In This Guide

Special assessments are one-time HOA fees for major repairs not covered by reserves. Check reserve funding levels and board minutes before buying to avoid surprise costs of $5,000-$100,000+.

Imagine closing on your dream condo, only to receive a letter three months later: "Special Assessment Notice - $45,000 due within 90 days for building repairs." This scenario is becoming increasingly common in 2026, especially in Florida.

Special assessments are one of the biggest financial surprises facing condo buyers today. Unlike monthly HOA dues, which are predictable, special assessments can arrive without warning and demand immediate payment. They're not optional—and failure to pay can result in liens on your property.

The problem is getting worse. New legislation in Florida requires buildings to fund structural reserves they've been deferring for decades. Insurance costs have skyrocketed. And aging infrastructure across the country is reaching the end of its useful life.

This guide explains what special assessments are, why they're increasing, and how to spot the warning signs before you buy. Armed with this knowledge, you can make informed decisions and avoid costly surprises.

What Is a Special Assessment?

A special assessment is a one-time fee charged to HOA members for major repairs, improvements, or emergencies not covered by regular reserves. Unlike monthly dues, special assessments can be substantial and often require payment within 30-90 days.

Think of regular HOA dues as your monthly subscription—predictable and budgeted. A special assessment is more like an unexpected bill: the HOA needs money for something big, and every owner has to contribute their share.

Why Special Assessments Happen

Special assessments are typically levied for:

- Major repairs: Roof replacement, elevator modernization, concrete restoration, plumbing overhaul

- Emergency situations: Hurricane damage, fire damage, structural failures

- Underfunded reserves: When the reserve fund doesn't have enough to cover planned repairs

- Legal settlements: Construction defect lawsuits, personal injury claims

- Regulatory compliance: Meeting new building codes or safety requirements

How Much Can Special Assessments Cost?

Special assessment amounts vary dramatically based on the project scope and number of units:

| Project Type | Typical Cost Per Unit |

|---|---|

| Roof replacement | $5,000 - $15,000 |

| Elevator modernization | $10,000 - $25,000 |

| Concrete restoration | $15,000 - $50,000 |

| Full building rehab | $50,000 - $150,000+ |

| Plumbing system replacement | $8,000 - $20,000 |

Costs vary significantly based on building size, location, and scope of work

Special assessment costs vary dramatically by project type

⚠️ Real Example:

In 2024, owners at a Surfside, Florida condo faced assessments of $80,000-$400,000 per unit for structural repairs and compliance with new safety laws. Some owners were forced to sell because they couldn't afford the assessment.

Why Special Assessments Are Increasing in 2026

Florida's new SIRS requirements (effective Jan 1, 2026) ban reserve waivers for structural items. Combined with aging infrastructure and insurance costs, many condos face mandatory funding increases they've deferred for years.

2026 marks a turning point for condo owners—especially in Florida. Several factors are converging to make special assessments more common and more expensive than ever.

GoverningDocs Research: What We Found in 38 Florida SIRS Reports

Our analysis of 38 real Florida Structural Integrity Reserve Studies (1,730 pages, representing nearly 2,000 units) reveals the scope of the problem:

- •30.8% of HOAs are underfunded below 50%—the threshold where special assessments become highly likely

- •26.9% are critically underfunded below 30%—facing imminent assessment risk

- •Average building age: 41 years—with 79% of buildings over 30 years old and major systems reaching end of life

- •45% of building components are due for replacement within 10 years

- •$10.1 million in total replacement costs identified across these associations

Source: GoverningDocs analysis of 38 Florida SIRS reports, January 2026

1. Florida's SIRS Requirements (Post-Surfside)

After the tragic Champlain Towers South collapse in 2021 that killed 98 people, Florida enacted Senate Bill 4-D requiring:

- Structural Integrity Reserve Studies (SIRS): Mandatory for buildings 3+ stories, assessing 8 structural components

- Milestone inspections: Required at 30 years (25 years if within 3 miles of coast)

- No reserve waivers: As of January 1, 2026, associations can no longer vote to waive reserves for structural items

💡 Key Change:

Before 2026, Florida condo boards could vote to waive reserve contributions—keeping monthly fees low but creating unfunded liabilities. That option is now illegal for structural items. Buildings that deferred maintenance for decades now must fund it immediately.

2. Aging Building Infrastructure

Many condos built in the 1970s-1990s are now 30-50 years old. Critical systems are reaching the end of their useful life:

- Concrete structures: Spalling and rebar corrosion from salt air exposure

- Plumbing systems: Original cast iron and galvanized pipes failing

- Electrical systems: Outdated panels unable to handle modern loads

- Elevators: Modernization required for code compliance

3. Insurance Cost Crisis

Property insurance costs in Florida have increased 40-100%+ in recent years. Many insurers have left the state entirely. This creates a cascade effect:

- Higher premiums → Higher HOA fees

- Insurers requiring repairs as condition of coverage → Special assessments

- Some buildings becoming "uninsurable" → Lender restrictions

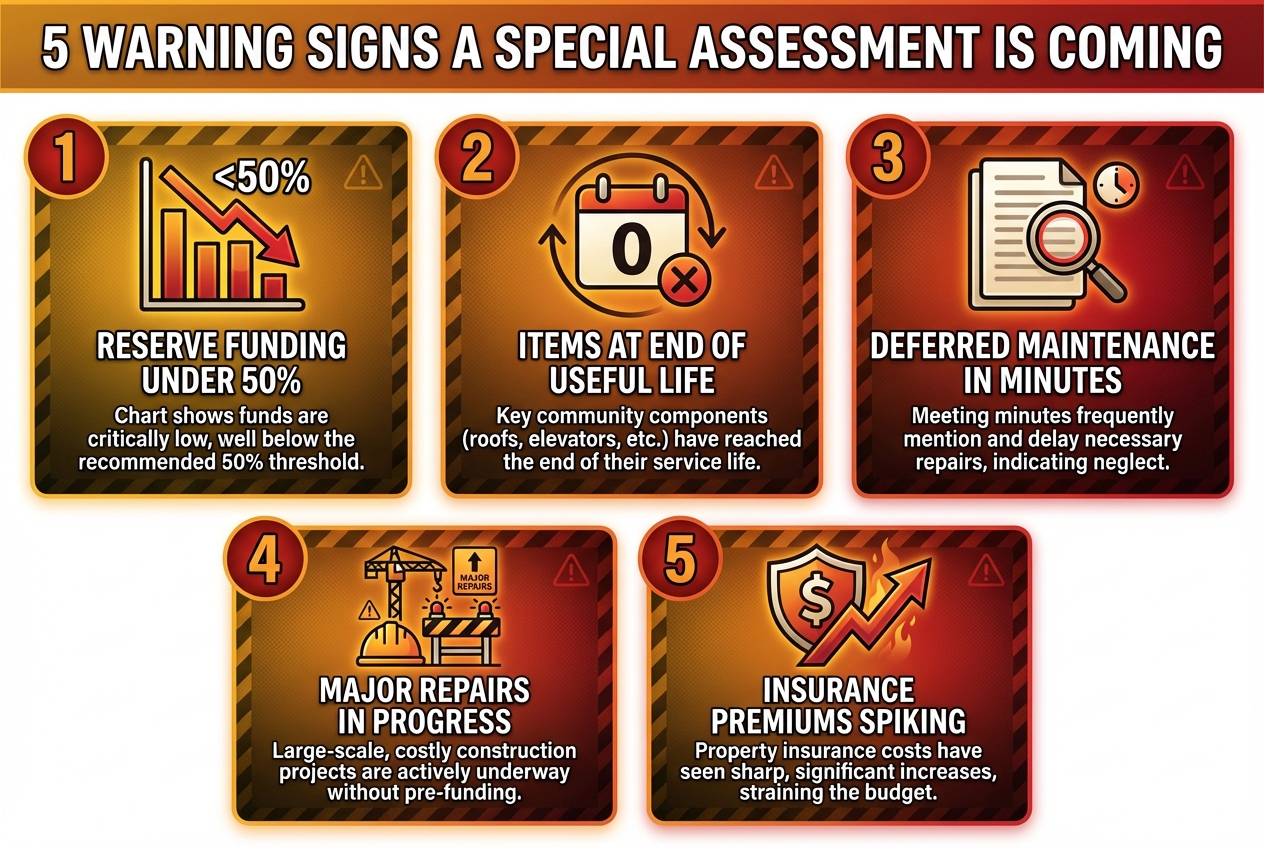

5 Warning Signs a Special Assessment Is Coming

Check the reserve study for under 50% funding, look for items at end of useful life (RUL=0), review board minutes for deferred maintenance discussions, and watch for insurance premium spikes.

The good news: special assessments rarely come out of nowhere. The warning signs are usually visible in HOA documents—if you know where to look.

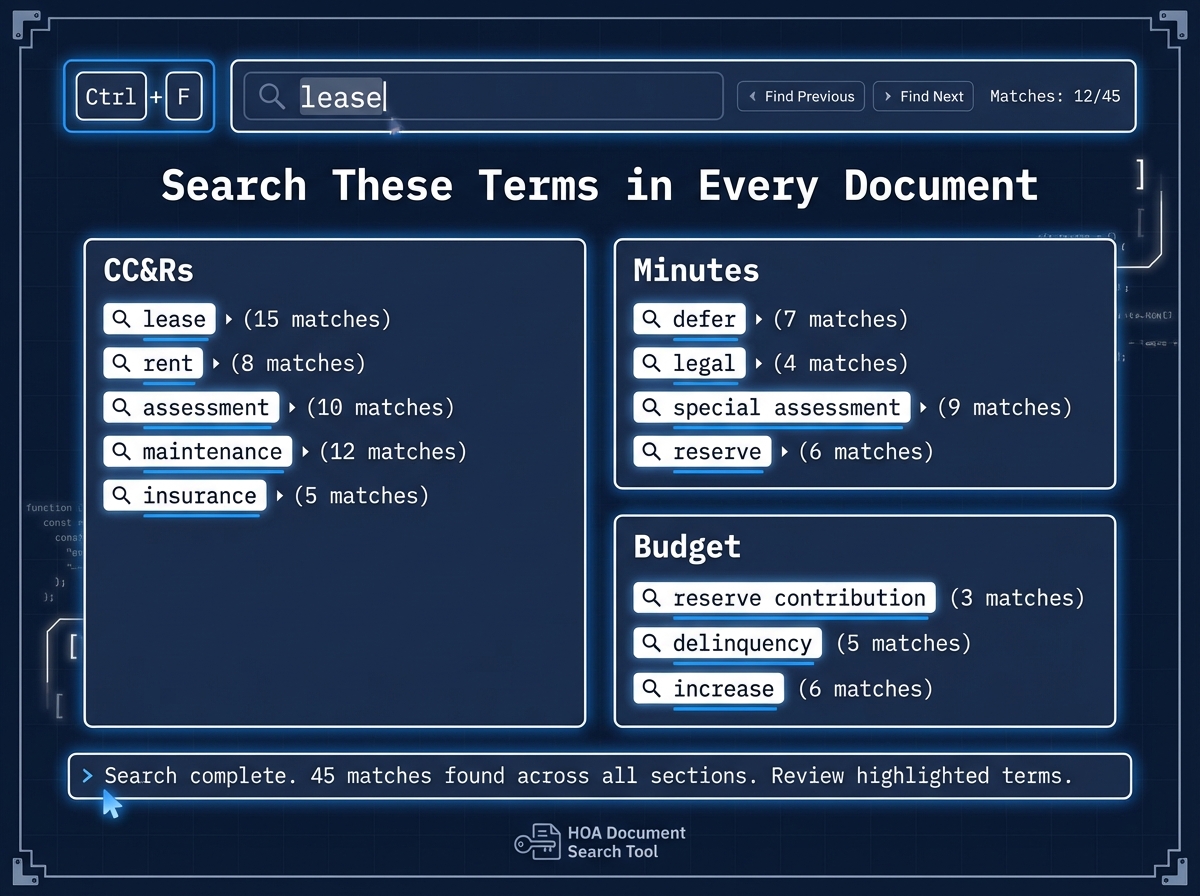

Watch for these warning signs in HOA documents

Warning Sign #1: Reserve Funding Under 50%

The percent funded metric in a reserve study shows how much money the HOA has relative to what they should have. Industry standards consider:

- 70%+ funded: Healthy reserves, low assessment risk

- 50-70% funded: Moderate risk, may need fee increases

- Under 50% funded: High risk of special assessment (our research found 30.8% of Florida HOAs fall into this category)

Warning Sign #2: Items at End of Useful Life (RUL = 0)

Reserve studies list the Remaining Useful Life (RUL) of each component. When RUL = 0, that item needs immediate replacement. Multiple items at RUL = 0 with insufficient reserves = special assessment.

Warning Sign #3: Deferred Maintenance in Board Minutes

Search board meeting minutes for phrases like:

- "Deferred to next meeting"

- "Tabled pending additional quotes"

- "Reserve waiver approved"

- "Special assessment discussed"

When boards repeatedly defer repairs, they're building up deferred maintenance that will eventually require a large payment.

Warning Sign #4: Recent or Ongoing Major Repairs

If the building is currently undergoing major work—or recently completed work—check whether it was fully funded from reserves or if assessments were used. Past assessments often predict future ones.

Warning Sign #5: Insurance Premium Increases

Significant insurance premium increases often signal:

- The insurer sees risk factors in the building

- Required repairs may be needed to maintain coverage

- Higher premiums may drain operating budgets, leading to assessments

How Special Assessments Are Calculated

Total project cost is typically divided by the number of units, though some HOAs allocate by square footage or ownership percentage. Payment may be lump sum or installments over 12-24 months.

Understanding how assessments are calculated helps you estimate your potential exposure when evaluating a condo purchase.

Allocation Methods

- Equal share: Total cost ÷ number of units (simplest method)

- By square footage: Larger units pay more

- By ownership percentage: As defined in CC&Rs

- By building/phase: If repair only affects certain areas

Check your CC&Rs for the "assessment allocation" section to understand how your building calculates assessments.

Payment Options

HOAs may offer different payment structures:

- Lump sum: Full payment due within 30-90 days

- Installments: Spread over 12-24 months (may include interest)

- HOA loan: Association borrows money, owners pay through increased dues

⚠️ What If You Can't Pay?

Failure to pay a special assessment can result in late fees, interest charges, collection actions, liens on your property, and potentially foreclosure in some states. If you're facing hardship, contact the HOA immediately to discuss payment plan options.

Who Pays: Seller vs Buyer?

Generally, whoever owns the property when the assessment is "levied" (officially approved by the board) is responsible. Check the estoppel certificate and negotiate assessment responsibility in your contract.

One of the most contentious issues in condo transactions is who pays for special assessments. The answer depends on timing and your contract terms.

The General Rule

The owner of record when the assessment is levied (officially approved) is typically responsible for payment.

Timing determines who pays for special assessments

| When Assessment Is Levied | Who Typically Pays |

|---|---|

| Before contract signed | Seller (usually) |

| During escrow (pending) | Negotiable |

| After closing | Buyer |

The Estoppel Certificate Is Critical

The estoppel certificate (or resale certificate) is an official document from the HOA showing:

- Current assessment balance

- Any unpaid amounts from the seller

- Pending or approved special assessments

- Violations on record

💡 Pro Tip:

Always request an estoppel certificate and review it carefully. Ask the seller directly: "Are you aware of any pending or planned special assessments?" Get the answer in writing as part of your contract.

Negotiating Assessment Responsibility

Your purchase contract can specify who pays for assessments. Common approaches include:

- Seller pays all assessments levied before closing

- Seller credits buyer for known upcoming assessments

- Price reduction to account for assessment risk

- Split responsibility for assessments levied during escrow

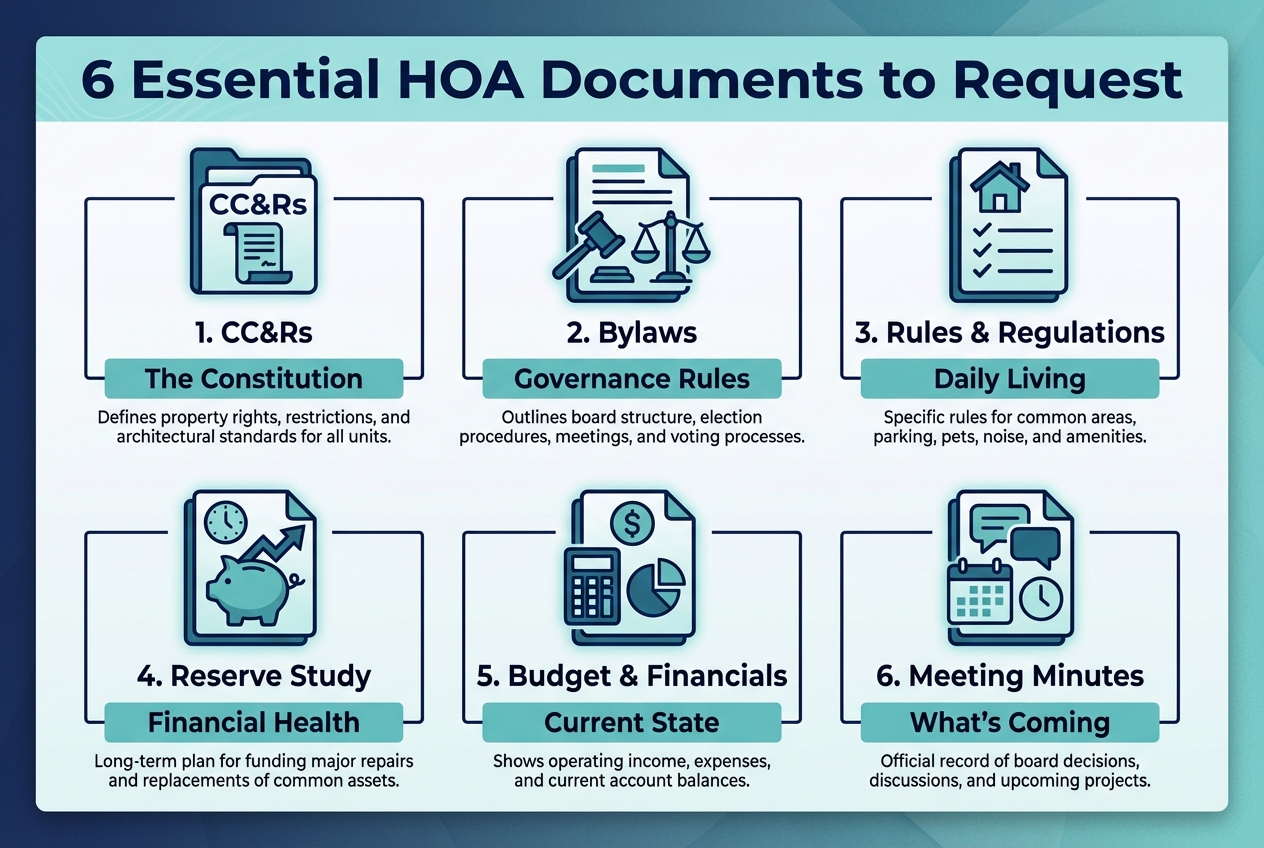

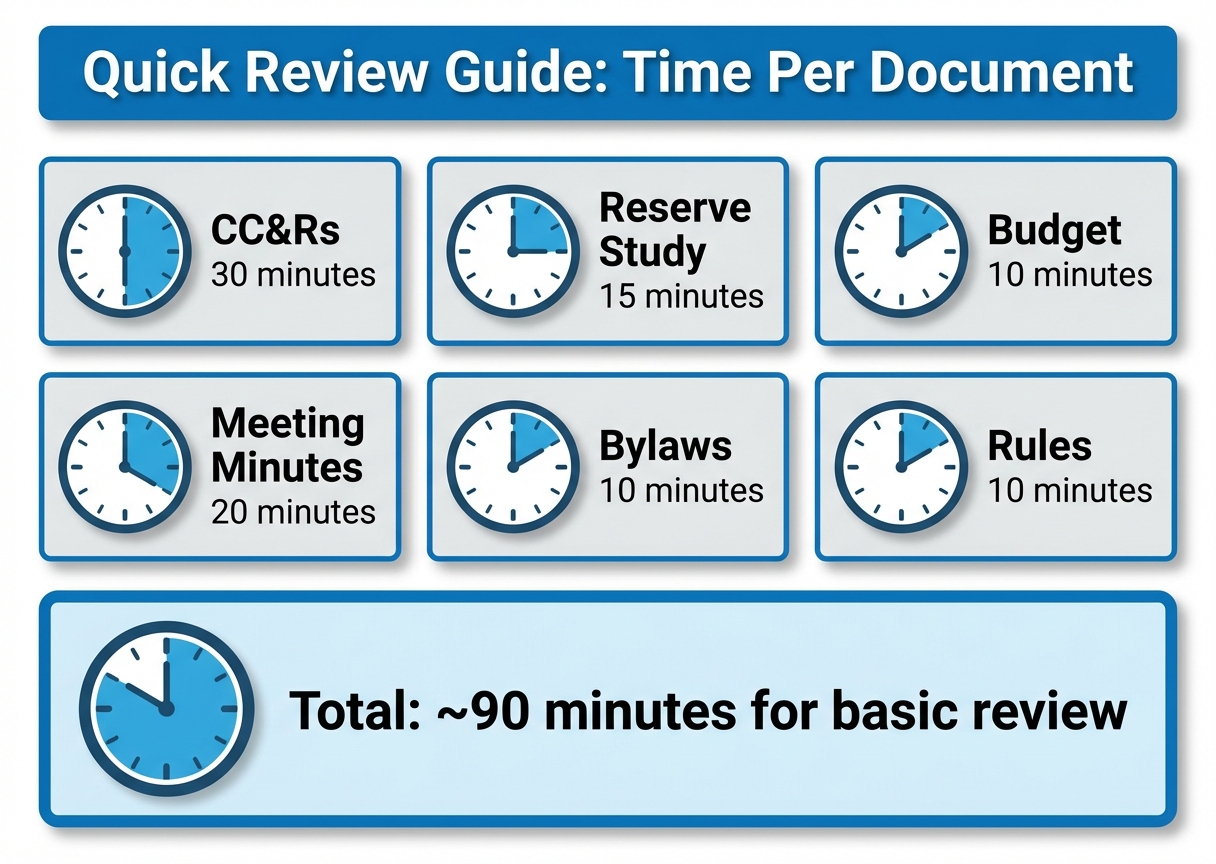

How to Research Before Buying

Request the reserve study and check percent funded. Review 12-24 months of board minutes for deferred maintenance discussions. Ask about planned capital improvements and check the estoppel for active assessments.

The best protection against surprise assessments is thorough due diligence during your contingency period.

Follow this checklist to identify assessment risk before buying

Your Due Diligence Checklist

Before Making an Offer:

- ☐Request reserve study - check percent funded

- ☐Review last 12-24 months of board minutes

- ☐Ask about planned capital improvements

- ☐Request estoppel certificate showing active assessments

- ☐Check building age and major system ages

- ☐Ask seller directly: "Any pending assessments?"

Questions to Ask Your Agent

- "What's the reserve study percent funded?"

- "Are there any pending or planned special assessments?"

- "Has this building had special assessments in the past 5 years?"

- "What major repairs are scheduled in the next 5 years?"

- "Is the building SIRS-compliant?" (Florida)

If your agent can't answer these questions, that's a red flag. Either they haven't done their due diligence, or the HOA isn't being transparent.

Florida-Specific: What Buyers Need to Know

Florida's SIRS reports are mandatory for 3+ story buildings. Milestone inspections are required at 30 years (25 near coast). Reserve waivers are no longer allowed as of January 1, 2026.

If you're buying in Florida, special assessment risk is especially relevant due to new state requirements.

SIRS Requirements

Structural Integrity Reserve Studies (SIRS) are now mandatory for Florida condos 3+ stories. They must assess 8 specific structural components:

- Roof

- Structure (load-bearing walls, foundation)

- Fireproofing and fire protection

- Plumbing

- Electrical systems

- Waterproofing and exterior painting

- Windows and exterior doors

- Any other item over $10,000 affecting structural integrity

The Reserve Waiver Ban

As of January 1, 2026, Florida HOAs can no longer vote to waive reserves for SIRS components. This means:

- Buildings that have been deferring reserves must now fund them

- Monthly fees are increasing across Florida condos

- Buildings with severe underfunding may need special assessments

⚠️ Buyer Beware:

Ask for the building's SIRS report and check which items have Remaining Useful Life (RUL) of 0. These items need immediate attention and are likely to trigger assessments.

Financing Implications

Fannie Mae and FHA have requirements for condo financing. Buildings with:

- Very low reserve funding

- Active special assessments

- Significant deferred maintenance

- Litigation issues

...may not qualify for conventional financing, limiting your buyer pool and affecting resale value.

Key Takeaways

Before You Buy

- 1.Check the reserve study. Under 50% funded = high assessment risk.

- 2.Read the board minutes. Look for deferred maintenance and assessment discussions.

- 3.Request the estoppel certificate. Verify no pending assessments.

- 4.Ask about SIRS compliance (Florida). Check for RUL=0 items.

- 5.Negotiate in your contract. Specify who pays for pending assessments.

Special assessments are a reality of condo ownership—but they shouldn't be a surprise. With proper due diligence, you can identify the warning signs and make an informed decision about whether a property's financial health fits your risk tolerance.

Analyze Your HOA Documents for Assessment Risk

GoverningDocs extracts key financial data from reserve studies and HOA documents—including percent funded, items at end of useful life, and special assessment history—so you can evaluate risk before buying.

Try Free Analysis →No signup required. Upload your reserve study or CC&Rs.

Frequently Asked Questions

Can I refuse to pay a special assessment?

No. Special assessments are legally binding obligations once properly approved by the HOA board (or membership, depending on your CC&Rs). Refusing to pay can result in late fees, interest, collection actions, liens on your property, and potentially foreclosure.

Are special assessments tax deductible?

Generally, no—special assessments for repairs or maintenance are not tax deductible for your primary residence. However, if the property is a rental, the assessment may be deductible as a business expense. Consult a tax professional for advice specific to your situation.

How much notice does the HOA have to give?

Notice requirements vary by state and CC&Rs. In Florida, boards must provide at least 14 days notice before a meeting where a special assessment will be voted on. Some CC&Rs require owner approval for assessments above a certain threshold. Check your governing documents.

Can I get a loan to pay a special assessment?

Yes. Options include personal loans, home equity lines of credit (HELOCs), or payment plans from the HOA. Some HOAs take out association-wide loans so owners pay through increased monthly dues rather than lump sums.

What's the difference between a special assessment and increased dues?

Special assessments are one-time charges for specific projects. Dues increases are permanent adjustments to your monthly payment. Buildings with well-funded reserves handle major repairs through reserves and gradual dues increases. Buildings with underfunded reserves often need special assessments.

Does a special assessment affect property value?

It depends. An active or pending assessment can decrease buyer interest and affect pricing. However, a completed repair project (especially for deferred maintenance) may actually improve property values by addressing concerns about building condition.