In This Guide

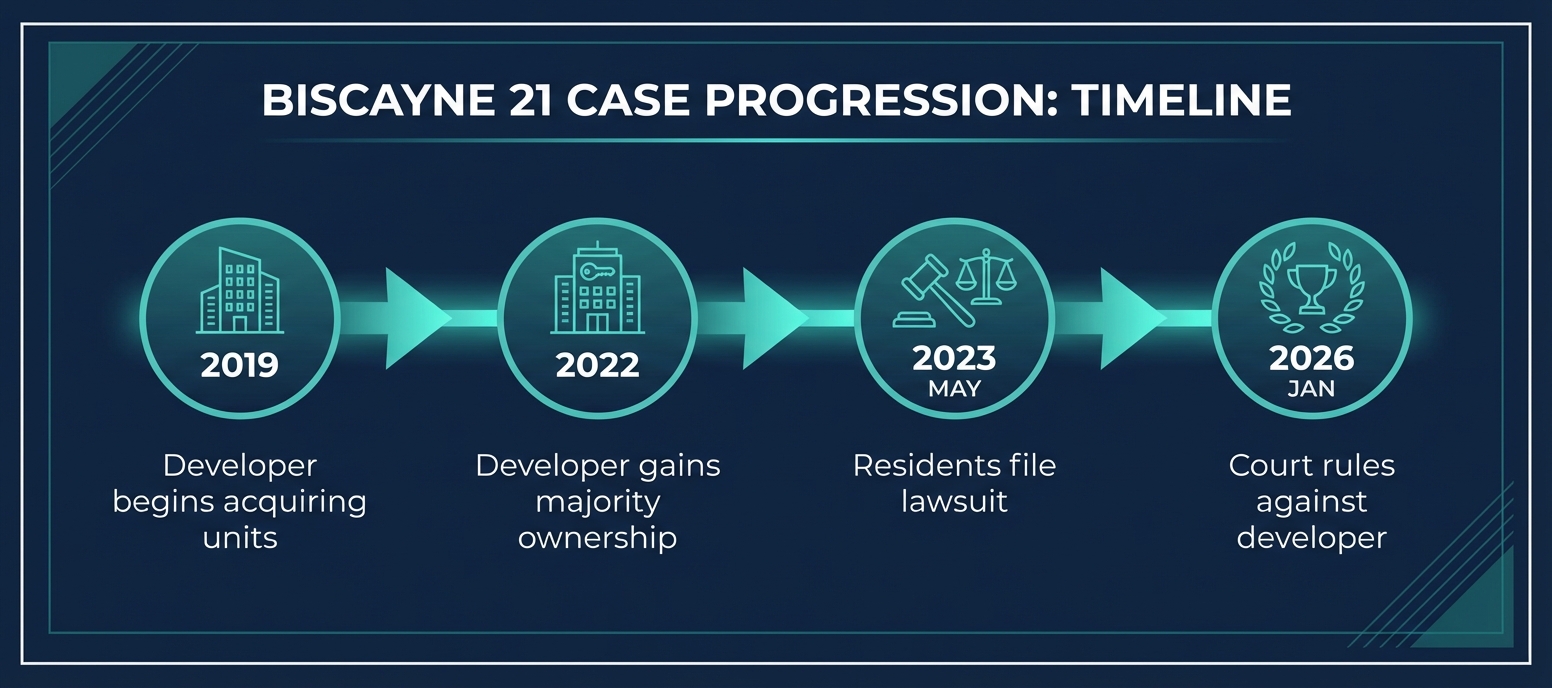

In January 2026, a Miami court blocked developer Two Roads Development from forcing the sale of Biscayne 21 after the company tried to lower termination approval from 100% to 80% of owners.

Imagine receiving a letter from your condo association saying you have six months to move out—not because you broke any rules, but because a developer bought enough units to legally force everyone to sell.

This nightmare scenario, known as condo termination, nearly became reality for 191 families in a Miami high-rise. But in January 2026, a Florida court delivered a rare victory for condo owners, blocking a developer's attempt to exploit a legal loophole and force a building sale.

The ruling in the Biscayne 21 case has major implications for anyone buying or owning a condo. Here's what you need to know about termination clauses in your condo declaration—and how to protect yourself before it's too late.

What Happened in the Biscayne 21 Case

Biscayne 21 is a 191-unit Miami high-rise where developer Two Roads Development acquired majority ownership starting in 2019, then tried to amend the declaration to lower the termination threshold from 100% to 80% so they could force a building sale.

Biscayne 21 is a 14-story condo building in Miami's Edgewater neighborhood, built in the 1960s. Starting in 2019, Two Roads Development began quietly acquiring units. By 2022, the company had majority ownership and attempted to terminate the condominium to demolish it for luxury redevelopment.

The problem? The building's original declaration required 100% owner approval for termination—essentially impossible to achieve.

The developer's strategy: Amend the declaration to reduce the threshold to 80%, which they could then meet with their majority ownership.

The court's ruling: In January 2026, Miami-Dade Circuit Court Judge Thomas Rebull ordered the developer to restore the building at its own expense (an estimated $65 million over two years, according to the developer's managing partner) rather than terminate it. According to attorney Donna DiMaggio Berger, the court found that changing the vote requirement "materially changed owners' voting rights" and couldn't be disguised as a "procedural tweak."

Timeline of the Biscayne 21 condo termination case

⚠️ Why This Matters

While this represents a rare win for condo owners, legal experts emphasize that each case depends on the specific language in your declaration. Similar lawsuits in other Florida districts could produce different outcomes, creating inconsistent protections statewide.

What Is Condo Termination?

Condo termination (also called bulk termination or deconversion) allows owners to dissolve a condominium association and sell the entire property, typically to developers. Requirements vary by state and each building's declaration.

Condo termination (governed by state law and condo declarations) is the legal process of dissolving a condominium association and selling the entire building or property as a single asset. Once terminated, individual unit owners lose their deeds and must vacate—usually in exchange for a buyout payment. In Florida, terminations are regulated under Florida Statute 718.117, which requires 80% owner approval, but if 5% or more object, the termination cannot proceed.

Why Developers Pursue Terminations

Developers target older buildings in desirable locations for several reasons:

- Land value exceeds the value of aging units

- Redevelopment opportunity for luxury high-rises or mixed-use projects

- Fewer obstacles than assembling land from multiple property owners

- Motivated sellers in buildings with high special assessments or maintenance issues

Who Benefits and Who Loses

Developers profit by acquiring land below market value and redeveloping for higher returns.

Some owners may welcome a buyout—especially those facing massive special assessments or struggling to sell units in aging buildings.

Other owners are forced out of homes they don't want to leave, often receiving buyouts below the cost of comparable replacement housing in the same neighborhood.

⚠️ Important

In Florida's current market, many condo owners already face $50,000-$150,000+ special assessments due to post-Surfside structural requirements. This creates a perfect storm where financially stressed owners may support termination, making holdout owners more vulnerable. Learn more about Florida's condo crisis or see what options owners have for SIRS assessments.

How Developers Exploit Termination Loopholes

Developers use strategies like bulk unit acquisition over time, declaration amendments to lower vote thresholds, and targeting financially distressed buildings to meet termination requirements without unanimous consent.

The Biscayne 21 case revealed a playbook that developers across Florida—and nationwide—are using to force condo terminations:

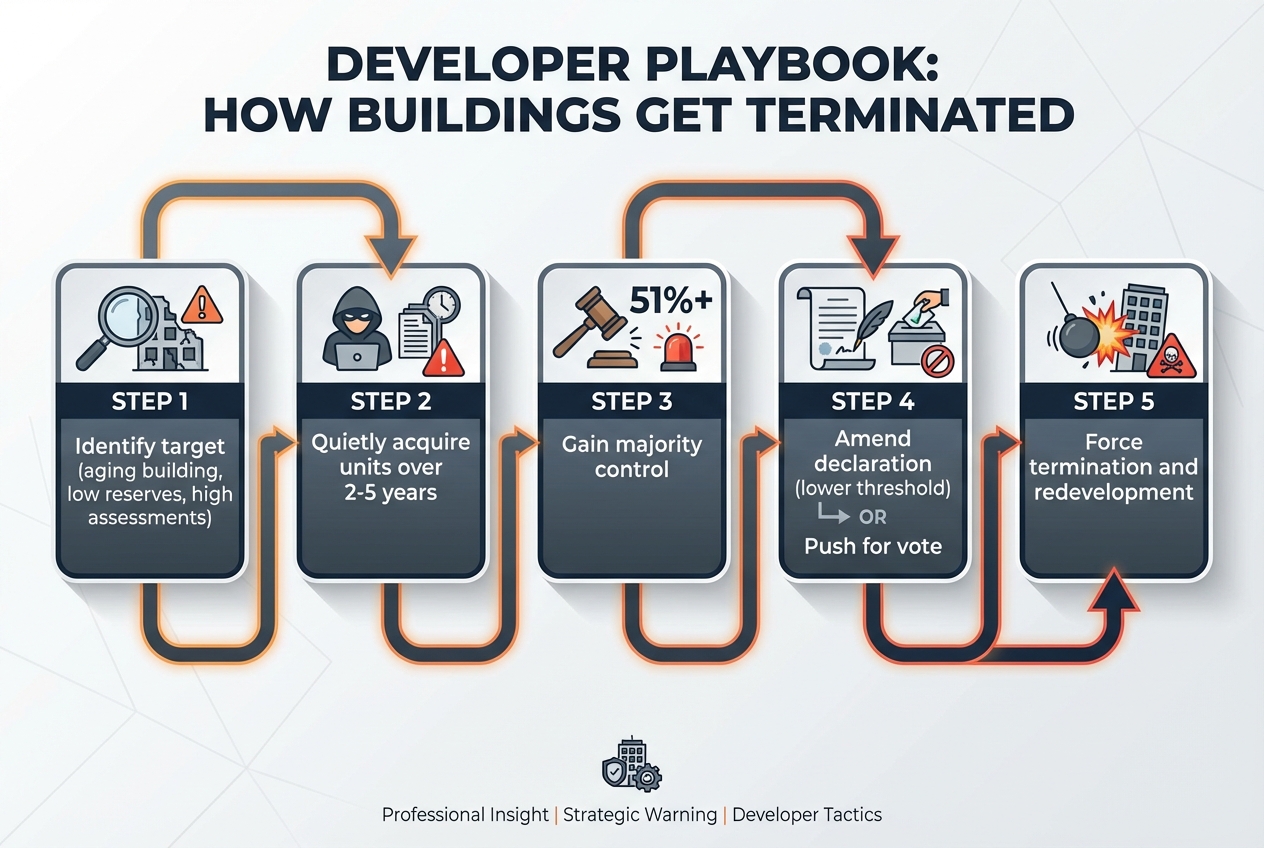

The developer playbook for forcing condo terminations

Strategy 1: Bulk Acquisition Over Time

Developers quietly buy units over several years before owners realize what's happening. By the time residents understand the threat, the developer already controls 50-70% of the building.

Strategy 2: Amending the Declaration

As the Biscayne 21 developer attempted, companies try to change the rules mid-game by:

- Lowering termination vote thresholds (100% → 80% → 51%)

- Redefining how votes are calculated (by unit vs. by ownership percentage)

- Adding termination provisions where none existed

The catch: While Biscayne 21 owners won this battle, the outcome depends heavily on your state's laws and your declaration's amendment procedures.

Strategy 3: Targeting Financially Distressed Buildings

Developers focus on condos with:

- High special assessments already levied or planned

- Low reserve funding (under 30%)

- Structural repair needs (especially in Florida post-Surfside)

- Rising insurance costs making ownership unsustainable

In these buildings, owners may vote for termination to escape financial stress—even if it means losing their homes.

Strategy 4: Offering Unequal Buyouts

Some developers offer higher payments to early sellers and lower amounts to holdouts, creating pressure to accept quickly.

💡 Pro Tip

If you receive an unsolicited purchase offer significantly above market value, check your county records to see if the same buyer is acquiring other units in your building. This could signal a termination attempt.

What to Check in Your Condo Declaration Before Buying

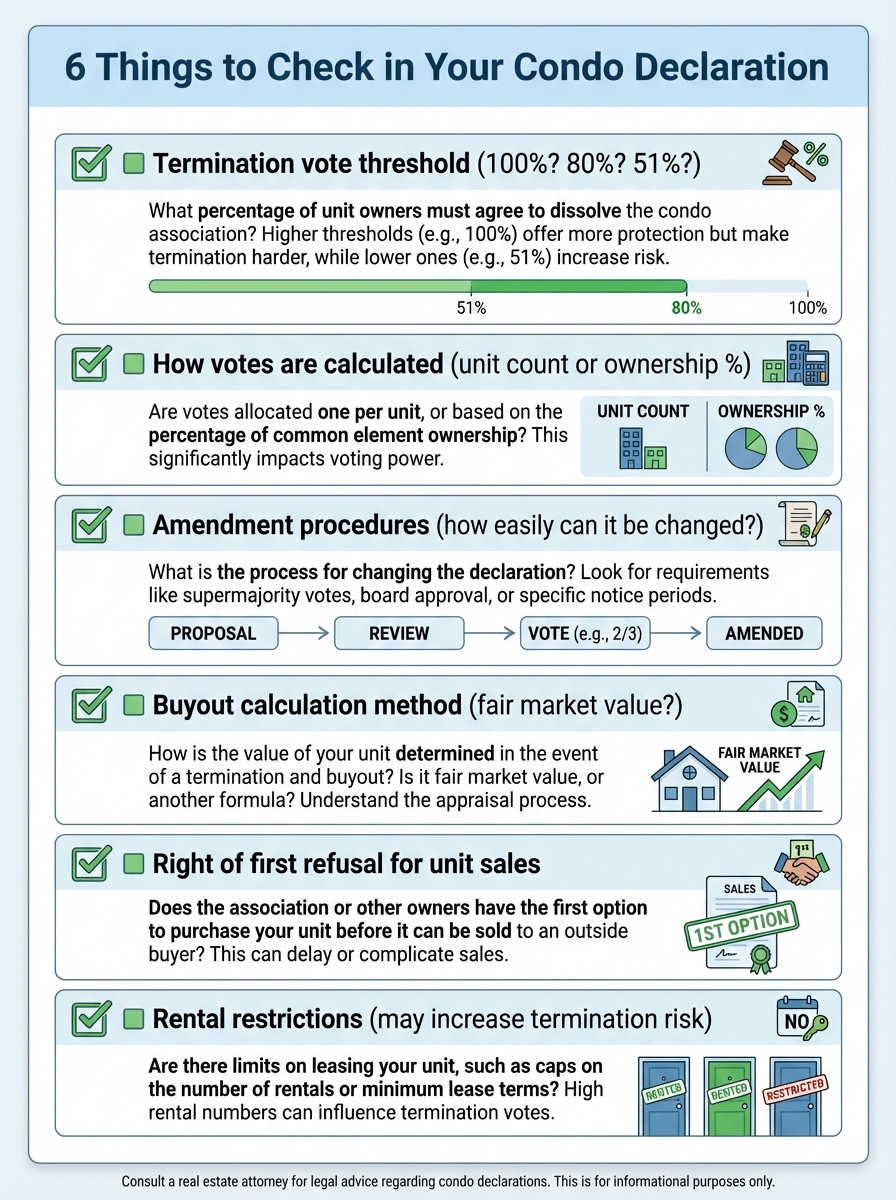

Before buying a condo, review the declaration's termination provisions for vote thresholds (100% vs 80% vs 51%), amendment procedures, buyout calculation methods, and right of first refusal clauses.

Your condo declaration (also called CC&Rs or master deed) contains the rules for termination. Here's what to look for:

1. Termination Vote Threshold

Search your declaration for terms like "termination," "dissolution," or "sale of common elements."

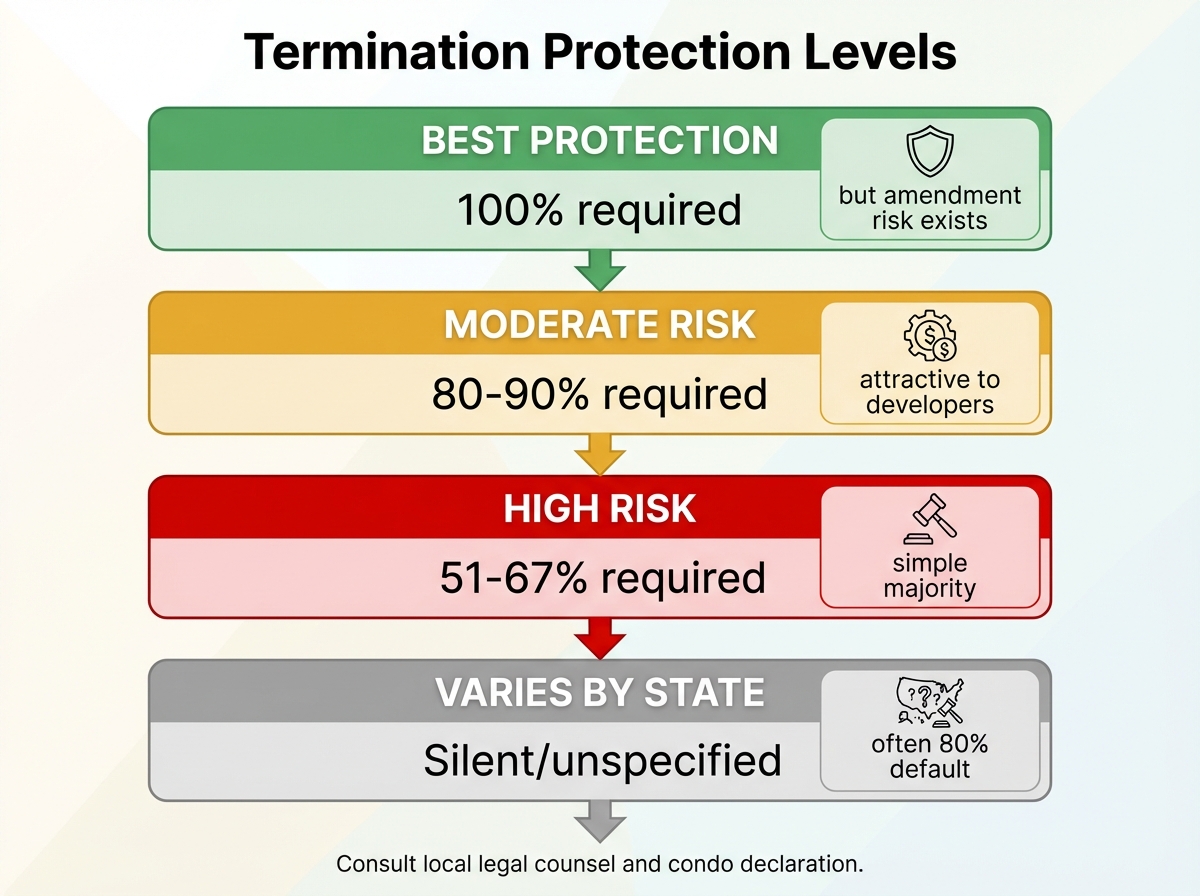

Termination vote threshold risk levels explained

What to look for:

- 100% required = Best protection (but see Biscayne 21 for amendment risk). States like Illinois require 100%, making termination nearly impossible for large buildings.

- 80-90% required = Moderate risk if building is attractive to developers. The Uniform Condominium Act (adopted in 14 states) sets 80% as the standard threshold.

- 51-67% required = High risk—developer only needs simple majority. Colorado has 67%, the lowest threshold nationally.

- Silent on termination = Defaults to state law (often 80% if the UCA has been adopted)

2. How Votes Are Calculated

Termination thresholds can be measured by:

- Unit count (e.g., 80% of all units)

- Ownership percentage (weighted by unit size or value)

- Class of ownership (different thresholds for residential vs. commercial)

Why it matters: A developer controlling 30 large penthouse units might have 60% ownership by percentage but only 20% by unit count.

3. Amendment Procedures

Check how easily your declaration can be changed:

- What vote percentage is required to amend termination provisions?

- Can the board amend the declaration, or does it require owner vote?

- Are there "unamendable" provisions that protect core rights?

🚨 Red Flag

If termination provisions can be amended with a simple majority vote, your 100% protection could disappear overnight.

4. Buyout Calculation Method

Some declarations specify how buyout payments are calculated:

- Appraised fair market value of individual units

- Pro-rata share of total sale price

- Depreciated value (often lower than market)

- Silent (determined by state law or negotiation)

Best protection: Declarations that require independent appraisals and fair market value payments.

5. Right of First Refusal

Some declarations give the association or other owners the right of first refusal when units are sold, potentially blocking bulk acquisition by a single buyer.

6. Rental Restrictions and Owner-Occupancy Requirements

Ironically, buildings with strict rental caps may be more vulnerable to termination because developers can't use rental income to justify keeping the building operational. Owner-occupants may be more willing to sell and move than investors.

Related: How to Check for Rental Restrictions in HOA Properties →

Essential items to review in your condo declaration

⚠️ Critical

Most buyers spend 90% of their time inspecting the unit and 10% on HOA documents. For condo termination risk, this should be reversed—your declaration matters more than your kitchen countertops.

Know What You're Buying Before It's Too Late

Upload your condo declaration to GoverningDocs' free CC&R Analysis Tool and get instant extraction of termination language, voting thresholds, and amendment procedures—no signup required.

Analyze Your CC&Rs Free →Upload your documents and get results in 3-5 minutes.

Frequently Asked Questions

Can my condo board force me to sell my unit?

Not directly, but if the required percentage of owners (often 80%) votes for termination, you can be forced to sell as part of a bulk termination—even if you vote against it.

Are condo terminations legal?

Yes, condo terminations are permitted under state law in most states, though specific requirements vary significantly. At least 14 states have adopted the Uniform Condominium Act (UCA), which establishes termination procedures. Each state's laws and individual condo declarations determine the exact process and vote thresholds required.

How much notice do I get before a forced termination?

This varies by state law and your condo declaration. In Florida, owners must receive at least 14 days notice before a meeting to vote on termination, and have a 90-day window to contest the plan after it's recorded. The timeline for vacating after approval varies by the termination agreement.

What happens if I refuse to leave after a termination is approved?

Once a legal termination is completed, you no longer own your unit—the association or buyer owns the entire property. Refusing to leave could result in eviction proceedings.

Can I buy termination insurance for my condo?

Currently, no standard insurance product exists to protect against forced termination. Your best protection is reviewing the declaration before purchase and monitoring any bulk unit acquisitions in your building.

Are new condos safer from termination than old ones?

Newer buildings are less attractive to developers for demolition and redevelopment, but they're not immune—especially in rapidly appreciating markets. The declaration language matters more than building age.

The Bottom Line

The Biscayne 21 ruling is a reminder that condo ownership comes with unique vulnerabilities that don't exist for single-family homeowners. While this case ended in a win for residents, many others don't—and by the time you realize a developer is targeting your building, it may be too late.

Before you buy a condo, take these actions:

- ✅ Request and read the full condo declaration, focusing on termination provisions

- ✅ Check county records for recent bulk unit sales to a single buyer

- ✅ Understand your state's default termination requirements

- ✅ Ask your real estate attorney to review termination and amendment clauses

Sources & References

- Florida condo termination: Residents win rare victory — Tampa Bay Times, February 1, 2026 (Primary source for Biscayne 21 case details)

- Two Roads Ordered to Restore Biscayne 21 Miami Condo Building — The Real Deal, January 14, 2026

- Judge Orders Developer To Repair 'Zombie' Condos After Termination Ruled Illegal — Bisnow, January 2026

- Florida Statute 718.117 - Termination of condominium — Florida Legislature

- Condominium Termination: A Potential Path for Repurposing and Redeveloping Aging Condominium Buildings — Ballard Spahr LLP, January 2023 (State-by-state termination requirements)

- Delivering Marketable and Insurable Title After Condo Termination — Florida Condo & HOA Law Blog, July 29, 2024 (Florida termination procedures and timelines)

This article is for informational purposes only and does not constitute legal or financial advice. Condo termination laws vary by state and individual condo declarations. Consult with a qualified real estate attorney before making any purchase decisions.