes a provision allowing associations to temporarily suspend SIRS reserve contributions under specific conditions:

- When it may apply: The building must have completed a milestone inspection within the previous 2 calendar years that identified necessary structural repairs.

- Duration: Up to 2 consecutive annual budget cycles, per the statute.

- Approval: Generally requires a majority vote of total voting interests (not just the board). Check your governing documents.

- Sunset: Available for budgets adopted on or before December 31, 2028, per the current statute.

- Key point: This doesn't eliminate the funding requirement. It delays contributions while the association addresses repairs identified in the milestone inspection. Associations should consult legal counsel before invoking this provision.

Important

A temporary waiver is not a permanent solution. Once the 2-year period ends (or repairs are completed), full SIRS reserve funding must resume. Use this time to plan your long-term financing strategy.

If You're on a Fixed Income

Fixed-income owners have additional options including senior assistance programs, hardship exemptions, and county aid. Talk to your board before assuming the worst.

Many Florida condo owners are retirees living on Social Security and fixed pensions. A $30,000-$100,000 assessment can feel impossible. Here's what to consider:

- Talk to your board first. Many associations have informal hardship policies. If they don't, ask the board to create one. Boards generally prefer to work with struggling owners rather than go through foreclosure proceedings.

- Apply for county assistance. The Miami-Dade program (and similar county programs) specifically targets moderate-income residents. The 140% AMI threshold covers many retirees.

- Consult a housing counselor. HUD-approved housing counseling agencies can help you evaluate your options for free. Find one at hud.gov/findacounselor.

- Explore reverse mortgage options carefully. Some owners 62 and older consider a Home Equity Conversion Mortgage (HECM). These products have significant terms, costs, and ongoing obligations (including property taxes and insurance). HUD-approved counseling is required before obtaining one. Speak with a licensed financial advisor before pursuing this option.

- Know your legal rights. Consult with a real estate attorney before making major decisions. Some owners have successfully negotiated reduced assessments or extended terms through legal counsel.

If selling becomes the right choice, that's OK too. Sometimes the smartest financial decision is to sell a unit you can't afford to maintain and move into housing that fits your budget. There's no shame in being practical.

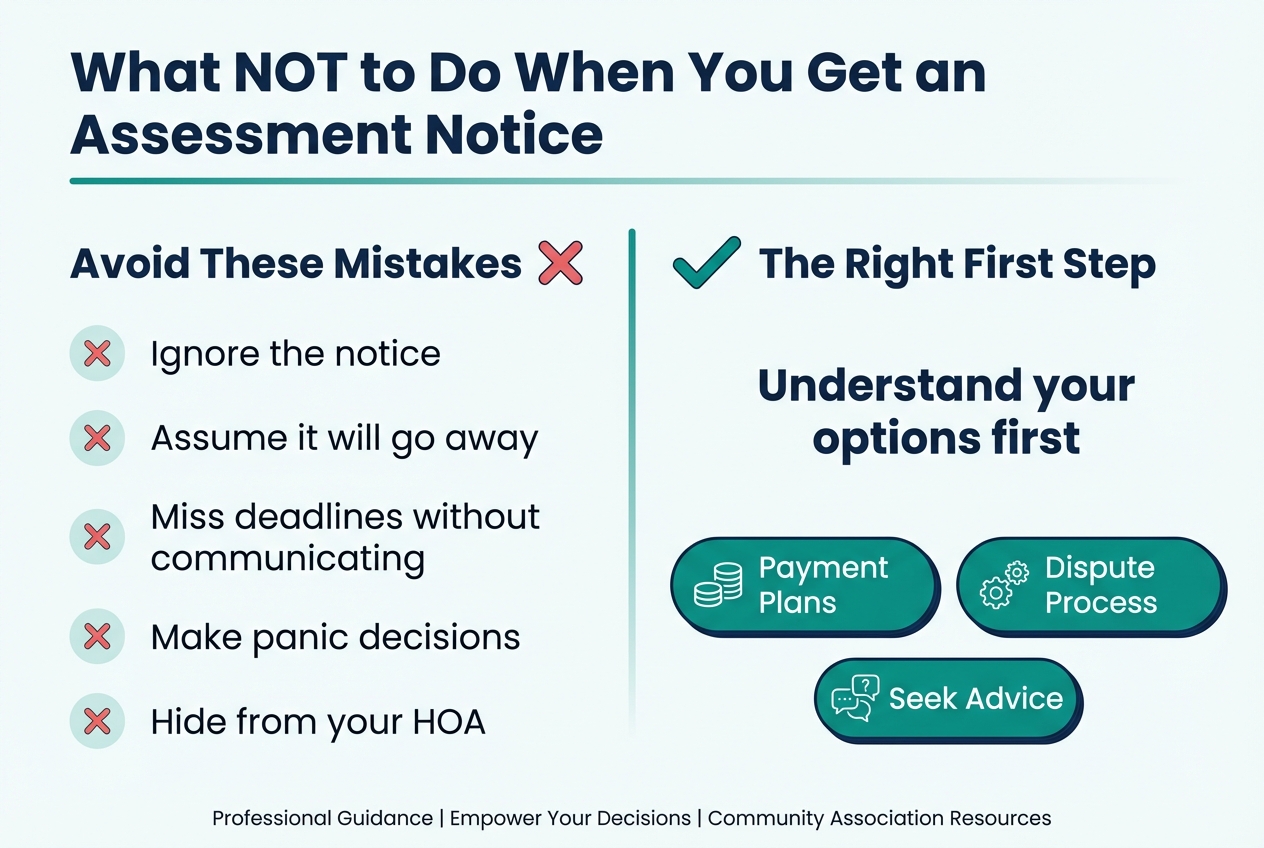

What NOT to Do

Ignoring the assessment, missing deadlines, or making panic decisions are the three biggest mistakes Florida condo owners make when facing SIRS assessments.

The biggest mistakes owners make when facing SIRS assessments

- Don't ignore the notice. Unpaid assessments typically accrue interest and late fees. Under Florida law, associations may lien your unit for unpaid assessments, and those liens can potentially lead to foreclosure proceedings.

- Don't assume it will go away. SIRS reserves are mandatory. The law changed permanently. Your building's obligations aren't going to be reversed.

- Don't miss payment deadlines without communicating. If you can't pay on time, tell your board or management company before the deadline. Proactive communication usually leads to better outcomes than silence.

- Don't make panic decisions. Selling your unit at a steep loss in today's buyer's market may cost more than paying the assessment. Run the numbers first.

- Don't go it alone. Talk to a housing counselor, attorney, or financial advisor before making major moves. Many offer free initial consultations.

Understand Your Building's SIRS Situation

GoverningDocs analyzes reserve studies and SIRS reports to show you exactly where your building stands. See percent funded, deferred maintenance items, and assessment risk. Free tools available, no signup required.

Upload your documents and get results in 3-5 minutes.

Frequently Asked Questions

Can my HOA foreclose on my unit for an unpaid assessment?

Generally, yes. Under current Florida law, both HOAs (Chapter 720) and condominium associations (Chapter 718) may place a lien on a unit for unpaid assessments and can pursue foreclosure, subject to specific notice and procedural requirements. The process takes time, but it's a real risk. Contact your board early to negotiate payment terms. Consult a Florida real estate attorney for guidance about your specific situation and rights.

How much are SIRS assessments typically costing Florida owners?

It varies enormously depending on building age, condition, and how much maintenance was deferred. News reports document assessments ranging from $100,000 to over $400,000 per unit in extreme cases. Based on GoverningDocs analysis of 38 Florida SIRS reports, 26.1% of buildings are funded below 50%, which typically indicates significant assessments may be needed.

Can my association still waive SIRS reserves?

Under current Florida law, associations with budgets adopted on or after December 31, 2024, can no longer waive reserve funding for the mandatory SIRS components. Full SIRS reserve funding must begin by January 1, 2026. This was a major change in Florida law. Non-SIRS reserves (for pools, landscaping, etc.) may still be subject to waiver by owner vote, depending on the association's governing documents. Consult your association's attorney for specifics.

What if I just bought my condo and got an assessment?

This is unfortunately common. Assessment responsibility between buyers and sellers depends on multiple factors, including the timing of the assessment, the terms of the purchase contract, closing documents, and applicable Florida law. This is a common point of negotiation in real estate transactions. Consult a real estate attorney to understand your specific rights and obligations. This is why reviewing HOA documents before buying is critical. Board meeting minutes and reserve study funding levels often signal upcoming assessments months or years in advance.

Is there any state-level financial assistance for SIRS assessments?

As of early 2026, most assistance programs are at the county level (like Miami-Dade's program). There have been legislative discussions about state-level relief, but nothing has passed yet. The Florida Housing Finance Corporation and individual counties are the best places to check for current programs.

The Bottom Line

SIRS assessments are stressful, but they're not a dead end. The law mandates these repairs for a reason. Buildings that complete SIRS compliance become safer, more financeable, and more attractive to future buyers.

Your job right now is to understand your options before making a decision:

- Request a payment plan from your association

- Push your board to explore association financing

- Check county assistance programs (especially Miami-Dade)

- Consider a HELOC or personal loan before credit cards

- Run the numbers on selling vs. paying before making a move

- Talk to a HUD-approved housing counselor if you're on a fixed income

Sources & References

- Florida House Bill 913 (2025) — Florida Senate (SIRS reserve funding requirements, temporary waivers, association loan authority)

- South Florida condo owners dumping homes after six-figure assessments — Yahoo Finance

- Miami-Dade County Condominium Special Assessment Loan Program — Miami-Dade County

- Champlain Towers South collapse (2021) — Wikipedia

- Florida Housing Finance Corporation — State housing programs

- Find a HUD-Approved Housing Counselor — U.S. Department of Housing and Urban Development

- 68% of Condos Sold Below List Price — Redfin (Florida metros 85-92%)

- Peeling Back the Layers to the Florida Condo Market Weakness — TD Economics (recovery outlook)

- Palm Beach County may help condo owners struggling to pay special assessments — CBS12

- GoverningDocs analysis of 38 Florida SIRS reports (1,730 pages) — Proprietary research, January 2026

This article is for general informational purposes only and does not constitute legal, financial, tax, or professional advice. The information presented reflects the authors' understanding as of February 2026 and may not reflect subsequent legislative changes, court rulings, or regulatory guidance. Florida condominium law is complex and varies by association. Always consult a licensed Florida attorney, certified public accountant, or qualified financial advisor before making decisions based on the topics discussed in this article. GoverningDocs is not a law firm, accounting firm, or financial advisory service.