In This Guide

HOA meeting minutes reveal deferred maintenance, litigation, and upcoming assessments. Look for tabled repairs, legal discussions, and reserve fund debates.

Your real estate agent handed you the HOA financial statements and said everything looks fine. The balance sheet shows healthy reserves, monthly fees are reasonable, and the budget seems solid.

Six months after closing, you get hit with a $15,000 special assessment for elevator repairs. When you dig into the board meeting minutes from the past year, the warning signs were everywhere—"defer to next meeting" appeared four times, followed by "emergency repair now required."

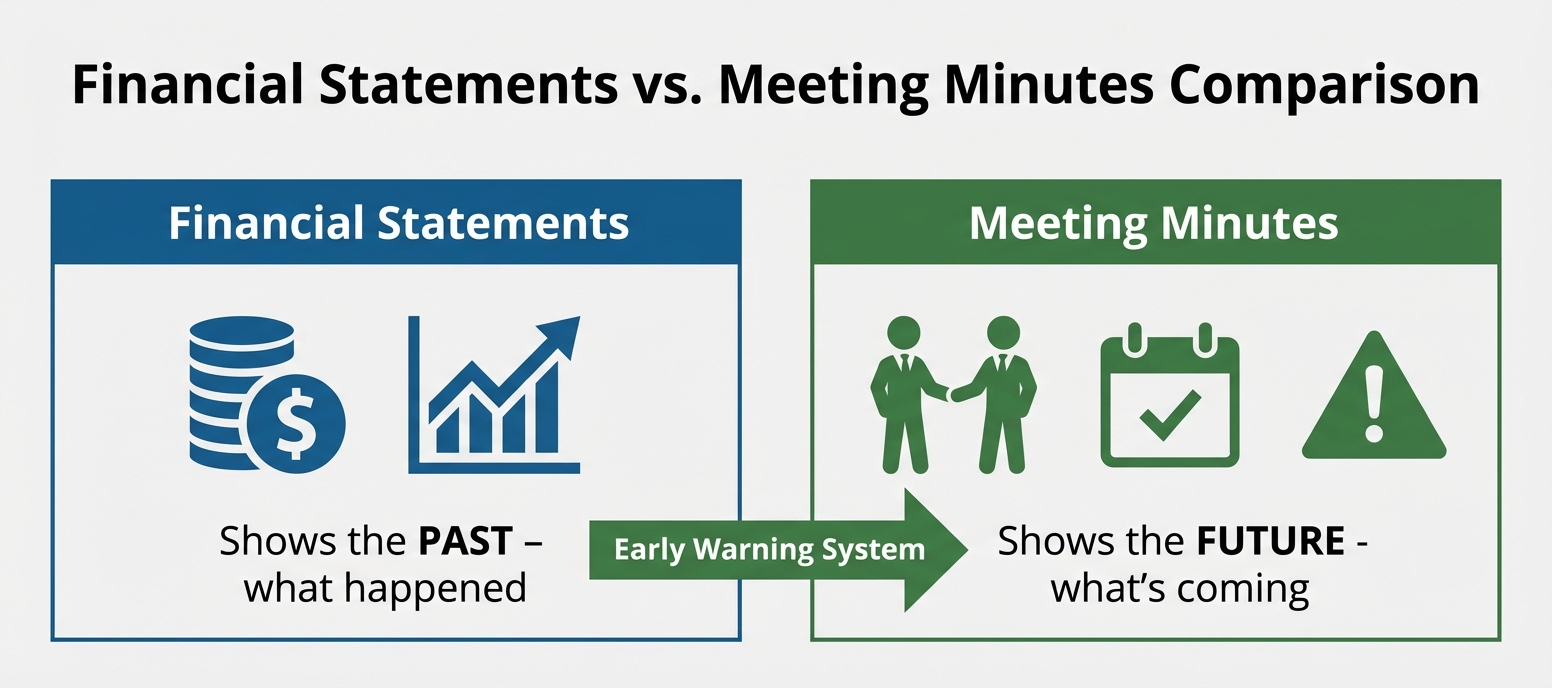

Financial statements show you the past. Board meeting minutes show you the future.

Most buyers never read meeting minutes, or they don't know what to look for. But experienced investors and detail-oriented agents know that the patterns in board discussions reveal risks long before they hit the budget. Here are the 7 red flags that may warrant further investigation—or could be reasons to reconsider your purchase.

Disclaimer: This article is for informational and educational purposes only and does not constitute legal, financial, or real estate advice. HOA laws, disclosure requirements, and buyer rights vary significantly by state and jurisdiction. The information provided represents common patterns observed in HOA governance but may not apply to your specific situation. Before making any real estate purchase decision, consult with a qualified real estate attorney, financial advisor, or HOA specialist familiar with your state's laws and local market conditions.

Why Meeting Minutes Matter More Than Financials

Financial statements are backward-looking snapshots, while meeting minutes are forward-looking discussions that reveal pending costs, unresolved problems, and board decision-making patterns.

When most buyers review HOA documents, they focus on three things:

- Monthly fees (how much do I pay?)

- Reserve balance (do they have savings?)

- Budget (where does the money go?)

These are important, but they're lagging indicators—they tell you what already happened. By the time a problem shows up in the financials, it's often too late.

Meeting minutes are different. They capture:

- What the board is worried about

- What repairs they're postponing

- What lawsuits they're discussing in executive session

- What special assessments they're considering

Financial statements show history; meeting minutes show what's coming

💡 Pro Tip

Request at least 12-24 months of meeting minutes—not just the most recent one. Patterns over time are more revealing than any single meeting.

Red Flag #1: Repeatedly Tabled Repairs

When the same repair appears in minutes 3+ times with phrases like "deferred to next meeting," "postponed pending bids," or "board voted to delay," it signals cash flow problems or decision paralysis.

What it looks like in the minutes:

- March: "Discussed roof leak in building C—board will get quotes"

- May: "Roof repair tabled pending reserve study review"

- August: "Roof repair postponed due to budget constraints"

- November: "Emergency roof repair approved—$85,000"

Why it matters: Deferred maintenance doesn't disappear—it gets more expensive. A $10,000 roof patch in March becomes a $85,000 emergency repair by November. And when the board finally acts, it's usually via special assessment because reserves are depleted.

Common items that signal trouble when repeatedly tabled:

- Roof repairs or replacement

- Elevator modernization or safety violations

- Parking structure concrete restoration

- Siding or waterproofing issues

- HVAC system failures

⚠️ Warning Sign

If the same major repair appears in minutes more than twice without action, this often indicates a special assessment may be coming—and it's likely to be larger than if the board had acted immediately.

Red Flag #2: Legal Counsel Discussions

Recurring mentions of attorneys, executive sessions for "legal matters," or lawsuit-related discussions signal ongoing or pending litigation that can drain reserves and increase fees.

What to look for:

- "Board entered executive session to discuss legal matter"

- Recurring attorney invoices in financial reports

- References to depositions, mediation, or settlement discussions

- "Pending litigation" mentioned without details

Types of litigation that drain HOA finances:

- Construction defect lawsuits against the developer (common in buildings under 10 years old)

- Personal injury claims (slip-and-fall, pool accidents)

- Owner vs. HOA disputes (collections, rule enforcement)

- Contractor disputes (failed repairs, unpaid bills)

Why it matters: Even if the HOA wins, legal costs can run $50,000-$500,000+ and often come from reserves or special assessments. And if they lose? Judgments can bankrupt smaller associations.

🚨 Serious Concern

If minutes mention structural defect litigation or building safety violations, this represents a significant risk that warrants consultation with a real estate attorney before proceeding. These cases can take years and potentially cost millions. Cash buyers with substantial financial resources and risk tolerance may still wish to proceed, but should obtain legal counsel to understand the full extent of potential liability.

Red Flag #3: Reserve Fund Debates

Board discussions about waiving reserve contributions, underfunding reserves, or disagreements over reserve study recommendations may indicate an increased risk of special assessments in the near future.

Red flag phrases in the minutes:

- "Board voted to waive reserve contribution this year"

- "Reserve study recommends $200K annual contribution, board approved $80K"

- "Discussion of special assessment for roof replacement"

- "Motion to borrow from reserves for operating expenses"

Why boards underfund reserves:

- Political pressure—owners demand lower fees

- Short-term thinking—"kick the can down the road"

- High delinquency rates—not enough income to fund properly

- Aging buildings—repair needs outpacing contributions

What happens next: When a major component fails (roof, HVAC, elevator), there's no money to fix it. The board either takes out a loan (increasing monthly fees) or levies a special assessment. Either way, you pay more.

⚠️ Critical Warning

In Florida, reserve waivers for structural components are now banned as of January 2026. If you see minutes from 2025 showing waived reserves, expect mandatory special assessments to catch up. Learn more about Florida's condo crisis →

Red Flag #4: Insurance Problems

Discussions about insurance premium increases, coverage gaps, carrier non-renewals, or difficulty obtaining quotes indicate the building has risk factors that insurers are pricing in or avoiding altogether.

Warning phrases in minutes:

- "Insurance premium increased 40% this year"

- "Current carrier will not renew policy"

- "Received only one quote for coverage"

- "Coverage reduced due to cost—now have $5M deductible"

Why this matters:

- Higher premiums = higher monthly fees (sometimes doubling)

- Non-renewal = the building may be uninsurable (mortgage lenders typically require adequate insurance)

- Coverage gaps = owners may face personal liability for damages not covered by the HOA's master policy

- High deductibles = small claims become special assessments

Common reasons insurers flee HOAs:

- Coastal locations (hurricane risk)

- Buildings over 30 years old with deferred maintenance

- History of water damage or mold claims

- Inadequate fire protection systems

- Swimming pools or other high-liability amenities

🚨 Critical Warning

If minutes mention "unable to obtain insurance" or "all carriers declined", this presents extreme risk. An uninsurable building typically cannot secure financing, may be difficult or impossible to sell, and could potentially face foreclosure. Consult with a real estate attorney and insurance specialist before proceeding with such a purchase.

Red Flag #5: Management Company Issues

High turnover of property management companies (3+ changes in 2 years) or repeated complaints about manager responsiveness signals either board dysfunction or systemic building problems that no manager wants to deal with.

Red flag patterns:

- "Board voted to terminate contract with XYZ Management"

- "Discussion of manager's lack of responsiveness to owner complaints"

- "New management company effective next month" (third change in two years)

- "Manager failed to obtain bids for repairs as requested"

Why high turnover happens:

- Board micromanagement—unrealistic expectations

- Unpaid management fees—HOA is broke

- Building has too many problems—managers don't want the liability

- Owner hostility—toxic environment

What this costs you: Each management transition causes disruptions—missed vendor payments, lost institutional knowledge, delayed repairs, and often higher fees as new managers renegotiate contracts.

⚠️ Important

One management company change is normal. Two in three years is a yellow flag. Three or more in two years is a red flag—something is deeply wrong.

Red Flag #6: Owner Delinquencies

Frequent discussions about collections, lien filings, write-offs of bad debt, or inability to collect from owners indicate the HOA is struggling to fund operations—meaning fee increases or assessments are coming for those who do pay.

Warning signs in minutes:

- "Board approved collection action against 15 units"

- "Motion to write off $45,000 in uncollectable debt"

- "Delinquency rate now 18% of units"

- "Discussion of increasing fees to offset non-paying owners"

Why high delinquency is a death spiral:

- Less income = deferred maintenance

- Deferred maintenance = lower property values

- Lower values = more owners walk away (strategic default)

- More defaults = higher fees for remaining owners

- Higher fees = even more people stop paying

Healthy delinquency rates: Under 5% is normal. 10-15% is concerning. Over 15% is a red flag that the building is in financial distress.

🚨 Critical

If minutes show delinquency above 20%, the building may be entering a financial crisis. Many conventional lenders have restrictions on financing condos in buildings with high delinquency rates (Fannie Mae guidelines typically require less than 15% delinquency for condo project approval), which can make units difficult to sell. Verify current lender requirements before purchasing.

Red Flag #7: Contentious Board Dynamics

Split votes on major decisions, board member resignations, or references to recall attempts indicate dysfunctional governance—which delays critical decisions and increases costs through inaction.

Signs of board dysfunction:

- "Motion failed 3-2 vote" (on routine issues)

- "Board member resigned effective immediately"

- "Special meeting called to discuss board member conduct"

- "Owners petition for recall of board president"

- "Meeting adjourned early due to disagreement"

What causes board conflict:

- Financial stress—tough decisions with no good options

- Personal agendas—board members pursuing self-interest

- Lack of experience—new boards making rookie mistakes

- Owner backlash—constant criticism from residents

Why it matters: Dysfunctional boards delay critical decisions, overpay for services (no consensus on bids), and create legal liability through inconsistent rule enforcement. This costs you money.

⚠️ Warning

Some conflict is healthy—it means the board is debating options. But if every decision is split and multiple board members resign, the association is ungovernable.

The 7 warning signs that predict special assessments and HOA troubles

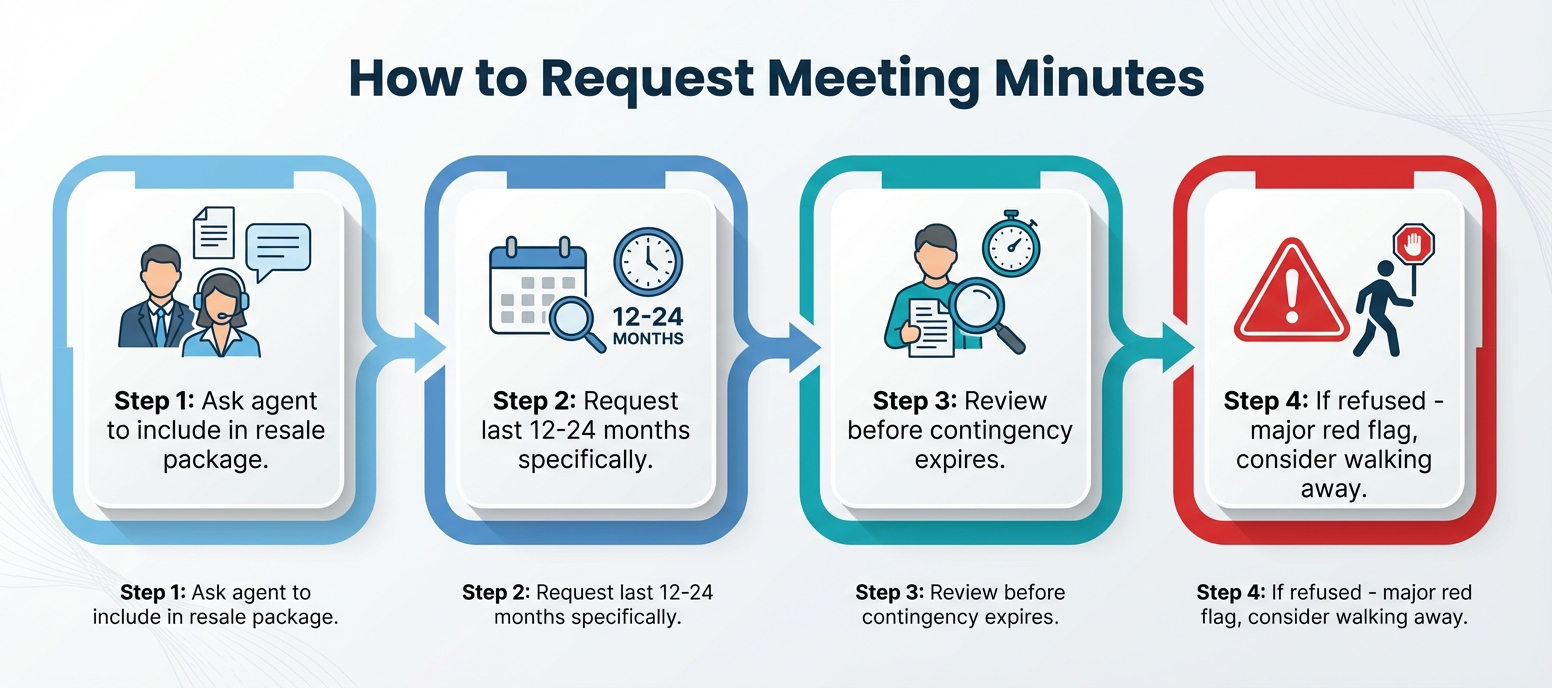

How to Request Meeting Minutes

Meeting minutes are typically included in the HOA resale package, but you should specifically request the last 12-24 months to identify patterns. Many state laws require HOAs to provide minutes to members and prospective buyers, though specific requirements vary by jurisdiction.

How to get meeting minutes during due diligence:

Step 1: Ask Your Agent to Include Them in the Resale Package

In many states, the resale certificate or disclosure package automatically includes recent meeting minutes. However, "recent" might only mean the last 3 months, and requirements vary by state. It's advisable to request 12-24 months specifically to identify patterns over time.

Step 2: Request Directly from the HOA or Management Company

If minutes aren't included, your agent can request them directly. In many jurisdictions, HOAs are required to provide minutes to prospective buyers (or their agents) within a reasonable timeframe, though specific requirements vary by state. Consult local real estate regulations or an attorney if the HOA is unresponsive.

Step 3: Review Before Your Contingency Period Expires

Don't wait until the last day. Most HOA contingency periods are only 3-7 days—not enough time to read 200+ pages of meeting notes. Request documents before you make an offer if possible. Learn why the 3-day review period fails buyers.

What If the HOA Won't Provide Minutes?

If the HOA refuses to provide meeting minutes—or says they don't keep them—that's a significant red flag. This may indicate:

- The board may not be following state recordkeeping requirements

- Potential concealment of important information (litigation, pending assessments)

- Poor governance practices or dysfunctional association management

This situation warrants serious reconsideration. Transparent, well-managed HOAs typically provide meeting minutes upon request. Consider consulting with a real estate attorney about your rights to obtain this information and whether to proceed with the purchase.

The process for requesting and reviewing HOA meeting minutes

Don't Have Time to Read 200 Pages of Meeting Minutes?

Upload up to 12 meeting minute PDFs and get AI-powered analysis that identifies all 7 red flag categories, recurring issues, and timeline patterns—completely free.

Try Free Analysis →Free tool • Upload 1-12 PDFs • Results in 5-10 minutes

Frequently Asked Questions

Are HOA meeting minutes public records?

Meeting minutes are generally available to homeowners and prospective buyers, but they're not "public" in the same way as government records. State laws vary significantly on access requirements—many states require HOAs to provide minutes to members and serious buyers, though associations may charge reasonable copying fees. Check your state's HOA statutes for specific requirements.

Can I attend HOA board meetings before buying?

Many state laws require HOAs to hold open board meetings that homeowners can attend, though rules for prospective buyers vary by jurisdiction. Executive sessions for legal or personnel matters are typically closed. Some states have specific open meeting requirements, while others give HOA boards more discretion. Attending a meeting before you buy, if permitted, can be a valuable way to assess board dynamics. Check your state's laws or consult with a local real estate attorney about your rights to attend.

How far back should I request meeting minutes?

Request at least 12 months—preferably 24 months. This lets you see patterns over time and catch issues that might not appear in just one or two meetings.

What if I find red flags in the meeting minutes?

If you find concerning patterns, you have three options: (1) walk away from the purchase, (2) negotiate a lower price to account for likely assessments, or (3) request an extended contingency period to investigate further with an attorney or HOA document analyst.

Do all HOAs keep meeting minutes?

Generally yes—most state laws and HOA bylaws require associations to keep minutes of board meetings. The Uniform Common Interest Ownership Act (adopted in many states) includes recordkeeping requirements. If an HOA says they don't keep minutes or won't provide them, this may indicate poor governance or potential concealment of important information. Consult with a real estate attorney about your rights and whether to proceed with the purchase.

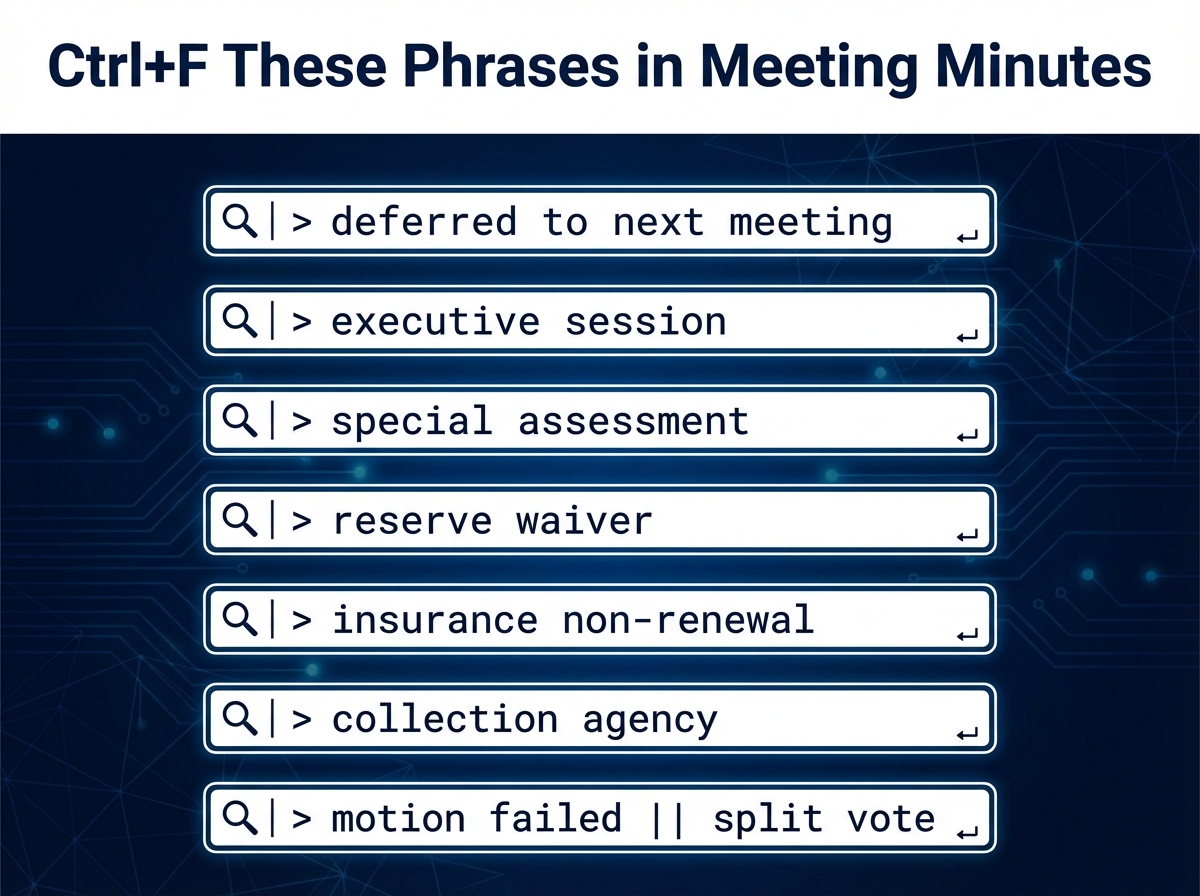

Can I use Ctrl+F to search for red flags?

Absolutely. If you have digital copies of the minutes, search for key terms like "defer," "postpone," "legal," "attorney," "assessment," "insurance," "resign," and "emergency." This helps you quickly identify potential issues in long documents.

Use these search terms to quickly identify problems in meeting minutes

The Bottom Line

Most buyers spend 90% of their time inspecting the unit and 10% reviewing HOA documents. For avoiding special assessments and HOA drama, this should be reversed.

Before you buy, make sure you:

- ✅ Request at least 12-24 months of board meeting minutes

- ✅ Search for key warning phrases (defer, legal, assessment, insurance)

- ✅ Look for patterns—one red flag is a concern, multiple are a deal-breaker

- ✅ Cross-reference minutes with the reserve study and budget

- ✅ Consider professional document analysis if you find concerning issues

Remember: financials show the past, minutes show the future. Read them carefully.

Important Legal Disclaimer

This article provides general information about HOA meeting minutes and common patterns that may indicate potential issues. It is not intended as, and should not be construed as, legal advice, financial advice, or a substitute for professional due diligence.

State and local laws vary significantly. HOA disclosure requirements, buyer rights, recordkeeping obligations, and access to meeting minutes differ by jurisdiction. The information in this article may not apply to your specific situation or location.

Before making any real estate purchase decision, consult with licensed professionals including a real estate attorney, financial advisor, real estate agent, and/or HOA specialist familiar with your state's laws and local market. Every property and HOA is unique, and professional guidance is essential for making informed decisions about such significant investments.