In This Guide

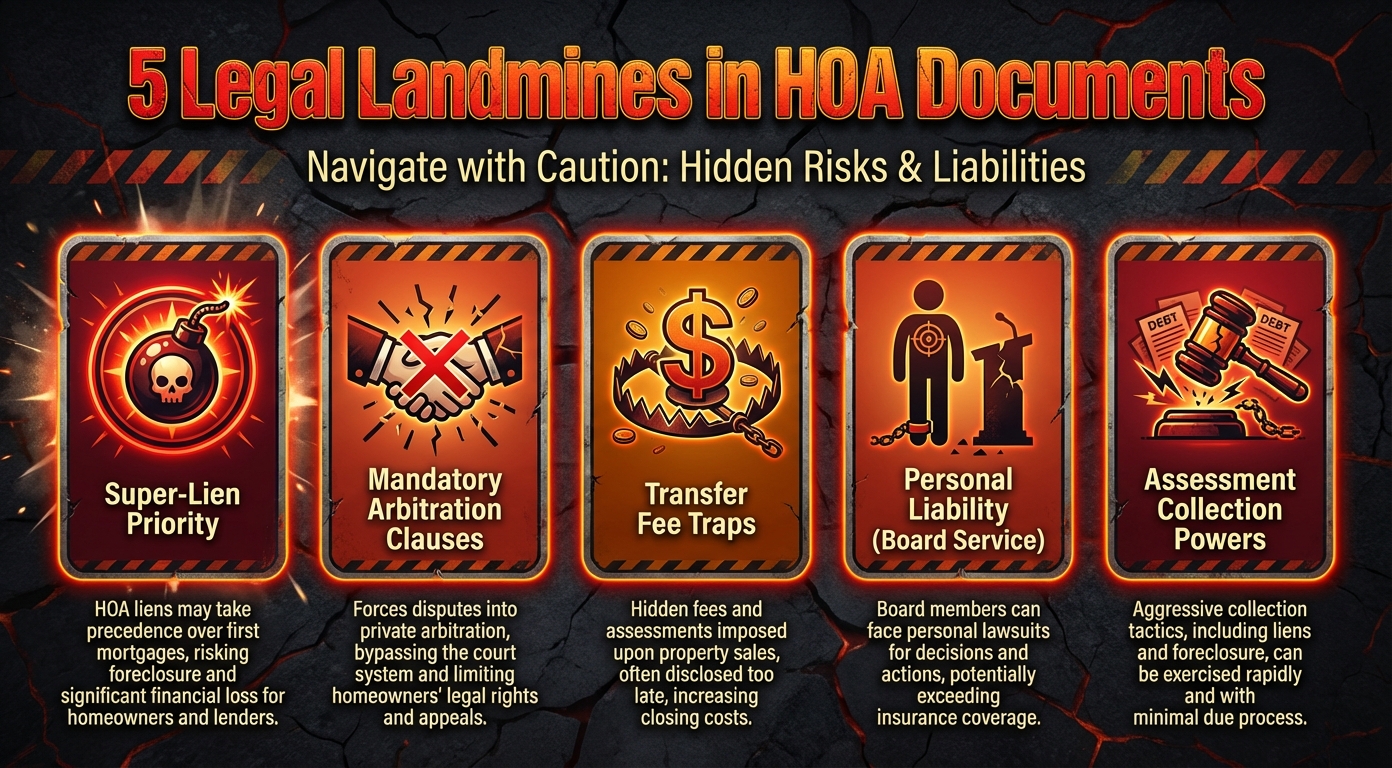

HOA legal risks include super-lien priority, mandatory arbitration, transfer fee traps, and personal liability for board decisions. Review CC&Rs carefully before closing.

Disclaimer: This article is for general informational purposes only and does not constitute legal advice. HOA laws vary significantly by state and change frequently. The information provided may not reflect current laws in your jurisdiction. Always consult with a licensed real estate attorney in your state before making decisions based on this content.

Imagine closing on a condo, only to receive a letter weeks later about unpaid HOA assessments from the previous owner—with the HOA claiming lien rights on your property. Scenarios like this, while not universal, illustrate why understanding HOA documents matters.

Many buyers don't realize that HOA governing documents are legally binding contracts that may include significant enforcement mechanisms. These documents aren't just guidelines for trash pickup schedules and holiday decorations. Depending on the HOA and state law, they may contain provisions about lien priority, dispute resolution requirements, and various fees at closing.

Real estate agents aren't attorneys, and HOA document review often falls outside typical transaction discussions. That's why it can be valuable for buyers to understand these documents independently.

This guide covers several areas of HOA documents that buyers may want to review during their contingency period. Understanding these topics can help you ask better questions and make a more informed purchasing decision.

The Hidden Legal Landscape of HOAs

An HOA is a legal entity that may have enforcement powers including liens, fines, and in some states, foreclosure. When you buy, you generally agree to CC&Rs as a binding contract recorded with the property.

When you purchase property in an HOA, you're not just buying a home—you're joining a private legal entity with its own governance structure, rules, and enforcement mechanisms.

The HOA as a "Mini-Government"

HOAs have been described as "mini-governments" because they may possess powers that many homeowners don't expect:

- Assessment authority: HOAs typically can levy regular assessments and, in many cases, special assessments

- Rule-making authority: HOAs may regulate aspects of property use (paint colors, landscaping, rentals, pets) depending on the CC&Rs

- Enforcement mechanisms: Depending on state law and governing documents, HOAs may be able to fine owners, place liens, or pursue other remedies

- Dispute resolution: Some HOAs require disputes to go through internal processes or arbitration before court

CC&Rs Are a Binding Contract

The Covenants, Conditions & Restrictions (CC&Rs) are recorded with the county and "run with the land." This means:

- Acceptance through purchase: Taking title generally means accepting the CC&R terms—whether you've read them or not

- Review before closing: Courts have generally upheld CC&R provisions, which is why reviewing these documents during your contingency period is important

- Future amendments: Depending on the governing documents, amendments approved by the required majority may apply to all owners

⚠️ Note:

CC&Rs are recorded with the property and generally remain in effect as long as you own the home. Unlike some other contracts, they typically cannot be cancelled unilaterally.

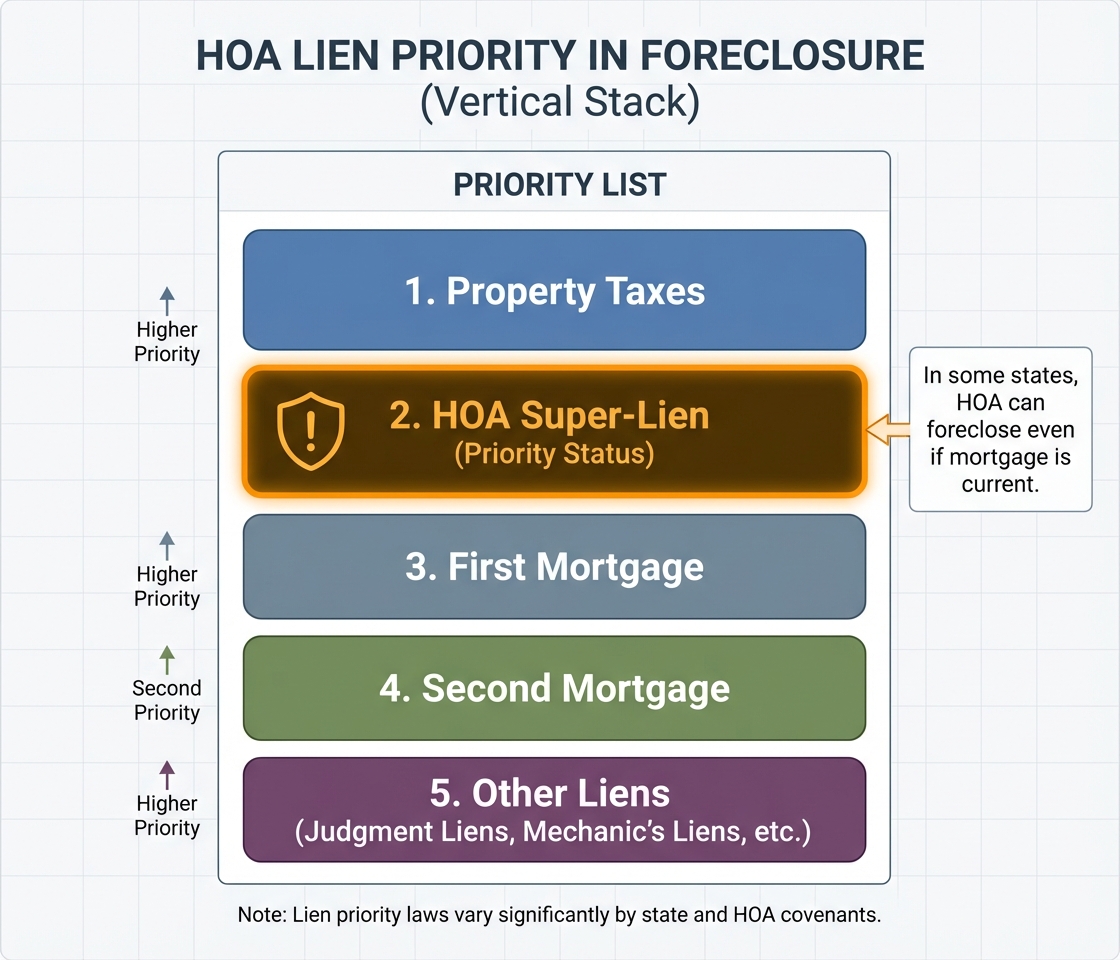

Super-Lien Priority: The Most Dangerous Risk

In roughly 20+ states, HOA liens may take priority over first mortgages for a portion of unpaid assessments. In some cases, the HOA may be able to foreclose even if your mortgage is current.

This is one of the most significant legal risks in HOA ownership that many buyers aren't aware of.

In most real estate transactions, the first mortgage has priority over other liens. If you default and the property is foreclosed, your mortgage lender gets paid first. But in states with "super-lien" laws, HOA assessment liens jump ahead of the mortgage for a portion of unpaid dues.

In super-lien states, HOA liens can take priority over your mortgage

How Super-Liens Generally Work

In states with super-lien laws, HOAs may have a limited priority lien for a portion of unpaid assessments—often the most recent 6-12 months, depending on the state.

What this can mean in practice:

- If the previous owner owed back assessments, the HOA lien for the super-priority portion may take priority over your mortgage

- In some states, the HOA may be able to foreclose on the super-lien amount, potentially affecting your mortgage

- Your mortgage lender may pay off the HOA lien to protect their interest—and could add it to your loan balance

States with Super-Lien Laws

As of this writing, approximately 21-22 states and the District of Columbia have some form of super-lien law. States commonly cited include: Alaska, Colorado, Connecticut, Delaware, Florida, Hawaii, Illinois, Maryland, Massachusetts, Minnesota, Nevada, New Hampshire, New Jersey, Oregon, Pennsylvania, Rhode Island, Vermont, Washington, and West Virginia. Some sources also include Alabama, Missouri, and Tennessee.

⚠️ Laws Change:

Super-lien laws vary significantly in scope and are subject to legislative changes. Verify the current law in your specific state with a local real estate attorney before relying on this list.

Nevada is often cited as having one of the strongest super-lien laws. Under NRS 116.3116, the HOA lien for up to 9 months of assessments can take priority over a first mortgage. The Nevada Supreme Court has ruled that an HOA foreclosure on this super-priority amount may extinguish a first deed of trust, though subsequent legislative amendments have added some lender protections.

⚠️ Note:

When buying in a super-lien state, you may want to verify that all HOA assessments are current before closing. Your title company or attorney can advise on what documentation to request.

Mandatory Arbitration Clauses

Some CC&Rs include mandatory arbitration clauses that may affect your dispute resolution options. Review the dispute resolution section to understand what procedures may apply.

Some CC&Rs contain dispute resolution clauses that may require mediation or arbitration before (or instead of) going to court. These clauses vary significantly in scope and enforceability.

What Arbitration Clauses May Affect

- Forum for disputes: Arbitration uses arbitrators (often attorneys or industry professionals) rather than a jury

- Appeal options: Arbitration decisions are generally final with limited grounds for appeal

- Discovery process: Arbitration procedures may differ from court procedures

- Class action provisions: Some clauses address whether class actions are permitted

Considerations About Arbitration

Some consumer advocates have raised concerns that arbitration may favor organizations that participate in arbitration frequently. If you have concerns about arbitration clauses, consult with an attorney who can evaluate the specific language in your CC&Rs.

Terms to look for in CC&Rs:

- "Arbitration," "mediation," "dispute resolution," "waiver of jury trial"

- Whether the clause is mandatory or optional

- How arbitration costs are allocated

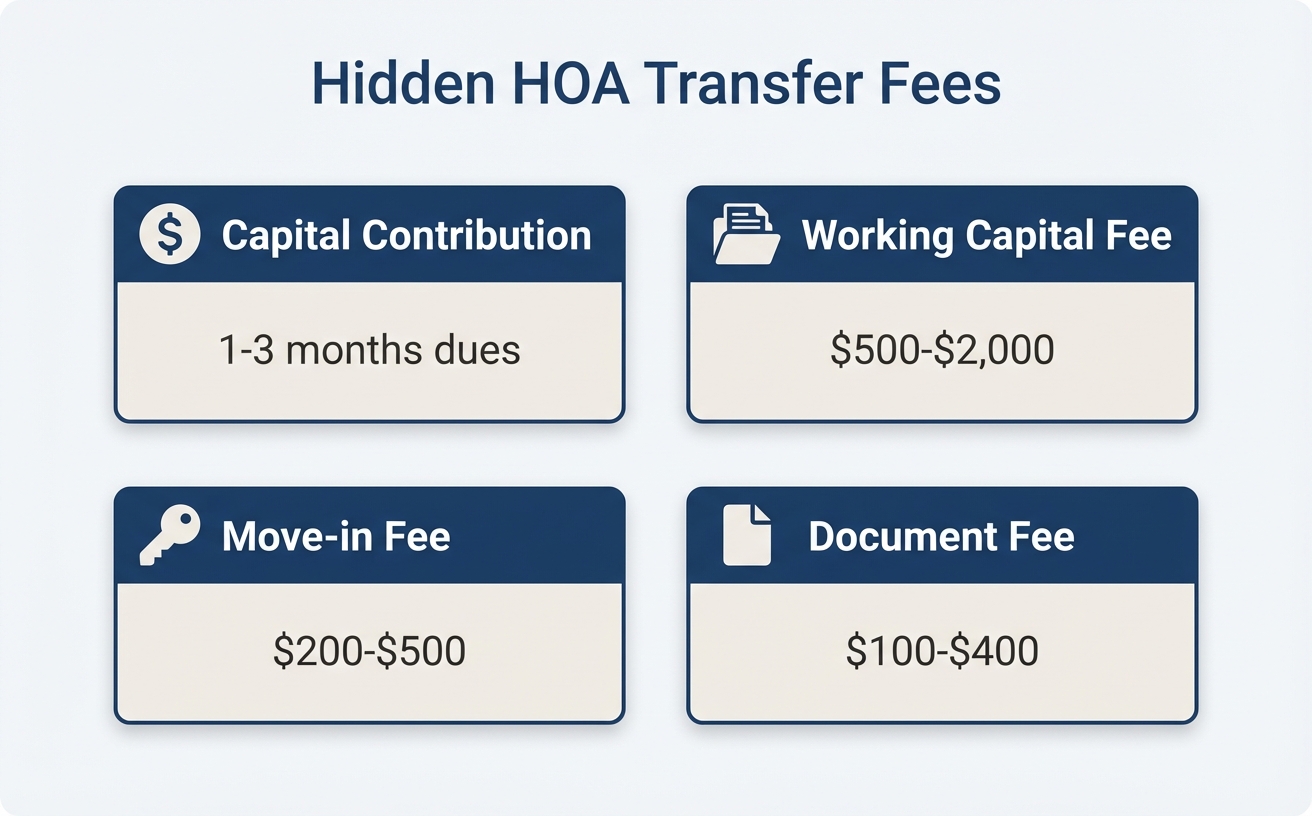

Transfer Fees

Many HOAs charge various fees when property changes hands, including capital contributions, working capital fees, and document fees. These amounts vary significantly by association.

When buying or selling in an HOA, there may be fees beyond standard closing costs. These are typically paid directly to the HOA and can vary widely depending on the association.

HOA transfer fees can add thousands to your closing costs

Types of Transfer Fees

Common types of HOA transfer fees include (amounts vary by association):

- Capital Contribution Fee: A one-time payment to the HOA reserves, sometimes calculated as a multiple of monthly dues

- Working Capital Fee: A contribution to operating funds

- Transfer/Resale Fee: Administrative fee for processing the ownership change

- Document Fee: Fee for providing CC&Rs, financials, and other disclosure documents

- Move-in/Move-out Fee: Deposit or fee for common area use during moving (sometimes refundable)

Why Understanding Fees Matters

Transfer fees can add up to a meaningful amount at closing. The total depends on your specific HOA—some associations charge minimal fees while others have multiple fees that together represent a significant cost.

💡 Suggestion:

Consider requesting a fee schedule from the HOA before making an offer. Who pays these fees (buyer vs. seller) may be negotiable depending on market conditions and contract terms.

Personal Liability Exposure

HOA board service may carry personal liability risks, though protections vary by state. Before volunteering, consider asking about D&O insurance coverage and indemnification provisions.

Many homeowners are recruited to serve on their HOA board with promises that it's "just volunteer work." While many states provide protections for volunteer board members acting in good faith, board service does come with fiduciary duties that volunteers should understand before agreeing to serve.

Potential Liability Risks for Board Members

Board members are sometimes named in lawsuits. Common allegations include:

- Breach of fiduciary duty: Claims that the board failed to act in the association's best interest

- Negligent decision-making: Allegations of decisions made without adequate information or due diligence

- Discrimination claims: Allegations of selective rule enforcement based on protected characteristics

- Contract disputes: Claims related to contracts signed without proper authority

Note: Many states have a "Business Judgment Rule" that protects board members who act in good faith, with reasonable care, and without conflicts of interest. Some states also have volunteer protection statutes. The extent of these protections varies—consult a local attorney to understand the rules in your state.

D&O Insurance Considerations

Directors & Officers (D&O) insurance can help protect board members from personal financial exposure for claims arising from their board service. If you're considering board service, you may want to ask:

- Does the HOA have D&O coverage? Not all associations carry this insurance

- What are the coverage limits? Limits vary widely depending on association size

- What exclusions apply? Policies typically exclude intentional wrongdoing, fraud, and criminal acts

- Are defense costs covered? Some policies cover legal defense; others only cover settlements or judgments

Indemnification Provisions

Some HOA bylaws include indemnification clauses that may require the association to defend and indemnify board members for actions taken in good faith. The scope and enforceability of these provisions vary. If you're considering board service, you may want to review these provisions with an attorney.

Assessment Collection Powers

HOAs may have various collection tools including late fees, attorney fee recovery provisions, liens, and in some states, the ability to pursue foreclosure for unpaid assessments.

HOAs may have collection powers that differ from typical creditors. Depending on state law and the governing documents, remedies for unpaid assessments can include liens and, in some cases, foreclosure—even if mortgage payments are current.

The five legal landmines buried in HOA documents

How Collection May Escalate

Collection processes vary by HOA, but a common pattern includes:

- Late fees: Interest and/or flat late fees as specified in the governing documents

- Collection letters: Written notices about the delinquency

- Attorney involvement: The account may be referred to a collections attorney, with those fees potentially added to your balance

- Lien filing: A lien may be recorded against your property, which can affect your ability to sell or refinance

- Further action: Depending on state law, the HOA may have additional remedies including foreclosure

Attorney Fee Provisions

Many CC&Rs include provisions allowing the HOA to recover attorney fees from delinquent owners. This can mean that collection costs are added to the amount you owe, potentially increasing the total significantly.

⚠️ Note:

If you're facing difficulty paying assessments, consider contacting the HOA early to discuss options. Some associations offer payment plans or other arrangements.

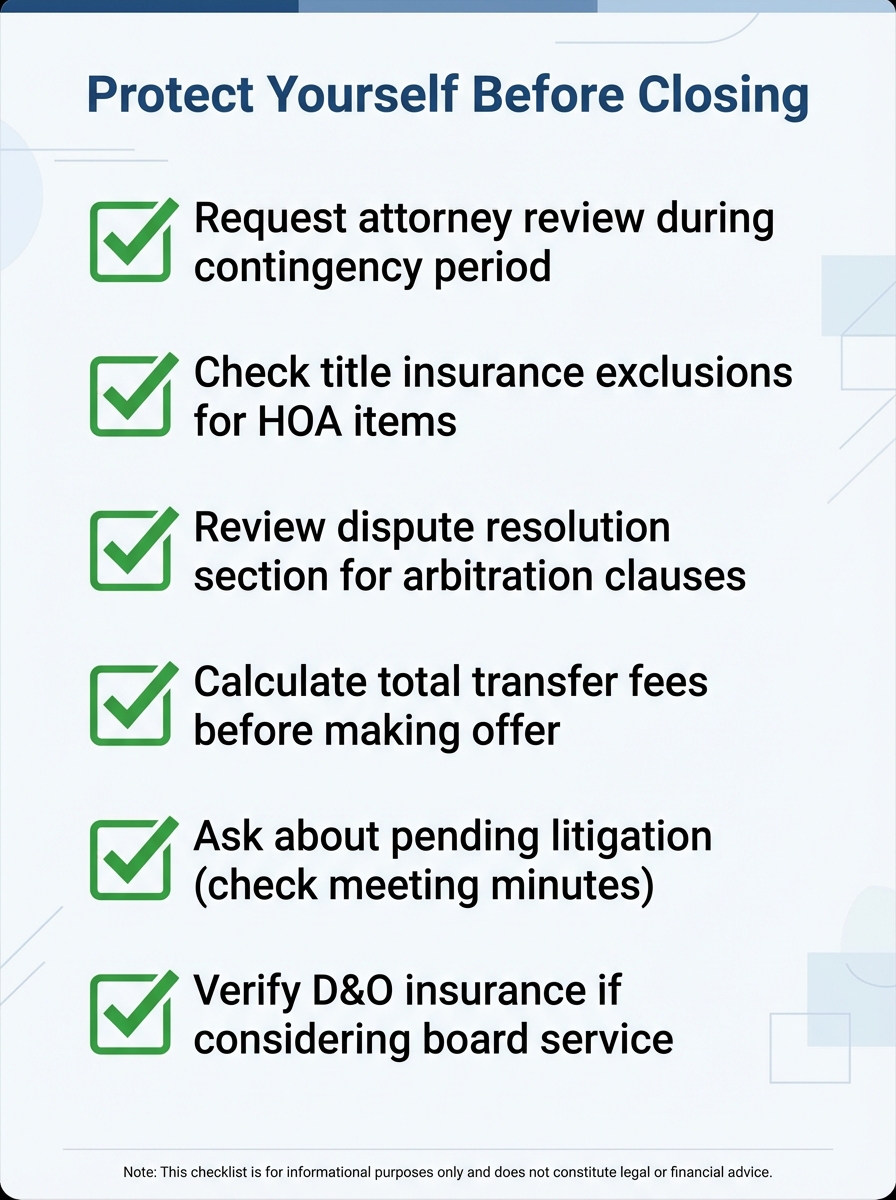

Due Diligence Considerations Before Closing

Many buyers find it helpful to review HOA documents with professionals during their contingency period. Consider consulting an attorney, reviewing title insurance options, and understanding all fees before committing.

The contingency period is typically when buyers have the opportunity to review HOA documents and assess potential risks. Below are some areas that buyers commonly consider—though your specific situation may warrant different priorities. Consult with qualified professionals for guidance tailored to your circumstances.

Common due diligence areas when purchasing HOA property

1. Consider Attorney Review of HOA Documents

Some buyers choose to have a real estate attorney review the CC&Rs, bylaws, and recent meeting minutes during their contingency period. Attorney fees vary significantly by location and complexity—contact local attorneys for quotes. Areas an attorney might review include:

- Lien priority and foreclosure provisions

- Dispute resolution requirements

- Assessment increase procedures

- Transfer restrictions

- Special assessment authority

2. Understand Your Title Insurance Coverage

Title insurance policies vary in what they cover regarding HOA-related issues. Questions you might discuss with your title company include:

- What HOA-related exclusions apply to this policy?

- How does the policy handle unpaid assessments from prior owners?

- Is enhanced coverage available for HOA-related risks?

Your title company or a real estate attorney can help you understand your coverage options.

3. Understand Transfer Fees

HOA transfer fees can vary significantly. Buyers often request a fee schedule from the HOA to understand these costs before finalizing an offer. Who pays these fees (buyer vs. seller) may be negotiable depending on your market and contract terms.

4. Inquire About Litigation

Many buyers want to know whether the HOA is involved in any legal disputes. Information about litigation may be available in HOA disclosure documents, meeting minutes, or through direct inquiry to the HOA or management company. Topics buyers sometimes ask about include:

- Current lawsuits involving the HOA

- Pending construction defect claims

- Disputes with owners or vendors

5. Insurance Considerations for Potential Board Members

If you're considering serving on the HOA board in the future, you may want to inquire about the association's Directors & Officers (D&O) insurance coverage. An insurance professional or attorney can help you understand what questions to ask about coverage.

Key Takeaways

HOA properties can work well for many buyers—but understanding the legal framework before you commit can help you make a more informed decision. Here are some areas buyers commonly consider:

Before Making an Offer

- 1.Review available HOA documents. CC&Rs and bylaws may contain information about liens, dispute resolution, and fees.

- 2.Understand potential transfer fees. These costs vary and may affect your total purchase price.

- 3.Research your state's HOA laws. Lien priority, foreclosure rules, and buyer protections differ by state.

During Your Contingency Period

- 1.Consider consulting a real estate attorney. They can review HOA documents and explain potential risks specific to your situation.

- 2.Discuss title insurance options. Ask your title company about coverage for HOA-related issues.

- 3.Inquire about the HOA's current status. Financial health, pending litigation, and planned assessments may be relevant to your decision.

The goal is to make an informed decision about whether an HOA property is right for you. Working with qualified professionals—real estate attorneys, title companies, and your agent—can help you understand the specific risks and benefits of any property you're considering.

Get Key Information Extracted Automatically

HOA documents can be lengthy and complex. GoverningDocs helps extract key information from CC&Rs and bylaws—including sections about assessments, restrictions, and fees—so you can review them more efficiently.

Try Free Analysis →No signup required. Not a substitute for professional legal advice.

Frequently Asked Questions

Can an HOA really foreclose on my home?

In many states, yes—HOAs may have the authority to foreclose on properties for unpaid assessments, though the rules vary significantly. Some states require judicial foreclosure (through the courts), while others permit non-judicial foreclosure. Some states have banned or restricted HOA foreclosures for small amounts. The specifics depend on state law, your CC&Rs, and the amount owed. Consult a local attorney if you're concerned about foreclosure risk in your state.

How do I find out if the seller owes back assessments?

Request an estoppel certificate (also called a resale certificate or status letter) from the HOA. This official document shows the current assessment balance, any unpaid amounts, pending special assessments, and violations on record. Most title companies require this before closing, but you should review it personally.

Are mandatory arbitration clauses enforceable?

In many cases, yes—but enforceability depends on your state's laws and the specific language in the CC&Rs. Federal courts have generally upheld arbitration clauses, but some states have carved out exceptions for certain claims (like discrimination or small claims). The specifics matter: how the clause is worded, whether proper notice was given, and whether the arbitration process is fundamentally fair. Consult a local attorney to evaluate the arbitration clause in your specific HOA documents.

Can I negotiate transfer fees?

Yes, but not directly with the HOA. The fee amounts are typically set in the governing documents. However, you can negotiate with the seller about who pays them. It's common to split transfer fees or have the seller pay as part of negotiations, especially in a buyer's market.

What if I disagree with an HOA rule?

Your options may be limited once you've closed. Common approaches include: (1) attending board meetings and advocating for change, (2) running for the board yourself, (3) gathering owner support to amend the CC&Rs (amendment requirements vary by state and governing documents). Legal challenges are possible but often expensive and difficult—courts generally defer to HOA authority unless rules are being enforced discriminatorily or clearly exceed the HOA's powers. Consult an attorney before pursuing legal action. The best time to evaluate rules is before you buy.

Does title insurance protect me from HOA issues?

Standard title insurance policies often have HOA-related exclusions. Coverage typically varies—some policies may cover unpaid assessments that were liens before closing, but not future assessments, CC&R violations, or super-lien issues. Ask your title company about your specific policy's exclusions and whether enhanced coverage is available for HOA-related risks in your state.

Remember: The answers above are for general informational purposes only. HOA laws and enforcement vary significantly by state, and every situation is unique. For advice about your specific circumstances, please consult with a licensed real estate attorney in your jurisdiction.