In This Guide

Florida's condo crisis means buyers face $50K-$400K special assessments. Check SIRS reports, reserve funding, and compliance status before buying.

You've found a beachfront Florida condo at what looks like a bargain price. But that "deal" could come with a $100,000+ special assessment bill that arrives months after you close.

Florida's condo market is in the middle of a structural safety reckoning. New laws passed after the 2021 Surfside collapse now require buildings to complete Structural Integrity Reserve Studies (SIRS), fund mandatory reserves, and fix decades of deferred maintenance. The result: a wave of special assessments hitting owners and buyers who didn't see it coming.

Some buildings are handling it well. Others are passing six-figure assessments to unit owners. The difference between a smart purchase and a financial disaster comes down to knowing what to check—and this guide shows you exactly what to look for.

What's Happening in Florida's Condo Market

Post-Surfside laws (SB 4D, HB 913) now require SIRS reports and mandatory reserve funding. As of January 2026, reserve waivers are banned — yet 56-72% of South Florida buildings remain non-compliant.

In June 2021, the Champlain Towers South collapse in Surfside killed 98 people and exposed a systemic problem: Florida condos had been deferring structural maintenance for decades, and the state had no mechanism to enforce repairs.

Florida's legislature responded with two landmark laws:

- SB 4D (2022): Required Structural Integrity Reserve Studies (SIRS) for buildings 3+ stories, covering mandatory structural components

- HB 913 (2025): Extended deadlines, banned reserve waivers starting January 1, 2026, and added buyer protections including a 7-day review period

The January 1, 2026 deadline was the inflection point. Associations can no longer vote to waive or reduce reserve contributions for the 8 SIRS components. Buildings that deferred maintenance for 20+ years now have to fund it all at once—and the bills are staggering. If you already own a Florida condo facing a SIRS assessment, see what options owners have.

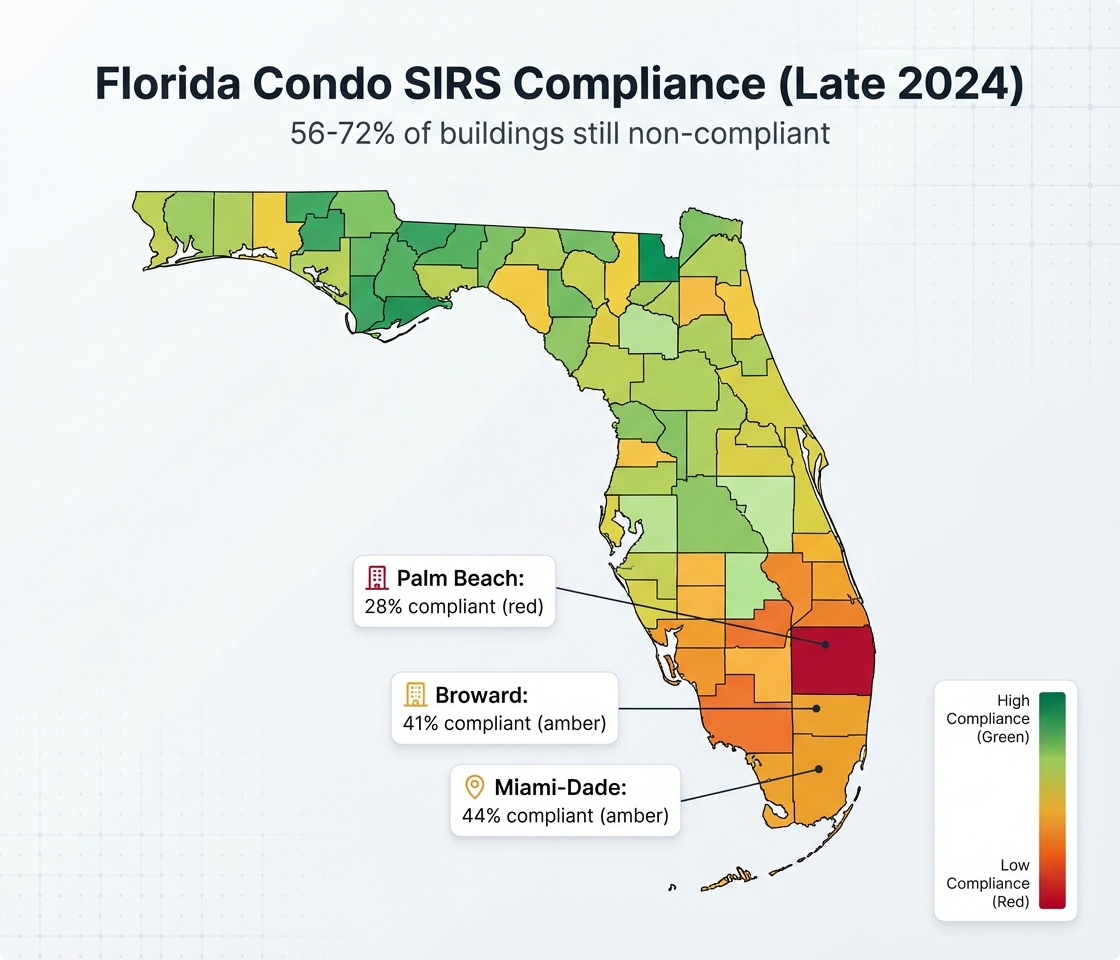

Current compliance rates tell the story (source: Condo Vultures / Miami Association of Realtors, Feb 2025):

| County | SIRS Compliance Rate | Non-Compliant |

|---|---|---|

| Miami-Dade | 44% | 56% |

| Broward | 41% | 59% |

| Palm Beach | 28% | 72% |

The Numbers That Should Scare You

Special assessments of $50K-$400K per unit are hitting Florida condos. Our analysis of 38 SIRS reports found 26.9% of HOAs are critically underfunded below 30%.

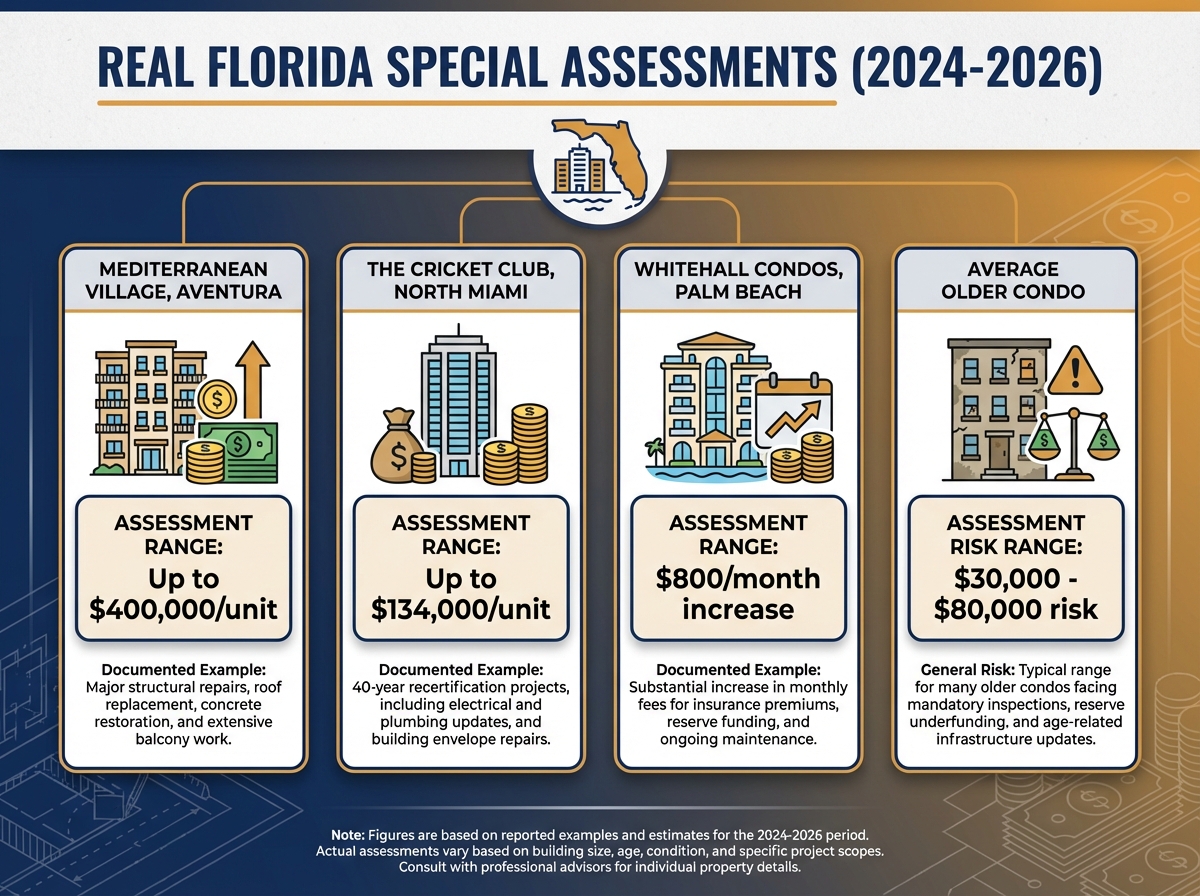

Real special assessment amounts hitting Florida condo owners

These aren't hypothetical numbers. Real Florida condos are passing real assessments right now (sources: Brosda & Bentley, Yahoo Finance):

| Building | Location | Assessment |

|---|---|---|

| Mediterranean Village | Aventura | Up to $400,000/unit |

| The Cricket Club | North Miami | Up to $134,000/unit |

| Williams Island (retired couple) | Aventura | $224,000/unit |

| Average older condo | Statewide | $30,000-$80,000 risk |

The market impact is already visible:

- Condo values down 19% for South Florida buildings 30+ years old since 2023 (Yahoo Finance)

- HOA fees surging 40-100%+ since the Surfside collapse for many buildings (Redfin)

- Nearly 70% of Florida condo sales closing below list price in early 2025 (Maco Realty Group)

📊 GoverningDocs Research

Based on our analysis of 38 Florida SIRS reports (1,730 pages, ~2,000 units), we found a bimodal funding distribution: 65% of associations are at or near 100% funded, while 26.9% are critically underfunded below 30%. Very few fall in between. Florida condos are either well-managed or seriously behind—there's little middle ground.

Other findings from our SIRS analysis:

- $10.1 million in total replacement costs identified across the sample

- 45% of components due for replacement within 10 years

- 92.1% of reports documented structural issues requiring attention

Based on GoverningDocs analysis of 38 Florida SIRS reports.

Why This Is Happening Now

Decades of waived reserves hit a wall on January 1, 2026, when Florida banned reserve waivers for SIRS components. Over 1 million of Florida's ~1.5M condos are 30+ years old with deferred repairs.

Florida's condo crisis didn't happen overnight. It's the result of decades of deferred maintenance colliding with new enforcement:

- Decades of waived reserves: Florida law previously allowed owners to vote to waive or reduce reserve contributions. Many associations did exactly that—keeping monthly fees artificially low while buildings aged.

- Over 1 million condos are 30+ years old: Florida has approximately 1.5 million condo units, and more than 1.1 million were built before the mid-1990s (Florida Policy Project). These buildings are now reaching the age where major structural components need replacement.

- Insurance costs 2 to 3x the national average: Florida's property insurance market has been in crisis, with premiums far exceeding what associations budgeted for. Many buildings face non-renewal or dramatically higher rates.

- Structural repairs can no longer be deferred: The SIRS requirement means buildings must inspect and fund repairs for roofs, structural systems, fireproofing, plumbing, electrical, waterproofing, and windows/exterior doors.

⚠️ The 8 Mandatory SIRS Components

Per Florida Statute §718.112, SIRS reports must assess these structural components: roof, structure (load-bearing walls and primary structural members), fireproofing and fire protection systems, plumbing, electrical systems, waterproofing and exterior painting, windows/exterior doors, and any item with a deferred maintenance cost exceeding $25,000. Reserve waivers for these components ended January 1, 2026.

What Buyers Must Check Before Making an Offer

Before buying a Florida condo, verify SIRS completion status, reserve funding percentage, pending special assessments, milestone inspection results, and insurance coverage changes.

SIRS compliance rates vary widely across Florida counties

Five things to verify before you make an offer on any Florida condo:

1. SIRS Report Status

Ask: "Has the association completed its SIRS?" If the building is 3+ stories, a SIRS is required by Florida law. If it hasn't been completed, you're buying into unknown structural and financial risk.

2. Reserve Funding Level

The single most important number. Under 50% funded means special assessments are likely. Under 30% means they're almost certain. Our research found 26.9% of Florida HOAs fall into that critical zone.

Related: How to Read a Reserve Study in 5 Minutes →

3. Pending or Planned Special Assessments

Ask the seller, the HOA, and your agent directly. Check the last 12-24 months of board meeting minutes for any discussion of assessments, fee increases, or major repair projects.

Related: Understanding HOA Special Assessments →

4. Milestone Inspection Results

Buildings 30+ years old (or 25+ years within 3 miles of the coast) must complete a Milestone Structural Inspection. Ask for the results. Phase 2 inspections (required when Phase 1 finds issues) are particularly important—they detail specific structural problems and repair costs.

5. Insurance Coverage and Premium Changes

Florida's insurance crisis compounds the condo crisis. Ask about recent premium increases, coverage reductions, and whether the building has had any difficulty renewing policies. Inadequate insurance is both a red flag and a cost risk.

Red Flags That Should Make You Walk Away

Walk away if the building hasn't completed a required SIRS, has multiple components at RUL=0, board minutes mention "defer" repeatedly, reserves are under 20%, or there's active structural litigation.

Not every issue is a deal-breaker. But these should make you seriously reconsider—or walk away entirely:

Walk-Away Red Flags

- ✗SIRS not completed and the building is required to have one — you're buying blind

- ✗Multiple components at RUL=0 — immediate repairs needed, assessments imminent

- ✗Board minutes repeatedly mention "defer" — pattern of kicking problems down the road

- ✗Reserve funding under 20% with major repairs coming — special assessment is virtually guaranteed

- ✗Active structural litigation — legal costs, uncertainty, and potential assessments to cover damages

Related: How to Review HOA Documents Before Buying →

The Two-Tier Market: Compliant vs Non-Compliant

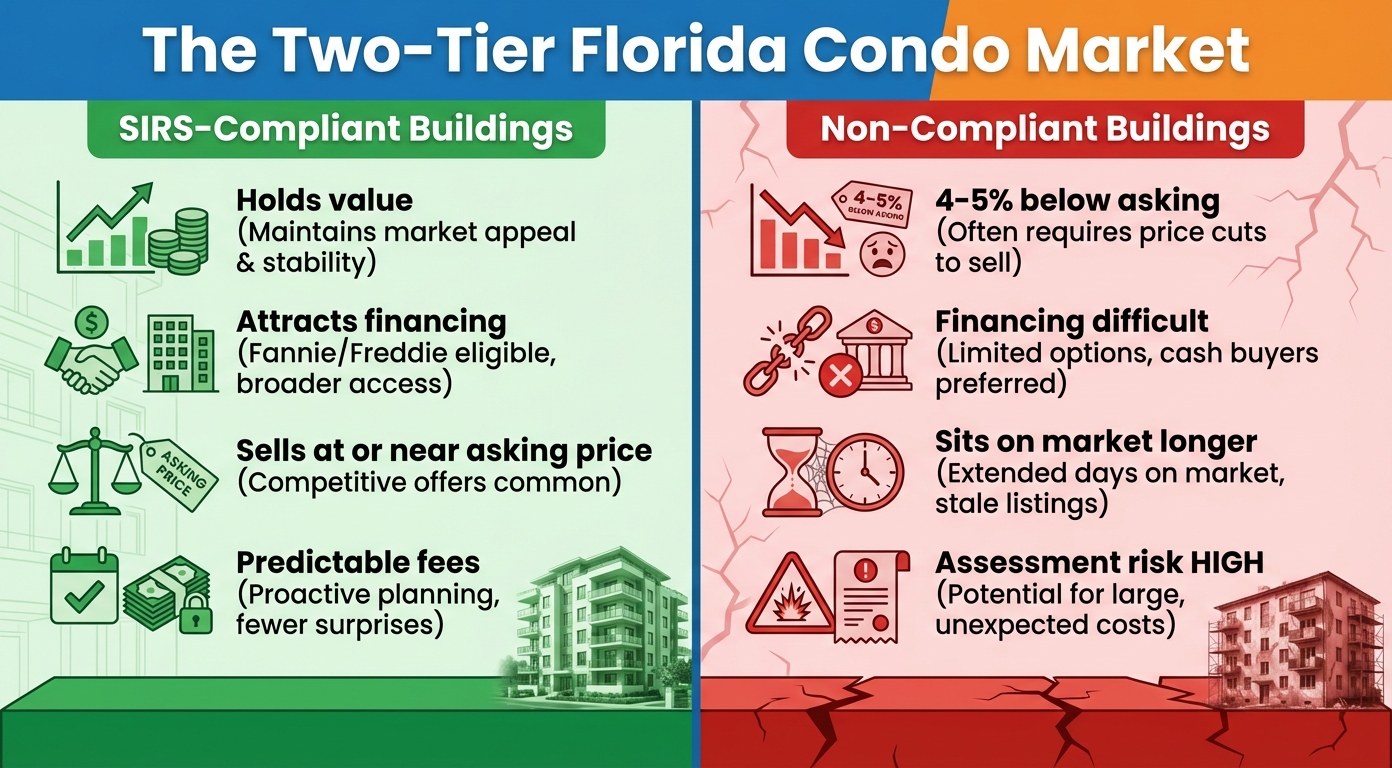

SIRS-compliant buildings hold value and attract financing. Non-compliant buildings sell 4-5% below asking, sit on the market longer, and face financing restrictions.

The Florida condo market is splitting into two tiers based on SIRS compliance

Florida's condo market is splitting in two. Where a building falls on SIRS compliance increasingly determines its market performance:

| Factor | SIRS-Compliant | Non-Compliant |

|---|---|---|

| Value | Holds value | Declining |

| Financing | Fannie/Freddie eligible | Difficult to obtain |

| Sale price | At or near asking | 4-5% below asking |

| Time on market | Normal | Sitting longer |

| Monthly fees | Predictable | Assessment risk HIGH |

This split matters for financing. Fannie Mae and Freddie Mac have tightened condo lending requirements — more than 1,400 Florida condo buildings are on Fannie Mae's restricted list. Non-compliant buildings may not qualify for conventional mortgages, leaving buyers with limited (and more expensive) financing options.

Nearly 70% of Florida condo sales closed below list price in early 2025. In the non-compliant tier, that discount is steeper and the inventory is growing.

New Buyer Protections (Know Your Rights)

Florida's HB 913 gives buyers a 7-day rescission period (up from 3 days), requires associations to post documents online, and mandates transparency on special assessments and SIRS results.

The same legislation that's causing the crisis also created new buyer protections. Know your rights under HB 913:

Your Rights Under HB 913

- ✓7-day rescission period — up from 3 days. Use every day of it.

- ✓Online document access — associations with 25+ units must post governing documents online.

- ✓Right to view SIRS — within 30 days of completion. If they won't share it, that's a red flag.

- ✓Assessment transparency — associations must disclose planned special assessments and any loans.

💡 Pro Tip:

Don't wait until closing to request documents. Ask your agent to obtain the SIRS report, reserve study, and last 12 months of meeting minutes before you make an offer. The 7-day review period is better than 3, but it's still not enough to analyze hundreds of pages from scratch.

Questions to Ask Before Buying a Florida Condo

Ask about SIRS completion, reserve funding percentage, planned assessments, milestone inspection results, and recent fee increases. Get answers in writing before you close.

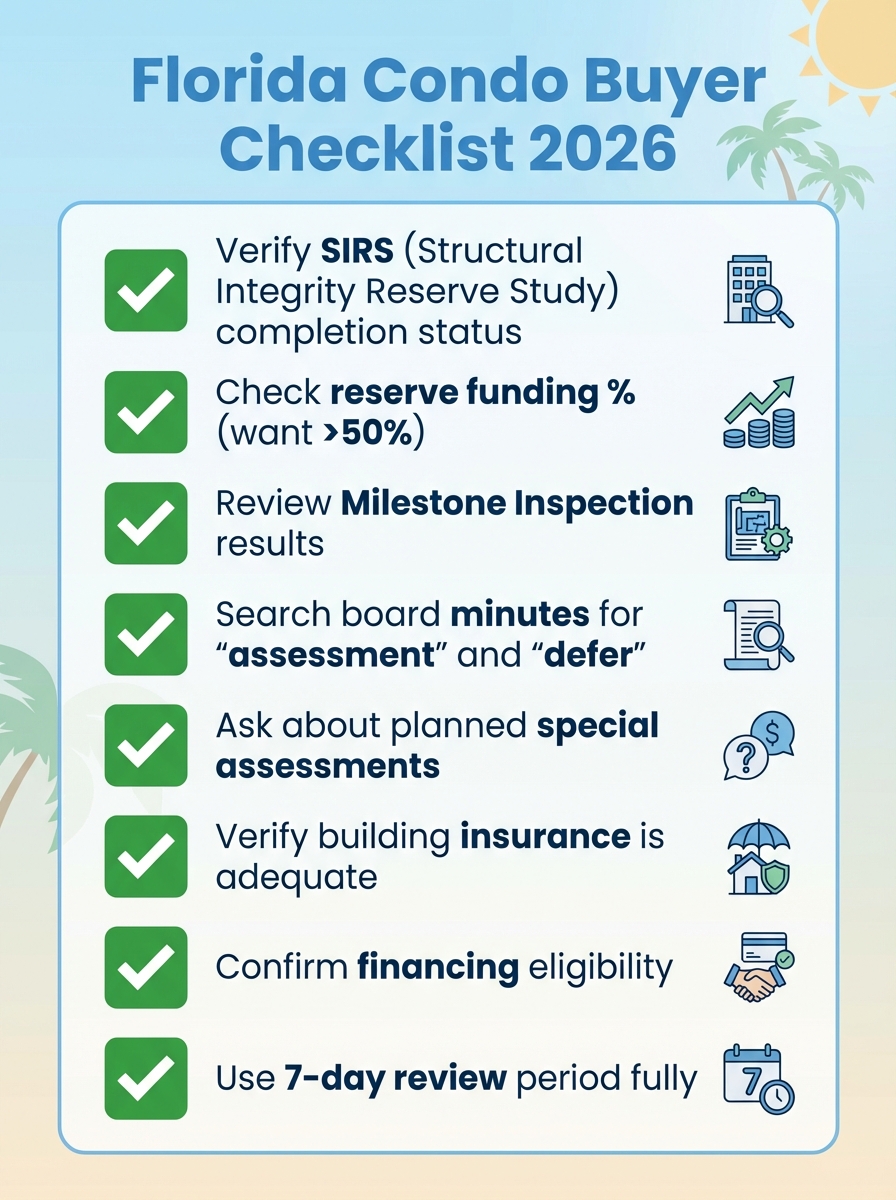

Use this checklist before buying any Florida condo in 2026

Ask these questions of your agent, the seller, and the HOA directly. Get answers in writing:

Essential Questions

- 1. "Has the association completed its SIRS?"

If required and not completed, you're buying into unknown structural risk. - 2. "What is the current reserve funding percentage?"

Under 50% is concerning. Under 30% is a serious red flag. - 3. "Are any special assessments planned or under discussion?"

Check board minutes too—verbal answers may not match what's in the records. - 4. "Has the building passed its Milestone Inspection?"

Phase 2 results are critical. Ask specifically about structural findings. - 5. "What are the monthly fees, and when did they last increase?"

Recent large increases may signal the beginning of catch-up funding.

Don't Buy a Florida Condo Without Checking the Documents

GoverningDocs analyzes SIRS reports, reserve studies, CC&Rs, and meeting minutes to identify special assessment risk, structural red flags, and compliance gaps—so you know what you're really buying.

Try Free Analysis →No signup required. Upload your reserve study or SIRS report and get results in 3-5 minutes.

Frequently Asked Questions

Is it safe to buy a Florida condo in 2026?

It depends entirely on the building. SIRS-compliant buildings with healthy reserves (70%+) and completed inspections are reasonable purchases. Non-compliant buildings with low reserves carry significant financial risk. The key is doing thorough due diligence on the specific building, not making a blanket judgment about the market.

What is a SIRS report and why does it matter?

A Structural Integrity Reserve Study (SIRS) is a Florida-mandated inspection and funding analysis of critical building components including: roof, structure (load-bearing walls), fireproofing and fire protection, plumbing, electrical, waterproofing, and windows/exterior doors. It tells you what condition the building is in and how much needs to be saved for repairs. Without it, you're guessing.

How do I find out if a building has completed its SIRS?

Ask the seller's agent, request it from the HOA directly, or check the association's website (buildings with 25+ units must post documents online under HB 913). You have a right to view the SIRS within 30 days of its completion. If they won't share it, consider that a red flag.

What reserve funding percentage is safe?

Generally, 70%+ is considered healthy. Under 50% is concerning—special assessments become more likely. Under 30% is a major red flag. Our analysis found 26.9% of Florida HOAs are critically underfunded below 30%. Context matters though: a building at 60% funded with a clear plan to reach 100% is different from one at 60% with no plan.

Can I get a mortgage on a non-compliant Florida condo?

It's getting harder. Fannie Mae and Freddie Mac have tightened requirements for condo lending. Non-compliant buildings may not qualify for conventional mortgages, limiting you to portfolio lenders or cash purchases—both of which affect the building's resale value and your financing costs.

What's the 7-day rescission period?

Under HB 913, Florida condo buyers now have 7 days (up from 3) to review association documents and cancel the contract without penalty. This period starts when you receive the documents, not when you sign the contract. Use every day of it—and request documents before making your offer to give yourself even more review time.

Are Florida condo prices going to keep dropping?

Non-compliant buildings will likely continue to face pricing pressure until they complete SIRS requirements and fund reserves. Compliant buildings in desirable locations are holding value better. The market is expected to stabilize as more buildings come into compliance, but that process will play out over 2026-2027.

Should I buy a non-compliant building at a discount?

Only if you fully understand the costs. A "discounted" non-compliant condo may seem like a deal until you factor in the special assessment, fee increases, and financing challenges. Calculate the total cost of ownership including likely assessments before comparing it to a compliant building at full price.

Sources & References

- Surfside condominium collapse — Wikipedia (98 deaths confirmed)

- Florida Senate Bill 4-D (2022) — Florida Senate, enrolled bill text

- Florida House Bill 913 (2025) — Florida House of Representatives

- DBPR Condominium FAQs — Florida Department of Business & Professional Regulation

- 62% of South Florida condo associations failed to complete SIRS by 2025 deadline — Condo Vultures, citing Miami Association of Realtors Condo Summit (Feb 2025)

- Aventura condo owners face unprecedented special assessments — Brosda & Bentley (Mediterranean Village, Williams Island)

- South Florida condo owners dumping homes after six-figure assessments — Yahoo Finance (Cricket Club $134K/unit, 19% price decline)

- Condo HOA fees surge in Florida amid insurance crisis — Redfin (2024)

- Cause and effect of Florida's new condo law — University of Florida Warrington College of Business

- The Future of Florida Condos: Facts & Statistics — Florida Policy Project (Jan 2025)

- New 2025 Florida Condo Laws (HB 913) — Perez Mayoral, P.A.

- Peeling Back the Layers to the Florida Condo Market Weakness — TD Economics

Proprietary statistics (reserve funding distribution, component analysis, structural findings) are based on GoverningDocs analysis of 38 Florida SIRS reports totaling 1,730 pages. All other statistics are sourced from the publications listed above. This article is for informational purposes only and does not constitute legal or financial advice.