In This Article

A Virginia court ruled that vague HOA assessment provisions are unenforceable. CC&Rs must specify the amount and purpose of assessments to be binding on owners.

What if your HOA couldn't legally collect assessments because the declaration was too vague about what they could charge?

On February 3, 2026, the Virginia Court of Appeals ruled exactly that in Terrace View Property Owners Association v. Jannah. The court found that an HOA's assessment provision was "too indefinite and uncertain to be enforceable" because it gave "no guidance as to the purpose or amount" of assessments.

According to GoverningDocs analysis of 1,100+ HOA documents, most declarations are drafted clearly enough to avoid this issue. But older communities or those with poorly drafted documents may have similar vulnerabilities—potentially giving homeowners a defense against collection.

What Happened: Terrace View v. Jannah

Terrace View POA sued lot owners Shekar and Barbara Jannah to collect unpaid assessments. The Virginia Court of Appeals ruled the association couldn't enforce its assessments because the declaration lacked specifics on amount and purpose.

Terrace View Property Owners Association is a subdivision in Forest, Virginia. The association sued Shekar and Barbara Jannah, lot owners who had stopped paying assessments.

The problem: The declaration authorized the POA to "establish and collect assessments" but provided no specifics about:

- How much the association could charge

- What purposes the assessments would fund

- How assessment amounts would be determined

The court's ruling: The Virginia Court of Appeals found the provision "too indefinite and uncertain to be enforceable." Without a clear mechanism for determining amounts and purposes, the association couldn't legally compel payment.

Case Citation

Terrace View Property Owners Association, Inc. v. Shekar Jannah, 2026 Va. App. Lexis 59 (Va. Ct. App. Feb. 3, 2026)

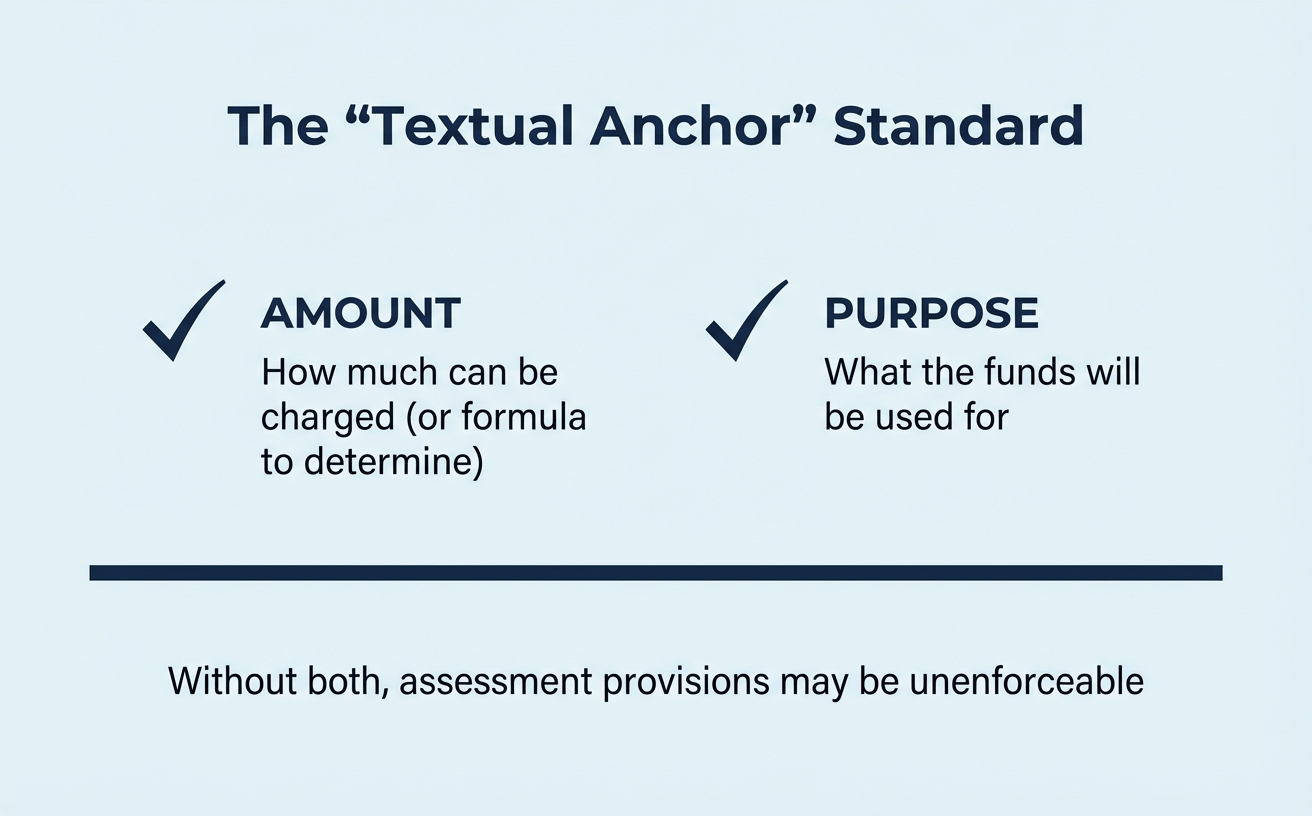

The "Textual Anchor" Standard

The court adopted a test requiring two elements for enforceable assessment provisions: (1) the amount must be determinable, and (2) the purpose must be specified. Without both, the provision fails.

The Virginia Court of Appeals applied what legal commentators call the "textual anchor" standard for evaluating HOA assessment provisions. This approach requires assessment clauses to provide a clear basis for determining:

Both elements must be present for an assessment provision to be enforceable

Two Required Elements

1. Amount: The declaration must specify how much can be charged—or provide a formula or mechanism for determining the amount. This could be a specific dollar figure, a per-square-foot calculation, or a reference to an annual budget process.

2. Purpose: The declaration must specify what the assessments will fund. Common purposes include maintenance of common areas, insurance, reserve contributions, and management fees.

Why This Makes Sense

HOAs aren't supposed to hoard cash or charge unlimited fees. Owners deserve to know what they're agreeing to when they buy into a community. A provision that says "we can charge whatever we want for anything" gives the board unlimited discretion—and that's not enforceable.

What the Court Rejected

Terrace View POA tried several arguments to save its assessment authority:

- Bylaws as a substitute: The association argued its bylaws provided sufficient detail. The court disagreed—the declaration itself must contain the assessment authority.

- Recent statutory changes: TVPOA cited recent amendments to Virginia law. The court found these changes didn't alter the analysis.

- Waiver through payment: The association claimed that prior payments by the Jannahs constituted waiver. The court rejected this, finding no evidence the Jannahs knowingly waived their rights.

What This Means for Buyers

Most CC&Rs meet this standard because lawyers typically draft clearly. But older or poorly drafted declarations may have similar vulnerabilities—worth checking during due diligence.

GoverningDocs recommends checking the assessment section of any CC&Rs before buying—specifically looking for clear language on how amounts are calculated and what purposes they fund.

This ruling flips the typical HOA risk narrative. Usually, buyers worry about what the HOA can charge. This case shows that sometimes the question is whether they can enforce it at all.

When This Matters

- Older communities: Declarations drafted 30-40+ years ago may have vague language that wouldn't pass modern standards.

- Developer-drafted documents: Some developers used boilerplate language without legal review, creating enforceability gaps.

- Small or informal HOAs: Communities formed without professional legal assistance are more likely to have problematic language.

Practical Reality

Even if assessment language is unenforceable, litigation can be expensive and time-consuming. This ruling may be most useful as leverage for negotiation—or as a defense if the HOA initiates collection actions.

Additional Implications from the Case

The court also found that TVPOA didn't qualify as a "property owners association" under Virginia's Property Owners Association Act (POAA). This meant the association couldn't use the special enforcement tools the statute provides—like automatic liens and expedited collections.

This is a state-specific nuance, but it highlights the importance of understanding whether your HOA operates under general common law or specific statutory authority.

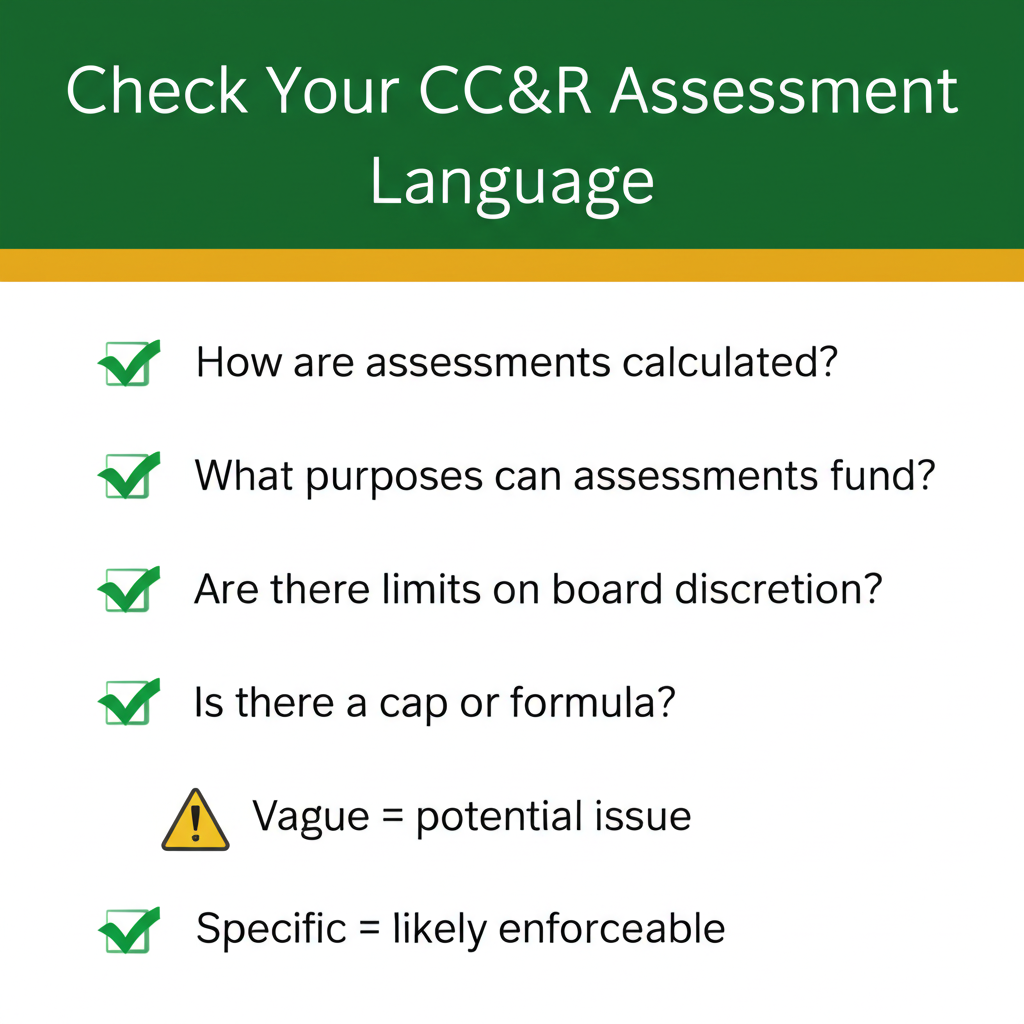

What to Look For in Your CC&Rs

Check whether your assessment section specifies how amounts are calculated and what purposes assessments can fund. Vague language like "may levy assessments as needed" could be a red flag.

According to GoverningDocs analysis of 1,100+ HOA documents, most professionally drafted declarations include specific assessment language with formulas or budget references—but older communities and developer-drafted documents from the 1970s-1990s often have gaps that could create enforceability issues.

Key questions to ask when reviewing assessment provisions

When reviewing a declaration's assessment provisions, look for answers to these questions:

Questions to Ask

- How are assessments calculated? Look for formulas (e.g., "based on square footage"), reference to a budget process, or specific dollar amounts.

- What purposes can assessments fund? Look for enumerated categories like maintenance, insurance, reserves, and utilities.

- Are there limits on board discretion? Look for caps on increases, requirements for owner approval, or restrictions on special assessments.

- Is there a formula or cap? Some declarations limit annual increases to a percentage or tie assessments to an index.

Red Flag Language

Watch for vague phrases like:

- "May levy assessments as needed"

- "Shall have the right to establish and collect assessments"

- "When and as due"

- "At the board's discretion"

Enforceable Language

Compare to clear language like: "Regular assessments shall be levied annually based on the approved operating budget, allocated equally among all lots, to fund maintenance of common areas, insurance, and reserve contributions."

Related: How to Review HOA Documents Before Buying →

Check Your Assessment Language

Use GoverningDocs' free CC&R Analysis Tool to extract assessment provisions, voting thresholds, and other key clauses from your declaration—no signup required.

Analyze Your CC&Rs Free →Upload your documents and get results in 3-5 minutes.

Frequently Asked Questions

Does this ruling apply outside Virginia?

The ruling is binding only in Virginia. However, courts in other states have applied similar principles requiring specificity in HOA assessment provisions. Similar challenges could potentially succeed elsewhere if the declaration language is sufficiently vague, though outcomes depend on state-specific law.

Can my HOA fix vague assessment language?

Yes, through a declaration amendment. Most declarations require a supermajority vote (often 67-75% of owners) to amend. If your HOA realizes its language is vulnerable, expect a proposed amendment.

Should I stop paying assessments if my declaration is vague?

Consult an attorney before withholding payment. Even if the language is technically unenforceable, the HOA may still sue, and litigation costs can exceed the disputed amounts. This ruling is best used as leverage for negotiation or as a defense if sued.

How common are vague assessment provisions?

According to GoverningDocs analysis, most professionally drafted declarations include clear assessment language. However, older communities, small subdivisions, and developer-drafted documents from earlier decades may have problematic provisions.

What's the difference between POAA and non-POAA associations?

In Virginia, associations that qualify under the Property Owners Association Act (POAA) have additional enforcement powers, including automatic liens. The Terrace View ruling found TVPOA didn't qualify, limiting its collection tools. This is one reason to check whether your HOA operates under general common law or specific state statutes.

The Bottom Line

The Terrace View v. Jannah ruling is a reminder that HOA authority isn't unlimited. Declarations must provide clear guidance on assessment amounts and purposes—otherwise, the provisions may be unenforceable.

For buyers: This is one more reason to read the declaration carefully before purchasing. Check the assessment section for clear language about how fees are calculated and what they fund.

- Most declarations pass the "textual anchor" test

- Older or poorly drafted documents may have vulnerabilities

- Litigation costs often exceed the practical benefit

- Use this knowledge as leverage, not as a reason to stop paying

Sources & References

- Appeals Court Finds Indefinite HOA Assessment Provision Unenforceable — Cowherd PLC, February 2026 (Primary source for case analysis)

- Terrace View Property Owners Association, Inc. v. Shekar Jannah, 2026 Va. App. Lexis 59 (Va. Ct. App. Feb. 3, 2026)

- Virginia Property Owners' Association Act (Va. Code § 55.1-1800 et seq.) — Virginia Legislative Information System

- Do I Even Have a HOA? — Cowherd PLC (Background on Virginia HOA structures)

This article is for informational purposes only and does not constitute legal advice. HOA law varies by state and individual declarations. Consult with a qualified attorney before making decisions about assessment disputes.