In This Guide

Rental restrictions are found in CC&Rs and HOA Rules. Look for lease minimums, rental caps, Airbnb bans, and tenant approval requirements that could prevent you from renting your unit.

You've found the perfect condo investment property, the numbers work perfectly, and then you discover—after closing—that the HOA requires a 1-year lease minimum and the rental cap has been reached. Your Airbnb investment strategy just died.

It happens more than you'd think. Rental restrictions are often buried in 200+ page HOA documents that buyers never fully read, hidden in sections with vague titles like "Use Restrictions" or "Rules and Regulations." By the time you discover the 6-month lease minimum or the 20% rental cap that's already been reached, you're contractually committed to a property that won't cash flow the way you planned.

Even worse, HOA boards can amend rental rules after you buy—potentially outlawing short-term rentals or implementing new restrictions through a simple majority vote.

But here's the good news: if you know where to look, you can identify rental restrictions before making an offer. In this guide, you'll learn exactly which HOA documents contain rental restrictions, the 5 types of restrictions that can kill an investment deal, and how to verify current rules vs pending changes during your contingency period.

Why Rental Restrictions Matter

Rental restrictions can prevent you from renting your unit entirely, require 6-12 month lease minimums that eliminate short-term rental income, or limit the total number of rentals allowed in the building.

HOA rental restrictions exist for legitimate reasons:

- Lenders often require owner-occupancy ratios to meet Fannie Mae/Freddie Mac financing guidelines (typically 50%+ owner-occupied)

- Insurance companies may demand short-term rental bans to control liability

- Boards may restrict rentals to preserve "community character"

But for investors, these restrictions can be dealbreakers:

- Rental caps limit the percentage of units that can be rented (e.g., "no more than 20% of units may be tenant-occupied"). If the cap is reached, you can't rent until another owner stops renting.

- Lease minimums require tenants to sign leases of 6 months, 1 year, or longer—eliminating short-term rental strategies entirely.

- Airbnb/VRBO bans explicitly prohibit short-term rentals, often defining "short-term" as anything under 30 days.

- Tenant approval requirements give the HOA board veto power over your tenants, adding weeks to your leasing process.

- Owner occupancy periods require you to live in the unit for 1-2 years before renting it out—killing immediate investment plans.

The stakes are high. If you buy a condo assuming you can run it as an Airbnb and later discover a 6-month lease minimum, you've just eliminated 40-60% of your projected rental income.

Where to Find Rental Restrictions in HOA Documents

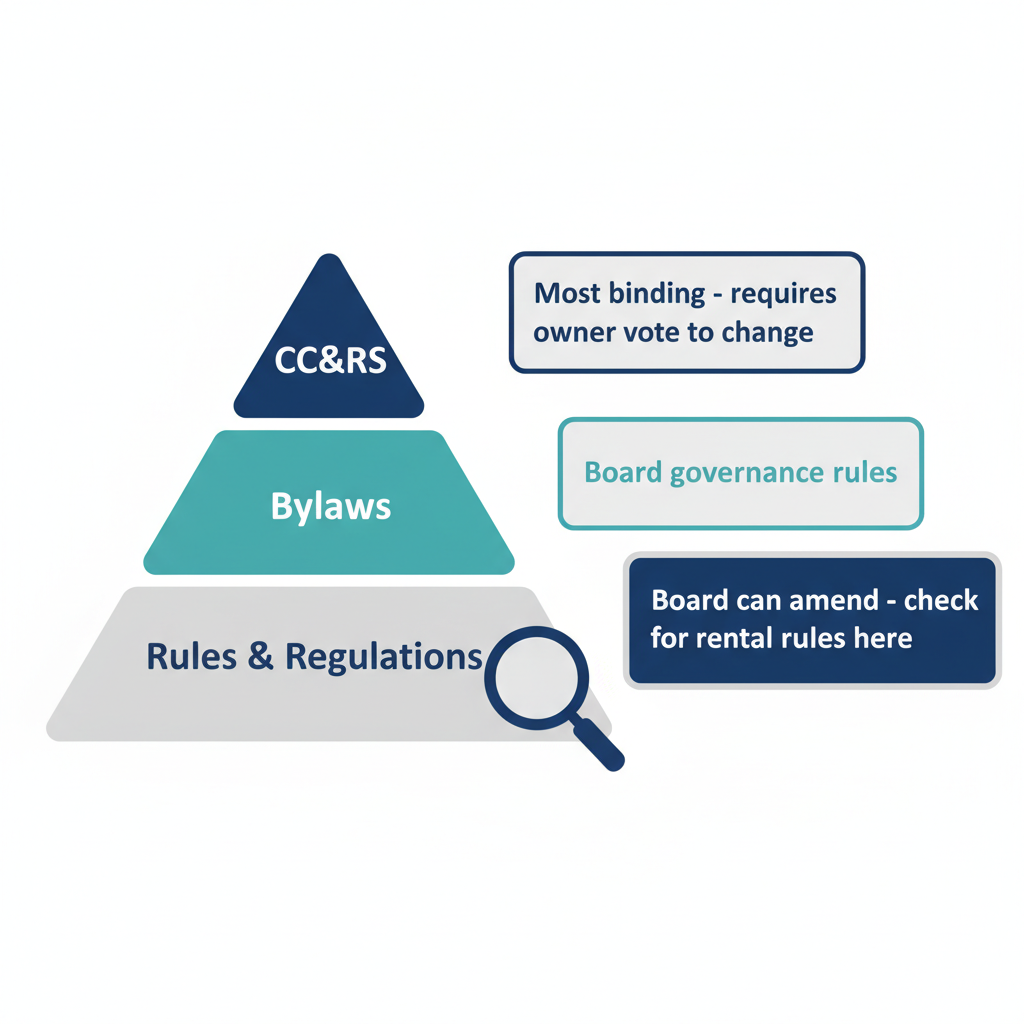

Rental restrictions appear in three places: CC&Rs (most binding), Rules & Regulations (board can amend), and recent meeting minutes (proposed changes). Check all three during your contingency period.

HOA documents follow a hierarchy. Understanding which document contains which rules tells you how easily restrictions can change:

HOA document hierarchy: CC&Rs are hardest to change, Rules & Regulations can be amended by the board

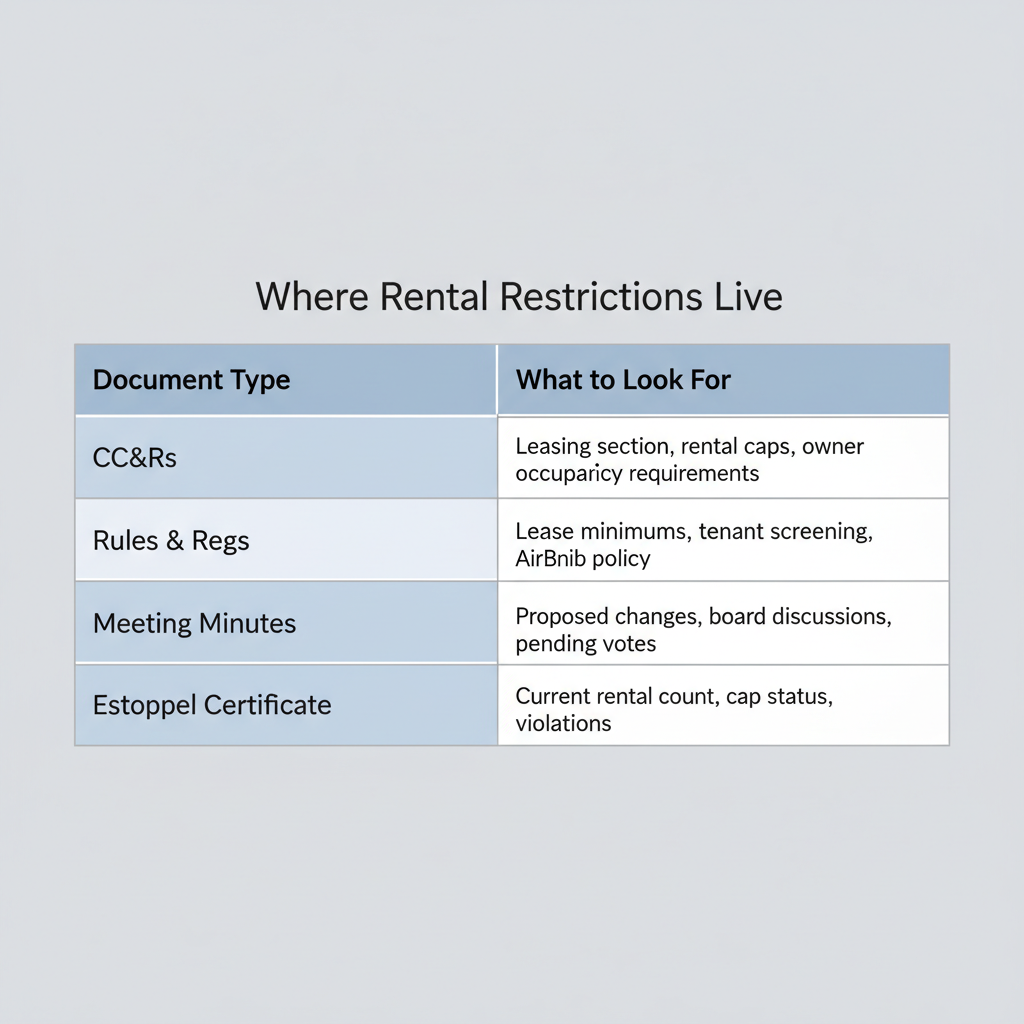

1. CC&Rs (Covenants, Conditions & Restrictions) - Most Binding

What to look for: Search for sections titled "Leasing," "Rentals," "Use Restrictions," or "Transfer of Title."

CC&Rs are the master governing document. Restrictions here typically require a supermajority vote (67-75% of owners) to change, making them relatively stable.

Common CC&R rental provisions:

- "No unit may be leased for a term less than [6 months / 1 year]"

- "No more than [20%] of units may be occupied by non-owners at any time"

- "Owner must occupy unit for [1 year] before leasing is permitted"

- "Short-term rentals under 30 days are prohibited"

⚠️ Important:

CC&R rental restrictions supersede all other documents. If the CC&Rs ban rentals or set a rental cap, the board cannot override this without an owner vote.

2. Rules & Regulations - Board Can Amend

What to look for: Sections on "Tenant Screening," "Lease Requirements," "Short-Term Rentals," or "Owner Responsibilities."

Rules & Regulations are more detailed operational policies. The board can typically amend these with a simple majority vote—meaning rental rules can change after you buy.

Common Rules & Regulations provisions:

- Tenant application/screening requirements

- Minimum lease terms (e.g., "No leases under 6 months")

- Registration requirements (must notify HOA before renting)

- Airbnb/VRBO/short-term rental policies

- Number of occupants per unit

- Pet restrictions that apply to tenants

💡 Pro Tip:

Even if current Rules allow short-term rentals, the board can ban them later via simple amendment. For investment properties, look for rental protections in the CC&Rs (harder to change) rather than relying on favorable Rules.

3. Board Meeting Minutes - Proposed Changes

What to look for: Discussions about "rental policy," "short-term rental concerns," "owner-occupancy ratios," or "lender requirements."

Meeting minutes are your early warning system. If the board is discussing rental restrictions, they may implement changes within 6-12 months.

Red flags in meeting minutes:

- "Board discussed concerns about increasing number of rentals"

- "Owners complained about Airbnb noise/parties"

- "Insurance company recommending short-term rental restrictions"

- "Lender requiring higher owner-occupancy ratio for refinancing"

- "Draft rental policy amendment to be presented at annual meeting"

Request the last 12 months of meeting minutes during your contingency period. This is where you'll catch restrictions before they're formally adopted.

5 Types of Rental Restrictions to Check

The five critical rental restrictions are: rental caps (% of units that can be rented), lease minimums (6-12 months), Airbnb/STR bans, tenant approval requirements, and owner occupancy periods before renting.

Five types of rental restrictions that can impact your investment strategy

1. Rental Caps (% Limits)

- What it means: A maximum percentage of units that can be tenant-occupied at any time (e.g., "No more than 20% of units may be rented")

- Why it matters: If the cap has been reached, you cannot rent your unit until another owner stops renting—even if you need to relocate for work

- How to verify: Ask the HOA management company: "What is the current rental occupancy percentage, and how close are we to the cap?" Get this in writing via the estoppel certificate (also called resale certificate)

2. Lease Minimums

- What it means: Tenants must sign leases for a minimum duration (common minimums: 30 days, 6 months, or 1 year)

- Why it matters: A 6-month minimum eliminates Airbnb, VRBO, and furnished finder rentals. A 1-year minimum eliminates corporate housing and mid-term rentals

- How to spot it: Look for phrases like "No lease shall be for a term less than [X months]" in CC&Rs or Rules & Regulations

3. Airbnb/Short-Term Rental (STR) Bans

- What it means: Explicit prohibition of short-term rentals, often defined as any rental under 30 days. May specifically name platforms like Airbnb, VRBO, HomeAway

- Why it matters: Even if there's no general lease minimum, a specific STR ban prevents vacation rental income

- How to spot it: Search documents for "short-term rental," "vacation rental," "Airbnb," "VRBO," "transient," and "hotel-like use"

⚠️ Important:

Some HOAs grandfather existing short-term rentals but ban new ones. If you're buying a unit currently used as an Airbnb, verify that the right to rent short-term transfers with the deed—it often doesn't.

4. Tenant Approval Requirements

- What it means: You must submit tenant applications to the HOA board for approval before leasing. Board has discretion to reject tenants

- Why it matters: Adds 2-4 weeks to your leasing timeline. Board can reject tenants for vague reasons like "not a good fit for the community"

- What to ask: "What is the tenant approval process? How long does approval typically take? What percentage of tenant applications are rejected?"

5. Owner Occupancy Requirements Before Renting

- What it means: You must live in the unit as your primary residence for 1-2 years before you're allowed to rent it out

- Why it matters: Kills immediate investment strategies. Designed to prevent "investor-only" buildings

- How to spot it: Look for "Owner must occupy unit as primary residence for [X period] before leasing is permitted" in CC&Rs

Red Flags That Signal Future Rental Restrictions

Warning signs of pending rental restrictions include board discussions about "community character," insurance pressure on short-term rentals, and neighboring HOAs recently implementing rental bans.

Even if current documents allow rentals, certain warning signs suggest restrictions are coming. Here's what to watch for:

Warning signs that rental restrictions may be coming

Board Discussions About "Community Character"

When board members use phrases like "preserving community character," "too many renters," or "investor problem," it's a strong signal that rental restrictions are being considered.

What to look for in meeting minutes:

- Owner complaints about tenant behavior

- Discussions of declining owner-occupancy rates

- Proposals to "study rental policies in similar communities"

Insurance Pressure on Short-Term Rentals

HOA insurance carriers increasingly demand short-term rental bans or charge significantly higher premiums for buildings that allow them.

What to look for:

- Meeting minutes mentioning "insurance renewal concerns"

- "Carrier requiring STR restrictions"

- "Premium increase due to short-term rentals"

If the HOA's insurance is up for renewal soon, there's a high probability that STR restrictions will be implemented to keep premiums manageable.

Lender Requirements for Owner-Occupancy Ratios

If the HOA is refinancing its master insurance policy, taking out a loan for a major repair, or if individual owners are having trouble getting mortgages, the board may implement rental caps to meet lender requirements.

Fannie Mae and Freddie Mac typically require: At least 50% owner-occupancy for condo financing approval. If your building falls below this threshold, expect rental restrictions.

Neighboring HOAs Recently Banned Rentals

HOA boards often look to nearby communities when considering policy changes. If similar buildings in your area have recently implemented rental restrictions, yours may follow.

How to check:

Ask your real estate agent or attorney to research recent rental policy changes at comparable properties in the same neighborhood or HOA network.

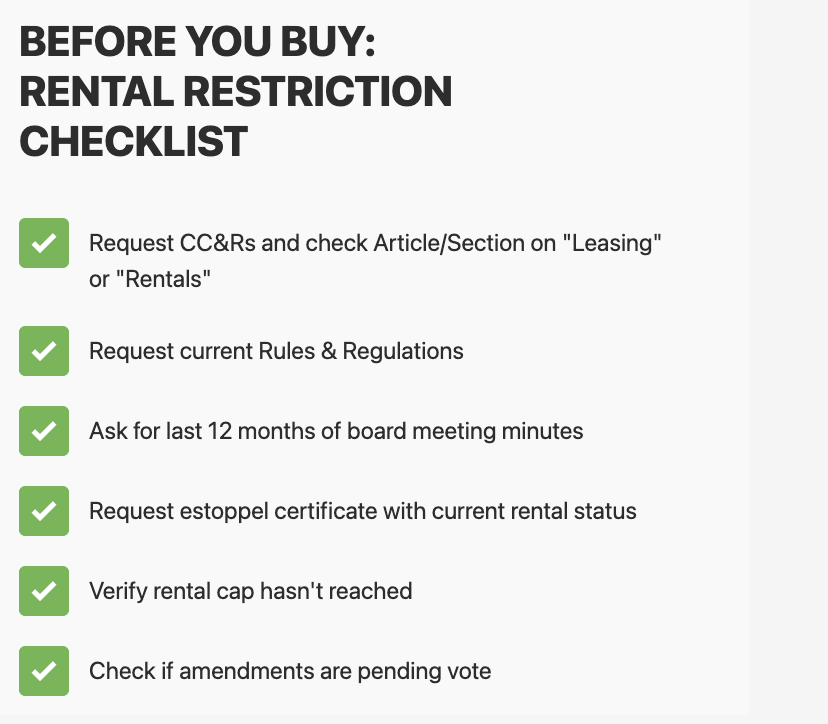

How to Verify Current vs Proposed Rental Rules

Verify rental rules by requesting an estoppel certificate (shows current rental count/cap status), last 12 months of meeting minutes (reveals pending changes), and asking if amendments are pending owner vote.

Don't trust the seller's word on rental restrictions. Here's how to verify the rules during your contingency period:

Checklist: How to verify rental restrictions before closing

1. Request an Estoppel Certificate (Resale Certificate)

An estoppel certificate is an official document from the HOA that discloses the current status of the unit and association.

What it should include:

- Current HOA dues and any outstanding special assessments

- Pending litigation

- Current rental occupancy percentage and rental cap status

- Any rental waiting lists

- Outstanding violations

Key question to ask:

"Is the rental cap currently at or near its limit? If yes, how long is the typical wait to get rental approval?"

2. Request Last 12 Months of Board Meeting Minutes

Meeting minutes reveal what the board is discussing—and what they're planning to vote on.

What to search for:

- "rental" / "lease" / "tenant"

- "short-term" / "Airbnb" / "VRBO"

- "occupancy ratio" / "owner-occupied"

- "amendment" / "policy change"

- "insurance" / "lender requirements"

If any of these topics appear in recent minutes, ask follow-up questions:

"Is the board considering changes to the rental policy? If yes, what is the timeline for implementation?"

3. Check if Amendments Are Pending Owner Vote

Sometimes rental restrictions have been approved by the board but are awaiting owner ratification (if the change requires amending CC&Rs).

Questions to ask:

- "Are there any pending amendments to the CC&Rs or Rules & Regulations related to rentals?"

- "When is the next annual owner meeting?"

- "What items are on the agenda for the annual meeting that could affect rentals?"

Red flag:

If the seller says "The board approved a new rental policy, but it's not in effect yet," be very cautious. The restriction may take effect shortly after you close.

Where Rental Restrictions Live

Quick reference: Where to find each type of rental restriction

Key Takeaways: Don't Get Blindsided by Rental Restrictions

Rental restrictions can derail your investment strategy—but only if you don't catch them in time. Here's your action plan:

✅ Before You Make an Offer

- 1.Request CC&Rs and Rules & Regulations in advance. Search for "lease," "rental," "tenant," "short-term," and "Airbnb."

- 2.Ask about the rental cap status. If the building is at or near its cap, factor in potential delays to renting.

- 3.Confirm your intended use is allowed. If you plan to Airbnb the unit, explicitly ask: "Are short-term rentals under 30 days permitted?"

✅ During Your Contingency Period

- 1.Request an estoppel certificate showing current rental occupancy percentage and any rental waiting lists.

- 2.Review the last 12 months of board meeting minutes. Look for discussions about rental restrictions, insurance concerns, or "community character."

- 3.Ask if amendments are pending vote. Confirm no rental policy changes are scheduled for the next 6-12 months.

The goal is simple: verify rental rules before you're contractually committed. A $500 pre-purchase HOA document review could save you from discovering a 1-year lease minimum after you've closed on what you thought was an Airbnb property.

Get Rental Restrictions Extracted Automatically

Stop searching through 200+ page HOA documents manually. GoverningDocs analyzes CC&Rs and Rules & Regulations to extract rental restrictions, lease minimums, caps, and Airbnb policies—in under 2 minutes.

Try Free Analysis →No signup required. Upload your HOA documents and get instant results.

Frequently Asked Questions

Can an HOA ban rentals completely?

Yes, but only if the CC&Rs allow it. HOAs can ban all rentals if the governing documents grant them that authority, typically requiring a supermajority vote (67-75% of owners). However, if the CC&Rs explicitly protect rental rights, the board cannot override this through Rules & Regulations amendments.

Can the HOA change rental rules after I buy?

Yes. If rental rules are in the Rules & Regulations (not CC&Rs), the board can amend them with a simple majority vote. CC&R amendments require a supermajority of owners and are much harder to change. This is why it's critical to check where rental permissions are documented.

What if I'm already renting my unit when new restrictions pass?

It depends on the specific amendment language. Some HOAs "grandfather" existing rentals, allowing current tenants to complete their leases but prohibiting new leases. Others apply restrictions immediately once a lease expires. Always verify the effective date and transition rules for new rental restrictions.

How do I know if the rental cap has been reached?

Request an estoppel certificate (also called a resale certificate) from the HOA. This official document should state the current rental occupancy percentage and whether the cap has been reached. If the cap is at its limit, ask if there's a waiting list and typical wait time.

Can I challenge an HOA's rental restrictions?

Challenging rental restrictions is difficult and expensive. Courts generally uphold HOA rules that are (1) clearly stated in the governing documents, (2) applied uniformly, and (3) serve a legitimate purpose (e.g., meeting lender requirements or reducing insurance costs). The time to negotiate is before you buy—not after.

Are Airbnb bans becoming more common?

Yes. Short-term rental restrictions have become increasingly common among HOAs, driven by insurance companies that require STR bans to maintain coverage and lenders that prefer higher owner-occupancy ratios. If Airbnb is part of your investment strategy, verify it's explicitly allowed—not just "not prohibited."